Gold is likely to break US$1,300 as investors rush to hedge their risk and buy safe haven assets in the wake of the Swiss currency turmoil.

“People got rid of their dollars and bought gold after the movement of the Swiss franc and the euro dropping,” said Mohamed Shakarchi, the owner of Dubai-based Emirates Gold Refinery. “Everybody has been affected by what the Swiss have done.”

Since the Swiss central bank’s surprise move on Thursday to abandon the franc’s cap against the euro, gold has advanced by more than 4.5 per cent.

Spot gold closed at $1,275.50 on Friday on the Comex in New York.

Enough macroeconomic damage has been done to boost the outlook for gold prices, said Pradeep Unni, senior relationship manager at Richcomm Global Services, a research house based in the Dubai Multi Commodities Centre.

“My personal target is $1,300 plus, but if we touch the resistance point of $1,320, we should see the gold market go beyond. It would be a trend breaker,” Mr Unni said.

Since Thursday, at least two global foreign exchange brokerages have gone into insolvency and Swiss companies have jumped for cover in the absence of hedging programmes deemed uneccessary since the introduction of a cap of 1.20 per euro in September 2011.

“Every time we have a system shock just like what happened with the Swiss [central] bank, investors will go back and rethink of having more gold to hedge their risk,” said Tariq Qaqish, head of asset management at Al Mal Capital in Dubai.

The decision by the Swiss National Bank to take out the floor against the euro is very significant for gold, said Nour Eldeen Al Hammoury, chief market strategist at ADS Securities in Abu Dhabi.

“The banking watchdog is likely to ease its sales of gold, which should boost its safe haven status,” Mr Al Hammoury said. “It previously used to sell gold to buy euros.”

Gold is likely to trade between $1,300 and $1,400 this year, while any declines will be limited above the $1,300 barrier, Mr Al Hammoury said.

Swiss National Bank had been amassing staggering reserves of foreign currency to keep the Swiss franc at 1.20 per euro, said Professor Nuno Fernandes at IMD Business School in Lausanne, Switzerland.

The bank’s balance sheet doubled in three years to 500 billion Swiss francs (Dh2.13 trillion), leaving the banking watchdog hugely exposed and experiencing a loss of 100bn Swiss francs with the 20 per cent revaluation of the franc last week, Mr Fernandes said. “The SNB’s equity has fallen from close to 70bn francs to a negative value of about 20bn francs, mark-to-market,” Mr Fernandes said.

Central banks are likely to continue amassing gold reserves this year, which should support prices, HSBC Securities (US) wrote in a report last week. Central banks, which have been big buyers of the commodity since 2010 after two decades of sales, are expected to add 400 tonnes this year, HSBC said.

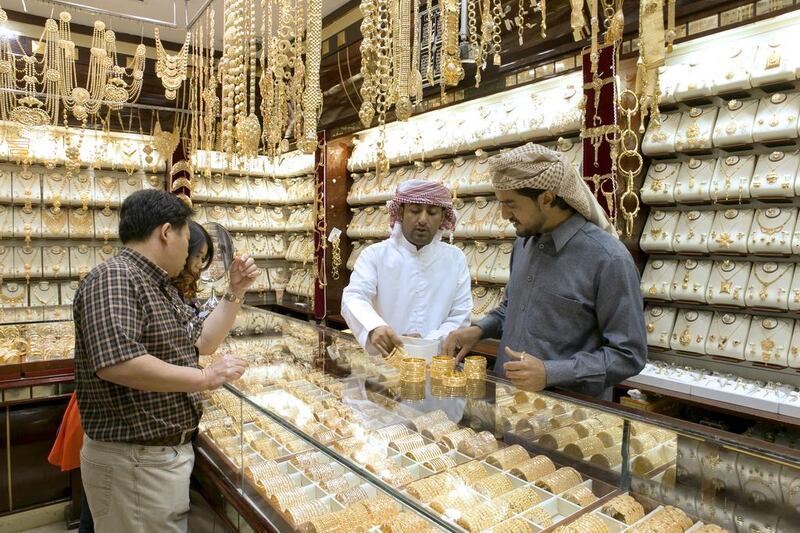

Regional gold traders noted that there was an uptick in buying of gold bullion over the two days since the Swiss currency move. “The retail demand was always there over the last few months, especially with Dubai Shopping Festival, but now speaking to bullion traders in Kuwait, Oman and here, they’ve witnessed some bullion getting built up,” Mr Unni said. “There has been special attention on the kilo bars and the 160-gram smaller gold bars.”

halsayegh@thenational.ae

Follow The National's Business section on Twitter