Tadashi Yanai

Tadashi Yanai, founder and chief executive of Uniqlo parent Fast Retailing, resigned as an independent board member of Japan’s SoftBank Group at the end of last month after 18 years on the job to focus on his fashion business.

A longtime ally and sometime critic of SoftBank founder and chief executive Masayoshi Son, the billionaire is one of only three external members of a board filled with SoftBank executives and heads of its portfolio companies.

The resignation comes at a time when SoftBank is battling with the fallout from the failed initial public offering of WeWork, with Mr Son saying he misjudged co-founder Adam Neumann's character and pledging to strengthen corporate governance at the group's investments.

Mr Son in November defended the board's rigour after reporting the group's first quarterly loss in 14 years, saying Mr Yanai was among the board members who criticised him for the WeWork investment.

"Almost all the board members gave me a hard time. I ended up being very exhausted," he said.

Mr Yanai, Japan’s richest man, was known for being willing to voice his dissent at some of Mr Son's decisions.

Both Mr Yanai, 70, and Mr Son, 62, have made and then shelved plans to hand over the reins of their companies in the past, with Mr Yanai previously saying he would retire at 65.

Mr Yanai said he does not want either of his two sons to take over as chief executive, but both were promoted and joined the ranks of company directors last year. Tokyo-based Uniqlo reported revenue of 2.3 trillion yen (Dh78bn) in the year to August 31, 2019.

Mr Yanai has a net worth of $30 billion (Dh110bn), while Mr Son is worth $15.3bn, according to the Bloomberg Billionaires Index.

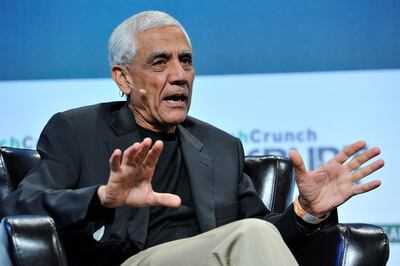

Vinod Khosla

California upped the ante in venture capitalist Vinod Khosla’s long-running fight over his coastal property near San Francisco, suing the billionaire to maintain public access to a Pacific Ocean beach. Until now, non-profit organisations have fought to maintain access to Martins Beach near Half Moon Bay, about an hour south of San Francisco. On Monday, California officials stepped into the fight for the first time by suing Mr Khosla in state court.

The beach was open to the public for decades before Mr Khosla bought the 89-acre property in 2008 for $32.5 million and shut off the lone road leading there. A state judge ordered his holding companies to restore that access.

Mr Khosla previously appealed to the US Supreme Court, which refused to review a lower-court ruling requiring him to allow beach goers access to the coast on a road that cuts through his property.

The California Coastal Commission closely tracked the lawsuits filed by the Surfrider Foundation. The agency said in a statement that it has spent several years collecting data, including surveys, about public use of Martins Beach.

In Monday’s complaint, the commission is asking for a judge to review new evidence to conclude the public “has acquired access rights” to the land based on historical use and California law.

Mr Khosla’s attorney Dori Yob Kilmer vowed to fight the latest lawsuit.

“Since the property was purchased by our client, the state and small activist groups have endeavoured to seize our client’s private property without compensation,” Ms Kilmer said in a statement. “While such tactics are commonplace in communist systems, they have never been tolerated in the American system where the US Constitution precludes the government from simply taking private property and giving it to the public.”

Mr Khosla, 64, is a co-founder of Silicon Valley technology company Sun Microsystems and founder of Khosla Ventures. He has a net worth of $2.1bn, according to Forbes.

Jeffrey Gundlach

Billionaire money manager Jeffrey Gundlach said his strongest market conviction is that the still-resilient dollar will weaken.

The greenback has largely defied expectations for its demise, with the Bloomberg Dollar Spot Index ending last year less than 1 per cent lower as foreign-exchange volatility dwindled. But the DoubleLine Capital chief executive said growing US government and trade deficits, a steepening yield curve and a pullback in foreign investment may finally hit the currency.

"My highest conviction idea is that the dollar will weaken," Mr Gundlach said on Tuesday on his annual Just Markets webcast. "As foreigners start to divest from the United States, which I think is going to be a theme of the next few years — it may start this year — you'll start to see a much weaker dollar."

Mr Gundlach, whose Los Angeles-based fund company oversees almost $150bn in assets, has been warning of a potential dollar slide since early January 2018. Should that decline materialise, Mr Gundlach expects it to benefit gold and other commodity prices.

The money manager said he doesn’t expect broad stock and bond market returns this year to “come anywhere close to 2019", when virtually all major assets delivered once-a-decade performances. However, investors can expect higher volatility in the decade ahead, according to Mr Gundlach.

“It won’t be the roaring ’20s and it won’t be the boring ’20s,” he said.

Among his other comments on the webcast, Mr Gundlach said Bitcoin could climb as high as $15,000 this year, although he added that he doesn’t own any of the digital currency.

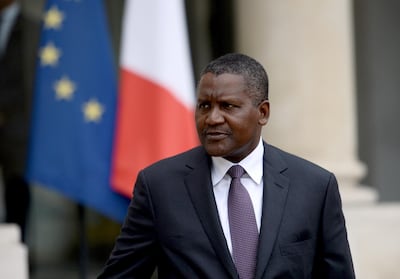

Aliko Dangote

Aliko Dangote, Africa’s richest man, became $4.3bn richer in 2019 as his fortune continued to grow on the back of investments in cement, flour and sugar.

The 62 year-old Nigerian businessman and Africa’s most prominent industrialist ended the decade with a net worth of almost $15bn, making him the 96th wealthiest man in the world, according to the Bloomberg Billionaires Index.

Born into a wealthy Muslim family of traders in the north, Mr Dangote incorporated his own business selling cement at 21. He shifted to manufacturing the building material in the 1990s, helped by government policies that encouraged ways to reduce the need for imports. His critics still accuse him of taking advantage of his closeness to the government to gain an unfair market advantage, a claim he repeatedly dismisses.

His conglomerate, Dangote Industries, includes the biggest cement company on the continent, the Lagos-listed Dangote Cement. That’s one of four publicly-traded companies under the Dangote umbrella that account for more than a fifth of the value of the Nigerian stock exchange.

This year could be a significant one for the billionaire, who is close to completing one of the world’s largest oil refineries in Nigeria. The plant has the capacity to meet more than Nigeria’s entire fuel consumption and could transform an economy that currently imports all its refined product needs. Dangote is also constructing a fertiliser factory on the same site.

Michael Bloomberg

Democratic presidential contender Michael Bloomberg will air a 60-second television commercial during this year's Super Bowl broadcast, the latest example of how the billionaire is using his vast wealth to advance his campaign.

The Bloomberg campaign said on Tuesday that the buy was in response to reports that US President Donald Trump's re-election campaign had secured its own spot during the telecast, which is one of the most watched events of the year. Last year's National Football League championship game drew nearly 100 million viewers.

Mr Bloomberg's aides did not say how much the commercial had cost, but executives from Fox, which is airing the 54th Super Bowl on February 2 in Miami, told Variety in November that a 30-second ad would cost more than $5m.

Mr Bloomberg entered the presidential race in November, months after the other candidates in the field launched their own bids. There are 14 Democrats still vying for the chance to take on Mr Trump in November.