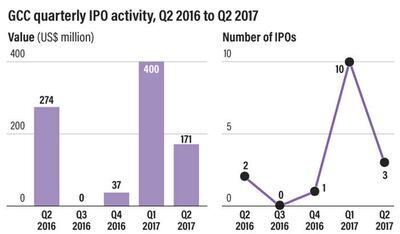

Proceeds generated from initial public offerings in the second quarter of the year decreased 38 per cent from the year earlier period even though the number of listings in the three months ending in June increased. Markets held three IPOs in the second quarter of 2017 compared with two in the same period a year earlier.

“During the second quarter, Saudi Arabia continued to be the main driver of IPO market activity in the GCC, while the NOMU parallel market for small and medium-sized enterprises in the kingdom remained popular among investors,” said Steve Drake, head of PwC’s capital markets and accounting advisory services in the Middle East.

The only primary exchange offering in the quarter was Jadwa Reit Al Haramain Fund, listed on the Saudi stock exchange, Tadawul. The fund, managed by Riyadh-based Jadwa Investment, is a Shariah-compliant real estate investment traded fund that aims to provide investors with income-generating real estate assets in the kingdom, primarily in Mecca and Medina. It floated 36 million shares raising US$96 million.

_______________________

Read more:

[ Snap, Blue Apron fuel worries about overheated IPOs ]

[ Index majors set to lock horns over stock exchanges ]

_______________________

On Saudi Arabia’s smaller NOMU market two listings raised $74.7m. Clothing company Thob Al Aseel floated raised $68m while Al Kathiri Holding, a construction material manufacturer, reaped $6.7m.

Saudi Aramco, deemed to be the world's largest listing aims to raise as much as $100 billion from a 5 per cent listing. The UAE’s Adnoc plans to sell a stake to the public in its Adnoc Distribution unit, which includes more than 300 service stations throughout the UAE, which could make it potentially the largest transaction on local equity markets since the DP World came to the market in 2007.

_______________________

Read more:

[ Saudi Arabia said to favour New York over London for Aramco listing ]

[ Tokyo seeks return to glory days with piece of Saudi Aramco IPO ]

_______________________

Globally, IPO activity increased by about 50 per cent in terms of proceeds and number of listings for the quarter, PwC said. A total of 379 IPOs raised $52.6 billion, compared with $35.2bn from 253 listings in the year earlier period.

For the first six months of the year 23 percent less was raised from listings compared with the first half of 2016 despite the number of offerings increasing to 13 in 2017 from three in the same period a year earlier.

_______________________

Read more:

[ Potential IPO of Adnoc's distribution unit could support growth strategy ]

_______________________

With the oil slump and low interest rates sovereigns and corporates are looking to fixed income to raise funding. Saudi Arabia raised $9b from US denominated Islamic bonds, or sukuk.

The global consultancy said though debt issuance in the GCC was oversubscribed domestically and internationally in the second quarter, interest rate hikes by the US Federal Reserve "may hamper GCC government debt appetite, while a hawkish policy would trigger a surge in borrowing cost across the global and regional debt market”.