Brokers say this month's return of institutional investors to UAE markets will support a six-week rally and cut volatility.

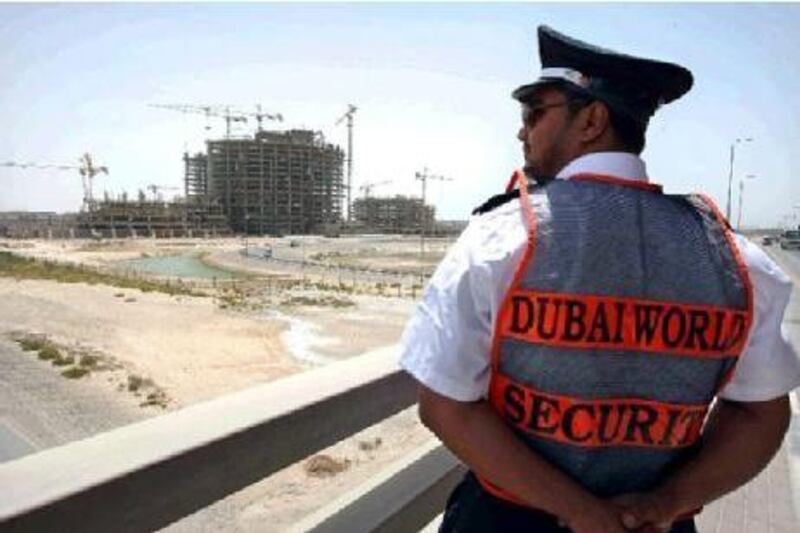

The inflow of institutional money to local funds closes a circle that began last November, after Dubai World's announcement that it would restructure its debt repayments prompted investment managers to divest from Abu Dhabi and Dubai.

Institutional investors have finally returned, with the proportion of western and local institutional players growing to 30 per cent from 5 per cent earlier this year, said Alfred Fayek, the managing director of Middle East and North African equities at EFG Hermes in Dubai.

The Dubai Financial Market General Index has added 17.7 per cent to 1746.71 since August 31, while the Abu Dhabi Securities Exchange General Index has added 10.7 per cent to 2758.67 in the same period.

After Dubai World reached an accord with 99 per cent of its bank creditors to restructure US$24.9 billion of debt, the market is now pricing in a final resolution, said Marwan Shurrab, the vice president and chief trader of Gulfmena Alternative Investments in Dubai.

"From what we're gathering, it is mostly institutional investors starting to play and international investors starting to eye the region once more," said Mr Shurrab. "The time frame for holding investments is also beginning to increase, from what we have been seeing from the beginning of the year, where most investors were looking for short-term investments and trading opportunities."

Dubai World's announcement triggered a wave of downgrades of government-related entities by credit agencies that prompted a flight of institutional capital, as the stocks no longer satisfied the conservative mandates of investment funds.

Fund managers focused on the UAE have also noted the increased interest.

"We have seen inflows of capital into our funds. It was both local and international, and we think, of course, part of the international increase of interest in higher yielding asset classes, particularly when interest rates are very low," said Yazan Abdeen, a fund manager at ING Investment Management in Dubai.

European investment banks, in particular, are showing more of a presence in the Dubai and Abu Dhabi stock markets than before, said Saad al Chalabi, an institutional trader at AlRamz Securities in Abu Dhabi. They arbitrage on both the gain on the equity and on the appreciation of the currency, he said.

"To euro funds, this market looks cheap, so they wouldn't mind entering, and the euro is doing very well against the dollar right now," said Mr al Chalabi. In the past month, the euro has gained 7.6 per cent against the dollar.

The inclusion of stocks in the FTSE global equity index series was also another positive step in the re-engagement of global investors with the UAE, Mr al Chalabi said. While its effects remain limited it has encouraged the sector to push towards fulfilling the requirements of the MSCI Barra to become classified as an emerging market, he said.

The upgrade to emerging market from frontier market by MSCI would allow tracker funds that rely on the ratings to include UAE stocks, further increasing share of institutional investors and decreasing the volatility in stocks experienced by day traders and retail investors.

Elsewhere in the region, Kuwait and Bahrain's measures were largely unchanged for the week, at 7,010.50 and 1,459.44 respectively. Oman's bourse added 0.4 per cent to 6,536.01. Qatar's measure added 0.6 per cent to 7,821.23 and the Saudi Tadawul All-Share Index fell less than 1 per cent on Friday to 6,244.62.