The Asia-Pacific remained the most expensive region for wealthy people, with Shanghai, Tokyo and Hong Kong the three most expensive cities in the world for the rich, according to Swiss private banker Julius Baer.

The Europe, Middle East and Africa region was in second place, the lender's Global Wealth and Lifestyle Report for this year showed.

The Americas are now the cheapest region for high-net-worth people, who are described as having more than $1 million in investable assets. Dubai climbed five positions to be ranked the world's 12th most expensive city for wealthy people.

“The change in Dubai’s ranking is due to a number of factors, including the removal of some cities from the index, a large fall in prices for some cities in Americas due to currency weakness, the rejigging of the index composition and overall price increases for Dubai index items,” said Mark Matthews, head of Asia Pacific research at Julius Baer.

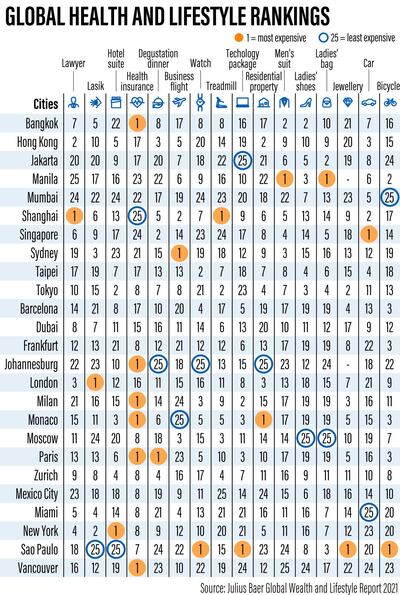

The Zurich-based lender compiled an index using a basket of consumer goods and services that represent discretionary purchases by HNWIs – ranging from residential property to laser eye surgery – and analysed costs in 25 key cities around the world.

The number of ultra-high-net-worth people – those with more than $30m in investable assets – in the Middle East is expected to grow by 24.6 per cent in the next five years, according to a February report by property consultancy Knight Frank.

The region will remain the fourth-largest wealth centre in the world, the report said.

The wealth manager changed the composition of the second edition of the Lifestyle Index to reflect evolving consumer tastes after Covid-19.

Wedding banquets, pianos, beauty services and personal trainers made way for new items such as bicycles, treadmills, technology packages and health insurance.

Overall, the price of goods and services in the basket registered an increase of only 1.05 per cent globally, Julius Baer said. Most index items in Dubai are priced at the international average or higher, the report showed.

The luxury categories with the biggest price falls were ladies’ shoes (11.7 per cent) and hotel suites (9.3 per cent). The biggest gains were in business class flights (11.4 per cent) and luxury watches (6.6 per cent).

“The relatively strong performance of Asia was driven by a broad variety of reasons," said Mr Matthews.

"Covid-19 did not become an epidemic in Shanghai, Tokyo, Hong Kong, Taipei, Bangkok and Singapore the way it did in most other cities in this index.”

However, there are outliers such as India’s commercial capital Mumbai, according to the index. Residential property costs less than half the global average in this Indian city and the only expensive items are cars.

The price increases in Europe, the Middle East and Africa were primarily driven by currency changes.

As European currencies such as the Swiss franc and the euro gained against the US dollar, cities such as Zurich, Paris and London became more expensive, the report showed.

Johannesburg emerged as the cheapest city in the world for HNWIs to live in.

The Americas region was ranked as the cheapest to live a luxury lifestyle this year, the index showed. This was mostly due to the price of the US and Canadian dollars falling against other major global currencies and a sharp devaluation of currencies in Latin America. The region now only has one city in the top 10 – New York.

“Next year, the most expensive cities will probably still be in China and the most important consumers of high-end goods will be the Chinese,” the report said.

The Swiss bank also found that the “conscious consumption movement” was taking off as Covid-19 has raised consumer commitment and awareness on the need for ethical and sustainable buying.

Many of these changes in behaviour are expected to endure long after the pandemic, it said.

“Millennials [aged between 25 and 40] and zillennials [aged 24 and less] are mostly adopting these environmental-friendly lifestyles," said Mr Matthews.

"They derive greater pleasure from experiences and their values dictate the things they buy."

He said these two demographic groups expect companies that manufacture these products to espouse values such as inclusivity. They are also vocal about the need to reduce carbon emissions.

A lot of investors in the GCC and Dubai took more calculated risks last year and shifted from bonds and fixed-income assets to equities in thematic sectors such as FinTech and sustainability, according to Omar Barghout, head of the investment advisory unit for the Middle East at Julius Baer.

The Swiss bank expects a significant rise in inflation from about mid-year.

15 most expensive cities to live in for the ultra wealthy:

- Shanghai

- Tokyo

- Hong Kong

- Monaco

- Taipei

- Zurich

- Paris

- London

- Singapore

- New York

- Bangkok

- Dubai

- Milan

- Sydney

- Barcelona