I might be young at heart, but I would trade it for the wisdom of today's teenagers when I was their age.

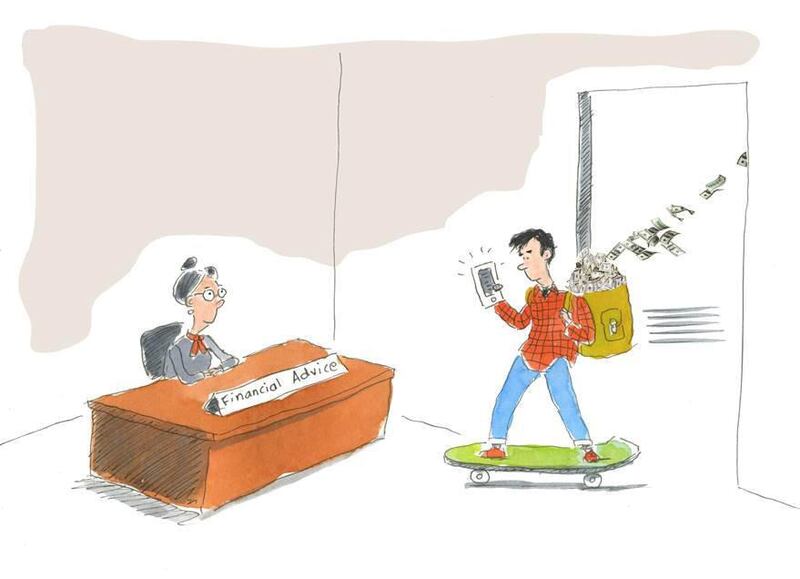

I am being reverse mentored by Generation Z and think I might have happened upon a little money earning ruse for both of us. Last weekend a niece and nephew were all over items I had set aside to clear out – taking photos and uploading to sell online. They even suggested a percentage they could earn from sales. I do nothing other than show them the goods. They then research value, price, press buttons, and deal with virtual customers, right down to posting sales. Zero liability and minimal effort for me, what’s not to like.

They had just come back from a jaunt at the shops; my teenage nephew blew me away when he showed me his new jacket, then lay his now defunct, used one down to take a picture and post it for sale.

Is this normal behaviour? They have such a fantastic can do, will do approach and just get on with it without any fuss.

It was a huge departure from a conversation I’d had with a millennial a few days earlier, who was depressed about his financial outlook, blaming baby boomers for his and his generation’s money woes.

His views are shared by many others, according to the findings of HSBC's The Future of Retirement: Shifting Sands survey conducted in the UAE last year. It concluded that millennials, those born between 1977 and 1995, according to the Centre for Generational Kinetics, realise they face huge financial pressures, and are conflicted in their approach to dealing with this.

They are the generation most concerned with what they will face should they run out of money in their later years, but only 41 per cent of those surveyed have actually started saving for retirement.

Another point of conflict: according to research out this week by Britain Thinks, a UK-based research and strategy group, millennials know how important it is to manage money, but think it’s boring, and would much rather be socialising thank you.

_______

Read more from Nima Abu Wardeh:

Feeling squeezed by VAT could actually make us happier

Supporting the refugee cause is more than just about money

More attention needed to link between financial woes and mental health

When marriage goes wrong, it's mothers who suffer most

_______

Managing money well versus short-term happiness and spontaneity is a significant issue for most of us. Not so for young people in the US that took part in a 2017 study on Generation Z, the generation born after millennials, by the Center for Generational Kinetics. It found that respondents are saving money, and planning for retirement. One in five said debt should be avoided at all costs because they have seen what it does to those older than them.

I hope stats out from the US apply to the UAE, and I wonder how it would affect the country’s economy in say 20 years.

Right now, milllennials are the UAE’s engine of growth. They are the country’s biggest demographic.

According to the World Population Review, the median age for both genders in the Emirates is 30.3 years. It’s a time of life when wages are still on an upward trajectory, and long-term foundations are set – but not always achieved.

Another report, released by dubizzle, found that 26 per cent of millennials in the UAE own property, compared with 28 per cent in Australia and 31 per cent in the United Kingdom. But 44 per cent of those polled in the UAE want to buy property, although that figure might have gone down as it was announced in 2016, and we all know that the cost of living has gone up since then.

Millennials and their attitude to spending, saving and investing is of huge importance to the UAE’s, and the globe’s economy. They are the key economic drivers of the decades to come. But while they are figuring out where to draw the line regarding how much to help the economy along versus their own financial growth, they’d better watch out for Generation Z overtaking them in the financial independence stakes.

If Gen Z has figured out that managing money well now means there’s no need for a trade off between money and happiness, then they are well on their way to taking over the world.

And I plan to help them.

They are mentoring me in many ways – through sharing their (to me) fascinating outlook on life, as well as their instant knowledge around all things iPhone related. My ruse is handing over all button-pressing activities and goods that are no longer needed to the Gen Zers in my life. My next step is to get them to hand their money over to me - once they make any - for safe keeping.

Nima Abu Wardeh is a broadcast journalist, columnist and blogger. Share her journey on finding-nima.com