Sales of luxury goods in the Middle East will outpace global demand this year as the market for fast cars, watches and jewellery grows a sparkling 15 per cent.

Bain & Company, a global information consultancy, yesterday said luxury sales would defy concerns over the euro-zone turmoil and fears of a slowdown in fast-growing emerging markets to exceed €200 billion (Dh893.02bn) around the world this year.

The Middle East will be one of the key drivers of that growth as emerging markets now make up 30 per cent of global luxury sales, Bain said in a report.

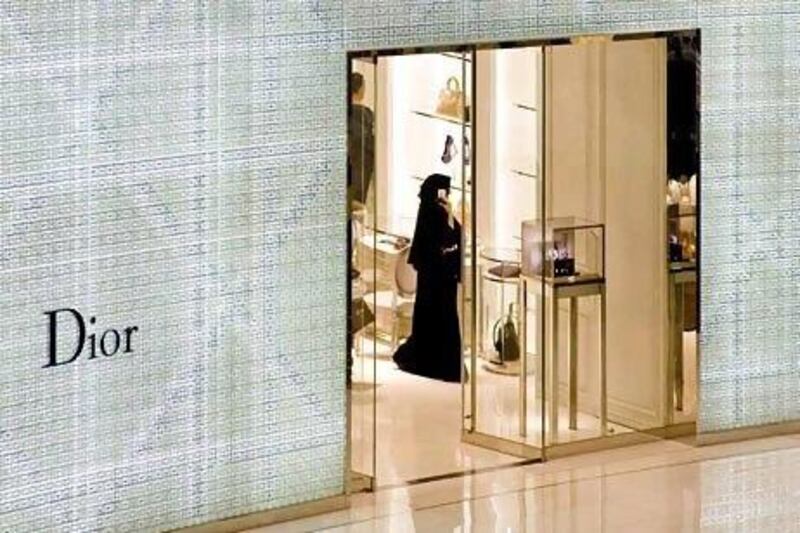

"The Middle East remains a crucial component in the sustained growth of the global luxury market," said Cyrille Fabre, the head of retail and consumer products practice for the Middle East at Bain. "The region has opened exciting growth possibilities for key industry players and continues to be a major destination for a wide range of luxury brands."

The luxury market in the Middle East is often difficult to quantify as luxury retailers rarely disclose sales figures. But those retailers that do talk about sales have reported bullish figures for the past year with growth forecasts often in excess of 15 per cent.

The market for luxury cars, in particular, has made a fast start to the year after Audi and BMW in the UAE in general, and Mercedes in Abu Dhabi, reported their best-ever first half to the year.

Each brand reported a rise of about 15 per cent in sales during the first six months of the year compared with last year.

The Chalhoub Group, one of the biggest luxury retailers in the region, said it bagged sales growth of 35 per cent last year - driven by a high-end spending spree in Saudi Arabia, the UAE and Qatar.

Governments across the Arabian Gulf, particularly in Saudi Arabia and the UAE, have boosted their economies in the past year with huge investments in infrastructure and direct handouts to local citizens, which has stimulated spending on luxury.

Globally, analysts had warned in recent weeks of a slowdown in luxury sales, with Burberry, which missed sales forecasts in the second quarter, an example of the trend.

But Bain was positive yesterday and said retailers in Europe would experience growth in sales of 2 to 4 per cent, while the Americas would fair slightly better with growth of 5 to 7 per cent.

China will grow 18 to 20 per cent, a similar level to Russia and India, as well as newly emerging economies such as Azerbaijan, Indonesia, Kazakhstan, Malaysia, Mexico, South Africa, Turkey and Vietnam, Bain said.

"Brands must develop strategies with much wider reach than ever before," said Claudia D'Arpizio, a Bain partner in Milan and the lead author of the published report, entitled Luxury Goods Worldwide Market Study.

"The lessons they learnt in earlier emerging markets will help but they now must manage even broader diversity of consumer preferences."