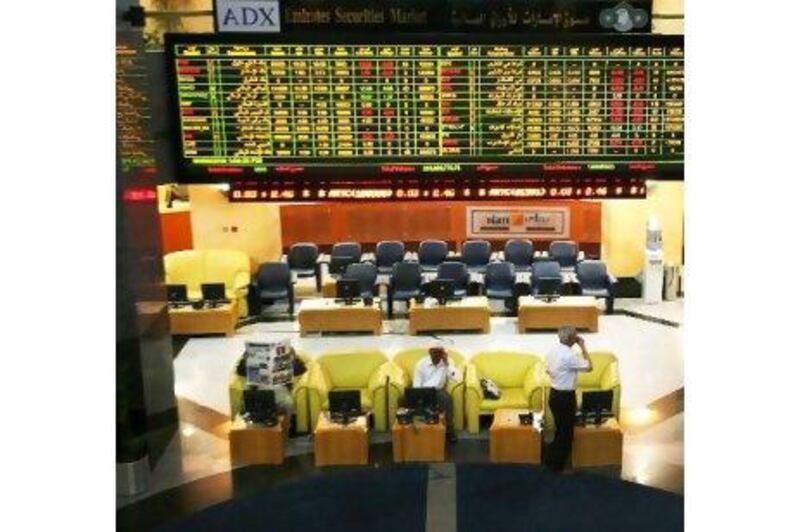

Much work needs to be done to bring the UAE's securities exchanges up to a world-class standard, according to analysts and market operators.

"The markets here still have the potential to become a regional hub for capital markets, bringing listings from Iraq and north Africa," said Julien Faye, the head of financial markets at Bain & Company in Dubai. "But for that to happen, regulators need to bring in stronger regulations, transparency, and make it cost-efficient for international investors to trade here."

Axiom Telecom, the mobile phones retailer, is considering a listing on the London Stock Exchange just two months after attempts to float on the Nasdaq Dubai were cancelled because of poor market liquidity, the latest in a series of companies considering listings abroad.

This week, the Dubai oil services company Topaz Energy and Marine also expressed interest in a London listing. Last year, the global ports operator DP World also said it was seeking a dual listing in London.

A steady stream of negative local catalysts wiped out confidence and liquidity on the exchanges over the course of last year, pushing institutional and foreign investors on to the sidelines and causing UAE bourses to underperform compared with their regional peers. Since then, the Securities and Commodities Authority (SCA) has embarked on a plan to revive the markets by introducing regulations aimed at making the market appear more transparent, hoping to bring investor capital back to the exchanges.

"The Abu Dhabi Securities Exchange is in the process of drafting a five-year strategic plan, which would include initiatives to position Abu Dhabi as a capital markets hub," said Elie Ghanem, the head of market and product development at the Abu Dhabi bourse. "The Government of Abu Dhabi has selected the exchange to be a champion of this initiative and it is something we are taking very seriously." The proposal is yet to be reviewed and submitted to the board.

The Dubai Financial Market, the Arab world's only publicly listed exchange, declined to comment.

Regional regulators will today convene a round-table discussion with the SCA at its annual summit to discuss the need for more comprehensive regulations in addition to improving liquidity on the country's stock exchanges. Also at the table will be two board members of the SCA, representatives from the Dubai Financial Services Authority, the Jordan Securities Commission and the IMF and World Bank. A number of law firms and brokerages will also be present.

This month the SCA introduced a set of draft regulations on mutual funds and investment management, as well as the legal framework for margin trading. It is waiting for feedback from the investment community. The SCA has also said it is committed to introducing regulations to stock borrowing and lending in addition to short-selling, which MSCI has also requested, but no specific date has been provided.

"Its definitely welcome that they have invited us and are interested in our thoughts and views," said Mohammed Ali Yasin, the chief investment officer of CAPM Investments in Abu Dhabi.