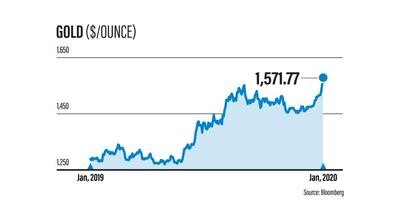

Gold surged to the highest level in more than six years as fast-rising tensions in the Middle East stoked demand for haven assets, with Goldman Sachs Group saying that bullion offered a more effective hedge than oil to the crisis. Palladium extended gains to an all-time high.

Bullion neared $1,600 (Dh5,876) an ounce as Tehran said it would no longer abide by any limits on its enrichment of uranium following the killing of General Qassem Suleimani. In addition, President Donald Trump said he was prepared to strike Iran “in a disproportionate manner” if it retaliates against any US target.

Gold “has entered 2020 with strong momentum”, Gavin Wendt, senior resource analyst at MineLife in Sydney said in an email. “When you factor in ongoing uncertainty with respect to US-China trade talks and heightened security issues with Iran, gold really is a no-brainer.”

Bullion is building on the largest annual increase in value since 2010, which was driven by a weaker dollar, lower real rates and the trade war’s drag on global growth. The widening fallout from the drone strike on Suleimani is threatening to escalate, denting risk sentiment and sending investors to safe haven assets. While Goldman Sachs analysts cautioned there was a large range of potential scenarios at this stage, the bank said bullion may prove a better bet than oil.

“History shows that under most outcomes gold will likely rally to well beyond current levels,” analysts including Jeffrey Currie and Damien Courvalin said in a note issued on Monday. That’s “consistent with our previous research, which shows that being long gold is a better hedge to such geopolitical risks.”

Spot gold prices climbed as much as 2.3 per cent to $1,588.13 an ounce, the highest level since April 2013, and traded at $1,579.13 at 7:47AM UAE time, while futures gained as much as 2.5 per cent to $1,590.90. Palladium jumped 1.5 per cent to $2,019.73 an ounce, a fresh record, while silver and platinum also rose.

There are other factors supporting gold price increases. The Federal Reserve is unlikely to raise interest rates any time within the next six months, which will in turn probably keep a cap on the US dollar — both of which are “extremely positive” for gold, according to MineLife’s Wendt.

Gold miners also traded higher. Newcrest Mining, Australia’s largest producer, rose as much as 4 per cent in Sydney, while Northern Star Resources gained as much as 2.4 per cent and Evolution Mining advanced as much as 7.5 per cent.

Palladium has also benefited from the optimism surrounding safe haven assets, as well as its own set of fundamentals — notably being in a multiyear deficit as demand rises for its use in car exhaust catalysts amid stricter emissions standards.

“Palladium, like gold, has been steadily tracking higher over the last two weeks, and the conflict between the US and Tehran seems to have bolstered this,” said Sean MacLean, research strategist at Australian foreign exchange brokerage Pepperstone. “Demand for palladium is increasing faster than its supply, so the long-term trend is on the up anyway.”