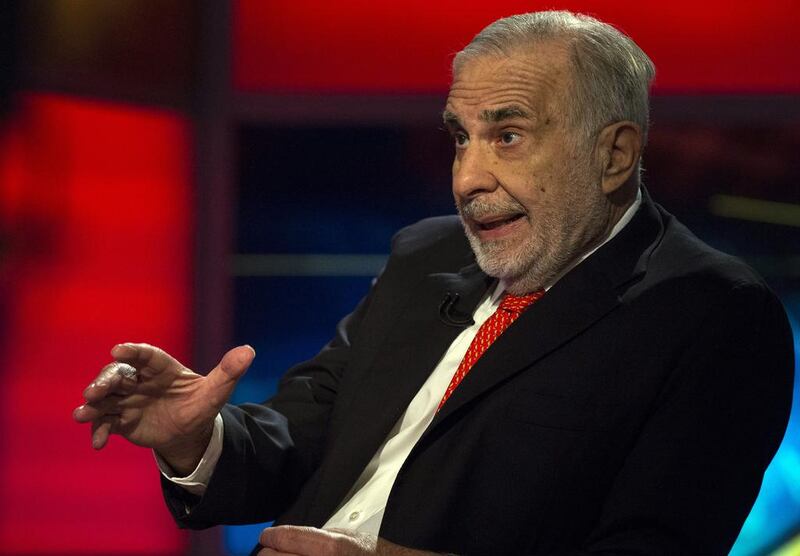

Carl Icahn

Billionaire activist investor Carl Icahn is interested in cryptocurrencies in a “big way” and may eventually put more than $1 billion into an alternative currency.

While Mr Icahn has yet to buy any digital asset, he said that he studies Bitcoin, Ethereum and the cryptocurrency sector to determine where the opportunities are.

Alternative currencies are becoming popular as a natural manifestation of inflation in the economy and any criticism around cryptocurrency having no underlying value is a “little wrong-headed”, he said.

“Well, what is the value of a dollar? The only value of the dollar is because you can use it to pay taxes,” he said. “I am looking at the whole business and how I might get involved in it.”

Mr Icahn also said he believes people are looking at alternative currencies because parts of the equity market are being traded at “ridiculous prices”.

He referred not only to those being driven up as so-called meme stocks but also certain strategies being offered by money managers.

“I do not think Reddit and Robinhood and those guys are necessarily bad. I think they do serve a purpose,” said Mr Icahn.

“Money is funnelling back into companies. Some of these companies might be OK but for a number of them, the risk-reward is absurd.”

Larry Chen

Larry Chen, the former schoolteacher from a poor Chinese village who became one of the world’s richest people, is about to lose his billionaire status as shares in his online education business slump.

GSX Techedu fell by 4 per cent in New York trading on Wednesday after Goldman Sachs downgraded the stock and slashed its price target. The shares are down 88 per cent since late January, wiping about $14bn from Mr Chen’s fortune and leaving him with a net worth of about $1.9bn, according to the Bloomberg Billionaires Index.

The company has been buffeted by a range of issues, including increased scrutiny of China’s education industry, a weaker-than-expected financial outlook and the implosion of one of its investors, Archegos Capital Management.

“Policy risk is the number one concern right now,” said Tommy Wong, a Hong Kong-based analyst at China Merchants Securities International, who gives the stock a "buy" rating.

A spokesperson for GSX declined to comment on the plunge in the company's share price or Mr Chen’s wealth.

China's education industry is under increased scrutiny after President Xi Jinping suggested in March that a surge in after-school tutoring was putting immense pressure on children. The country’s education ministry plans to create a dedicated division to regulate all private education platforms for the first time.

In April, GSX was among four private education providers fined the maximum penalty of 500,000 yuan ($78,198) for using false or misleading prices to lure customers.

It was a major headache for Mr Chen, who owns about 44 per cent of GSX, at a time when his company’s shares were already being hit by a weaker-than-expected outlook. GSX shares tumbled last month after the company gave a second-quarter revenue forecast that missed the average analyst estimate.

Archegos, the family office run by Bill Hwang, collapsed in March after it failed to meet margin calls. The investment firm had built highly leveraged positions in GSX and other companies using swaps.

When some of those shares fell, banks demanded collateral that Mr Hwang was unable to provide, so they offloaded large blocks of GSX and other shares. GSX fell by as much as 56 per cent in one day.

