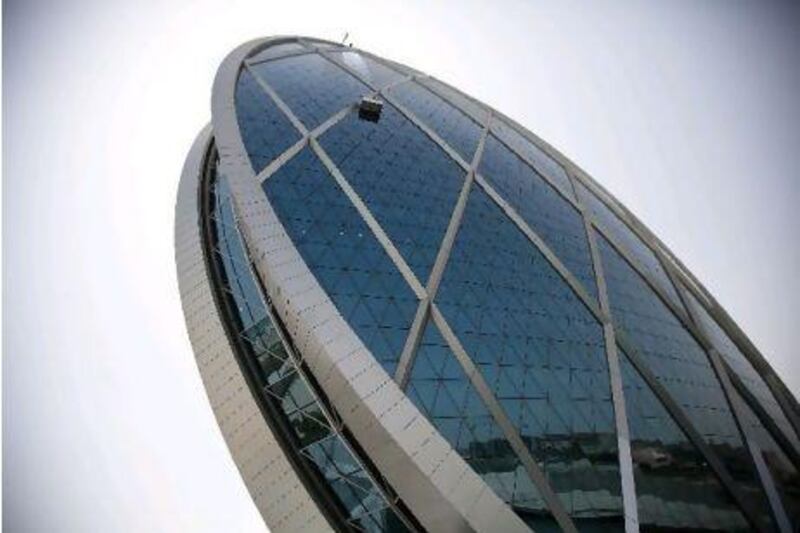

Aldar Properties jumped the most in almost two months after the Abu Dhabi developer revealed it had no plans to delist, putting an end to market speculation.

Are you the strongest link?

Business Quiz 2011 Do you have your finger on the pulse of business? Take our online contest for your chance to win brunch for two. Take the quiz

"[The] Aldar board is fully committed to maintaining the company's listing," Aldar said in a statement to the Abu Dhabi Securities Exchange (ADX).

Speculation about a delisting has swirled ever since Mubadala Development, the developer's largest single shareholder, injected Dh2.8 billion into the company about a year ago. Mubadala, a strategic investment company owned by the Abu Dhabi Government, made the injection by buying bonds from Aldar that would later convert into shares, giving it more than a majority stake upon full conversion.

About Dh2.1bn of those bonds converted to shares on December 16, raising Mubadala's stake in Aldar to 49 per cent. That sent Aldar's shares to their lowest since their 2005 listing. The shares advanced 2.4 per cent yesterday, however, the highest price gain since October 30, to 85 fils at the close.

The ADX General Index was little changed at 2,350.28, while the Dubai Financial Market General Index edged 0.8 per cent lower to 1,328.07.

"There is little interest in the market," said Wadah Taha, the chief investment officer at Al Zarooni Group, based in Dubai.

"In previous years we would see a small rally during this period as investors make a few purchases, what we call 'window dressing', to increase the value of their portfolio at the year end. This has not happened this year."

Elsewhere in the region: Kuwait's measure added 0.1 per cent to 5,802.50; Bahrain's measure was little changed at 1,133.21; Oman's index added 0.2 per cent to 5,649.10; Qatar's QE Index rose 0.4 per cent to 8,816.02.

twitter: Follow our breaking business news and retweet to your followers. Follow us