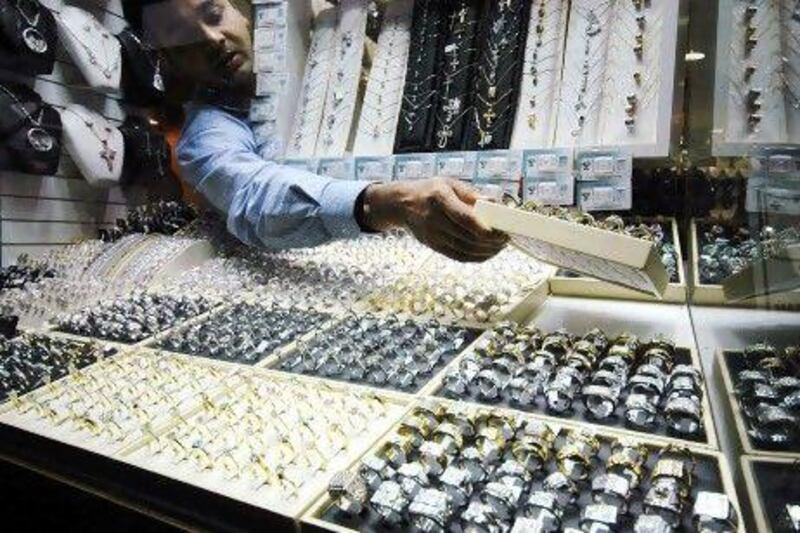

Gold may have been the commodity story of the year, but now diamonds are also being touted as an investor's best friend - with demand rising in India, China and the Middle East.

Shopaholics:

Industry Insights Get the scoop on what's happening in the retail world. Learn More

Worldwide demand will grow by 6 per cent a year to 2020 while supply will increase by 2.8 per cent annually, the management consultancy Bain & Company forecasts in a new report. The biggest increase in demand should occur in the higher-carat segment, according to the report, which was commissioned by the Antwerp World Diamond Centre. The data bodes well for Dubai's already fast-growing diamond business.

A total of 206.1 million carats was traded in Dubai in the first six months of the year, a 57 per cent increase on the same period last year, according to data from the Dubai Diamond Exchange.

Values increased to US$25.3 billion (Dh92.93bn) from $16.3bn.

"This year's record diamond trading volumes are testimony to Dubai's global standing in the diamond industry," Ahmed bin Sulayem, the executive chairman of Dubai Multi Commodities Centre Authority, told The National last month.

Demand will be buoyed by buyers from the growing ranks of Chinese and Indian middle class, which Bain predicts will double by 2020.

Chinese and Indian buyers should account for 30 per cent of sales by the end of the decade, a 50 per cent increase. Purchases by these buyers will almost equal the US, Bain found.

"The appetite for high-quality diamonds in China and India is growing," said Gerhard Prinsloo, a Bain partner.

"But industry players would be ill-advised to take their eye off of the US and its preeminent position as the world's number one diamond market."

To expand the market and "establish diamonds as a full-fledged investment asset", the industry will have to improve transparency, create a traded market and improve the method of valuations, the report said.

High-net-worth individuals and banks in China, India and the Middle East have shown an interest in investing in large, high-quality diamonds, which are growing increasingly scarce.

The limited availability of diamonds above two carats "points to disproportional increases in revenues from this segment", Bain predicts. The large diamonds typically represent 5 per cent of the volume of diamond production, but 50 per cent of the sales value for producers.

Family-owned diamond retailers will be hardest hit by the scarcity, as specialised chain stores grab more market share. The market share of independent jewellery stores fell from 38 per cent in 2000 to 24 per cent last year.

twitter: Follow our breaking business news and retweet to your followers. Follow us