A top UAE banker has attacked the greed culture within the country's financial system as bad-loan provisions in the sector approach Dh50 billion (US$13.61bn).

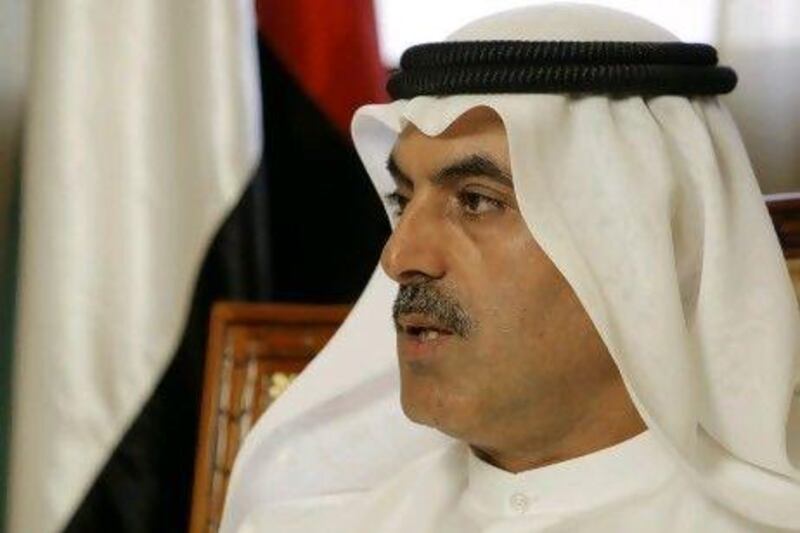

Abdul Aziz Al Ghurair, the chief executive of the Dubai bank Mashreq and a former Speaker of the Federal National Council, said the time had come for lenders to put customers ahead of profits.

"I think banks did a terrible job in servicing the client, everywhere including Mashreq," he said.

"We were focused on growth," he said at a banking conference in Dubai. "We used to have our direct-sales people only go and sell a single product to the customer. It could be a credit card, it could be a salary transfer, it could be a mortgage, it could be an auto loan. He goes there and closes the deal and comes back. The customer doesn't like that. The customer likes a bank that looks after the A-to-Z relationship."

Mr Al Ghurair's comments come five months after the UAE Central Bank capped personal loans at 20 times a customer's monthly salary and required that the debts be repaid within 48 months.

The new rules, which threaten to dent high profit margins on consumer loans, were part of a push to curb easy lending that led many customers to rack up excessive debt and filled the country's prisons with defaulters. Defaulting on a debt in the UAE can lead to a prison sentence because loans are often secured with cheques, and criminal penalties result when cheques bounce.

Arup Mukhopadhyay, the head of consumer banking at Abu Dhabi Commercial Bank, said the new regulations were followed by a "slight decline in the market in the short term" but were ultimately healthy for the system.

"It's actually beneficial for the market," he said. "If you have the patience, over a period of time it will become better."

Back when competition for customers in the UAE's saturated banking market was fierce, some customers were given "10 mortgages", justified on the basis that property prices would keep rising, Mr Al Ghurair said. Dubai's property market was one of the fastest-growing in the world between 2004 and 2008 as shiny skyscrapers shot up, but prices came crashing down more than 50 per cent in some areas after the bubble burst.

"Banks did do that, but now they are also wiser - not because of regulation. They found out this was a dumb decision," he said.

While the UAE lacks an established credit bureau and regulations on consumer lending are light compared with those in developed countries, Mr Al Ghurair was quick to dismiss the suggestion that anyone but banks was to blame for the wave of defaults, which has crimped economic growth and hurt lenders' profits in the past two years.

Provisions for bad loans at UAE banks reached Dh49.2bn at the end of August, a rise of 50 per cent from the end of 2009.

"We can always blame somebody else - the credit bureau, the Central Bank, et cetera - but I think the biggest blame is [on] ourselves, the bank itself," Mr Al Ghurair said. "We have to change our mind-set, which is greed. Banks are a greedy bunch of people, and they love to see the numbers go up year after year. When I see my competition is growing, then I look internally and I justify a transaction which is not doable."

Mashreq had coped with defaults, was well-supplied with capital and expected profit growth of 10 to 15 per cent this year and next, he said. While "the worst is over" for UAE banks, a successful future hinged on a reorientation towards customers instead of an inward emphasis on profits and loan growth, Mr Al Ghurair said.