Google-parent company Alphabet hit a milestone, as a rally in the stock took it above a $1 trillion (Dh3.67tn) valuation for the first time, solidifying the dominance of technology and internet stocks as the biggest titans of Wall Street.

Shares rallied in the last half hour of trading on Thursday to close at $1,450.16, up 0.8 per cent on the day.

With the gain, Alphabet became the newest member of an elite club to trade with the historic 13-digit market capitalisation. Only two other US names are past the threshold: Apple, valued at about $1.38tn, and Microsoft, at $1.27tn.

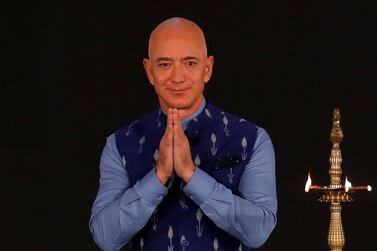

Amazon flirted with the level last year, but the e-commerce company would have to rise more than 7 per cent for its current valuation of $931.1 billion to move above $1tn.

These four companies are by far the largest on Wall Street, and their huge size gives them an big impact on overall market direction. Together, they represent more than 15 per cent of the weight of the S&P 500.

The rest of the market is, at best, hundreds of billions of dollars away from trillion-dollar valuations. The fifth-largest US stock by market cap, Facebook, currently has a valuation of $632.9bn. The biggest company outside the tech or internet sector is Berkshire Hathaway in sixth place, valued around $559bn.

Alphabet’s move above the level is just the latest step higher for the company. Shares are up about 40 per cent from a June 2019 low, with the rally largely fuelled by optimism over its 2020 prospects, particularly with respect to ad revenue. Alphabet will report fourth-quarter results on February 3.

Among recent commentary, Evercore ISI raised its price target on the stock to $1,600 from $1,350, writing that it expects the company will continue “to compound on its defensible dominance in Search and video advertising with YouTube.”

Earlier this week, Deutsche Bank raised its own target to $1,735, writing that the stock “trades too cheaply”. The firm cited more ad product launches, an expanded stock buyback programme and “improving competitiveness in the cloud business”.