Petr Kellner

The widow of Czech billionaire Petr Kellner has been listed as the largest shareholder of telecoms company O2 Czech Republic and Moneta Money Bank, regulatory filings showed last week amid ongoing inheritance proceedings.

Kellner’s death in a helicopter crash on an Alaskan skiing trip in March has set off one of the biggest private wealth transfers in central Europe’s former communist countries since the shift to democracy three decades ago.

His investment group PPF said his widow, Renata Kellnerova, had been appointed administrator of the estate during the proceedings.

“As such, she is listed as the holder of relevant public companies subject to regulation by the Czech National Bank. [Ms Kellnerova's] appointment as the administrator of the estate does not mean the inheritance process is complete yet,” it said.

The March accident came as PPF, of which Kellner owned 98.9 per cent, was pressing ahead with one of the Czech Republic’s biggest banking mergers since the early 2000s to gain a controlling stake in Moneta.

Kellner had a net worth of $17.5bn at the time of his death, according to Forbes.

To meet regulatory conditions, Ms Kellnerova was listed as the beneficial owner of PPF’s stakes in both Moneta and O2 Czech Republic, controlling 29.94 per cent and 83.5 per cent, respectively, according to the filings.

PPF said Ms Kellnerova would be a family representative on a newly formed executive committee to advise Ladislav Bartonicek, a PPF minority shareholder who is leading the company after Kellner’s death.

Kellner founded PPF in the early 1990s and it grew into a global player with assets worth €39.7bn ($48.3bn) at the end of last year in sectors such as telecoms, property, finance and engineering across Europe and Asia.

The group posted a loss of €291 million last year amid the coronavirus pandemic, which hit its consumer lending business, the first loss in its history.

PPF agreed with Moneta this month to combine their Czech lending assets and create a banking group to compete with the country’s top banks.

Kim Jung-ju

Kim Jung-ju, 53, the billionaire behind Nexon, is having a turbulent month.

The Tokyo-listed gaming company's shares have fallen by 21 per cent since it forecast a decline in profit on May 12, suggesting its strong performance when the Covid-19 pandemic kept people indoors will not be sustained as some countries reopen.

That has erased about $1.9bn from the South Korean entrepreneur’s net worth, reducing his fortune to $8.1bn, according to the Bloomberg Billionaires Index.

On top of that, Mr Kim’s diversification away from gaming into markets such as cryptocurrency is facing obstacles. Bitcoin has dropped about 38 per cent since it rose to a record in April, a stark example of the swings in the prices of online coins that have left some mainstream investors sceptical.

Mr Kim has been an avid supporter of digital currencies and has been acquiring cryptocurrency exchanges in recent years. Nexon also bought $100m worth of Bitcoin last month.

“It was bound to come down,” Bloomberg Intelligence analyst Matthew Kanterman said of Nexon’s earnings forecast. “Last year was a high base and they are not going to replicate that.”

On Bitcoin, “corporations do not like buying stuff with too much volatility”, he said, suggesting Nexon is unlikely to add to its purchase for now.

Even before Nexon bought Bitcoin, Mr Kim’s holding company NXC, which owns about half of Nexon, snapped up 65 per cent of Korbit, a cryptocurrency exchange in South Korea, in 2017.

The following year, NXC’s subsidiary in Europe acquired another cryptocurrency exchange: Luxembourg-based Bitstamp.

Korbit’s book value plunged to about 3.1bn won ($2.8m) at the end of last year, from about 96bn won at the end of 2017, according to NXC’s financial statements for 2017 and 2020. A spokesman for NXC said there is no plan to sell the exchanges that it bought.

Mr Kim was also keen to acquire Bithumb, one of South Korea’s largest online currency exchanges, according to local media reports earlier this year. The NXC spokesman declined to comment.

Mr Kim declined to be interviewed while Owen Mahoney, Nexon’s chief executive officer, was not available for comment.

Mr Kim founded Nexon in South Korea in 1994 after majoring in computer science and engineering at Seoul National University.

In 2011, Nexon listed in Japan. The company, which is famous for hit titles such as MapleStory and KartRider, posted net income attributable to its parent's owners of 69.7bn yen ($639m) in the first six months of last year as lockdowns forced people to spend more time at home.