Most people don't leave the house without their keys, wallets and phones. Soon it may just be one thing: their phone. Far-fetched? Possibly, but innovation in the mobile industry is evolving fast. Phones are already replacing cash in Japan, where users can pay for groceries with them, while InterContinental hotels are testing the use of Web-enabled phones as room keys.

Smartphones such as the iPhone, BlackBerry and Android-based devices are changing the mobile industry, providing high-speed internet on the move, offering hundreds of thousands of applications and storing thousands of songs. Nearly 1 billion new smartphones will be sold by 2013, accounting for nearly 50 per cent of new phones in North America and Europe within three years, according to the consultancy Gartner.

And the research company Motally says most people in the Middle East browse the internet using a BlackBerry handset. The iPhone is second most popular. It is one of few regions where BlackBerry beats the iPhone, partly because BlackBerry got a head start on the iPhone, and the free messaging is particularly popular, especially with the young. Etisalat, for instance, already has a "Youth BlackBerry offer", where an entry fee of Dh50 a month gives them instant messaging and social networking.

Eric Schmidt, the chief executive of Google, said recently smartphone sales would soon surpass PC sales and that his company's new mantra was "Mobile First" with his best developers working on mobile. Customers in several developed markets already state that their decisions on what mobile devices to buy are between 80 and 85 per cent determined by the type of device and the content and applications on offer - as opposed to operator brand.

Smartphones are shaking up the structure of the industry and operators need to rapidly decide where to play in the value chain in order remain in contention. In the next few years, most people in developed markets will have the internet in their pocket wherever they go, rapidly changing how people interact with each other. The internet has started it, but smartphones are accelerating a fundamental change in inter-human communication: from talk to text.

In fact, 80 per cent of iPhone owners use e-mail and 50 per cent use social-networking sites such as Facebook. This is four times more than your average Nokia user. Add to this free Skype-to-Skype calls, and operators can be forgiven if they are worried about core voice and SMS revenue growth. "In the next few years, users will be charged by the data used and not voice minutes," said Daniel Hesse, the chief executive of the US telecommunications company Sprint.

One of the key themes of the Mobile World Congress in Barcelona this year was near-field communication (NFC), where the phone's in-built sensors can communicate with their surroundings, enabling uses such as paying in shops just by swiping the phone. Beyond NFC, the phone is already being used as a payment tool in places such as Japan or in emerging markets as a secure way to transfer money between family members or make payments such as taxi fares, supplier bills or to receive salaries.

NFC allows for phones to carry the users' "DNA" - personal information in a protected SIM environment to run secure applications - allowing for phones to be used as national IDs. It is especially for these transactional functions that mobile operators have an advantage over the global innovation power of Apple, Google and Facebook in the entertainment and information space, through their established distribution networks and local presence.

On the entertainment side, Smartphone users are beginning to cut out the mobile operator and replace them with the internet and the device players. Users now consume content services from device vendors' applications stores. Apple customers have already made 3 billion downloads from the company's app store. With the entire internet at their disposal and hundreds of thousands of apps on offer, the telecoms operator is more often than not relegated to simply providing connectivity.

Some of the major operators such as Vodafone, Orange and Telefonica are working on alternatives consisting of their own apps stores in alliances with other major operators and are customising their own-brand handsets to allow for optimised access. The jury is still out on whether they will be successful. Smaller operators have already given up trying to dominate this space and instead focus on simply providing a competitive device offer.

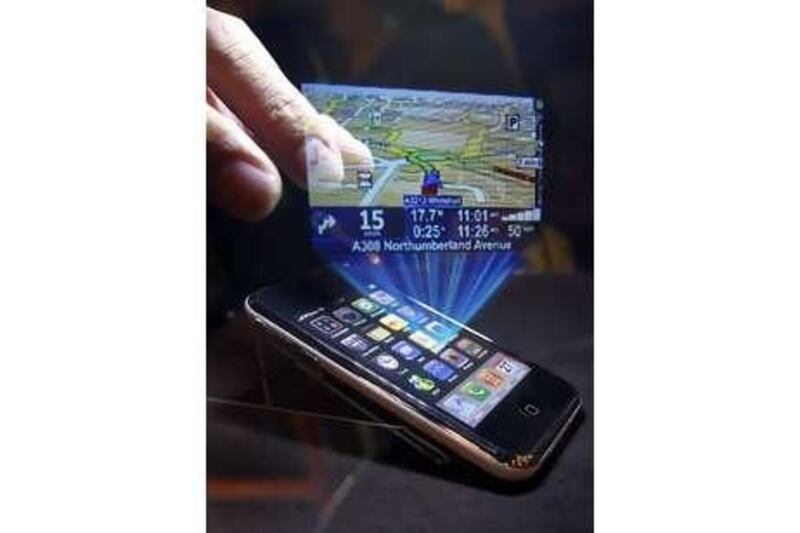

The next battles will be fought on location-based and context-driven information because of the anticipated advertising opportunities. Google in particular is driving this by enhancing its maps, Street View and local search capabilities. This year, for instance, it acquired Plink, a mobile visual search tech firm whose app allows you to take a picture of a famous painting with your phone and get all the information show up on your phone.

This is just the beginning. With 25 per cent of all new phones GPS-enabled, and by taking photos of their surroundings, users can interact not just with people but with their environment. Machine-to-machine (M2M) is on a steep upward trend. The vision here is that in the mid-term, 100 per cent of electronic devices will be connected to the internet through either Wi-Fi or 3G plus, with the connectivity coming through the operators.

This would allow consumers to use their smartphones as their information dashboards for home appliances (to regulate air-conditioning, etcetera) or as remote controls for their cars and entertainment devices. This is especially being developed by operators such as Telefonica as a way to enhance their connectivity offerings. How worried should mobile operators be? Operators need to carefully evaluate at what stage of development their markets are and how much their business will be affected by the exploding popularity of smartphones.

Operators in developed markets are already living through the smartphone trade-off of exploding data traffic, higher subsidies and losing control of the content value chain - in exchange for higher data access revenue. Google, Apple and other device vendors such as Nokia, with its Ovi store, are taking ownership of customers away from operators in their push to provide the emotional experience. This year is a key period - one in which operators need to make strategic decisions on where to play in the value chain.

Questions abound concerning what device strategy to follow, what alliances/partnerships to forge, how exactly to evolve their portals into app stores and build emotional experiences and how to go beyond their traditional value chain into services such as M2M, payments and ID. So far, operators in the Middle East are somehow protected from the new players in the value chain as language barriers provide an edge to local offerings and competitive data pricing and little subsidies make the economics favourable. But as smartphones keep growing strongly, this might change soon.

One thing is clear though: if innovation continues on its current trajectory, phones might just be on the way to becoming the ultimate all-in-one device. Joao Sousa is a partner and Andreas von Maltzahn a principal at Delta Partners, a TMT advisory and investment company based in Dubai business@thenational.ae