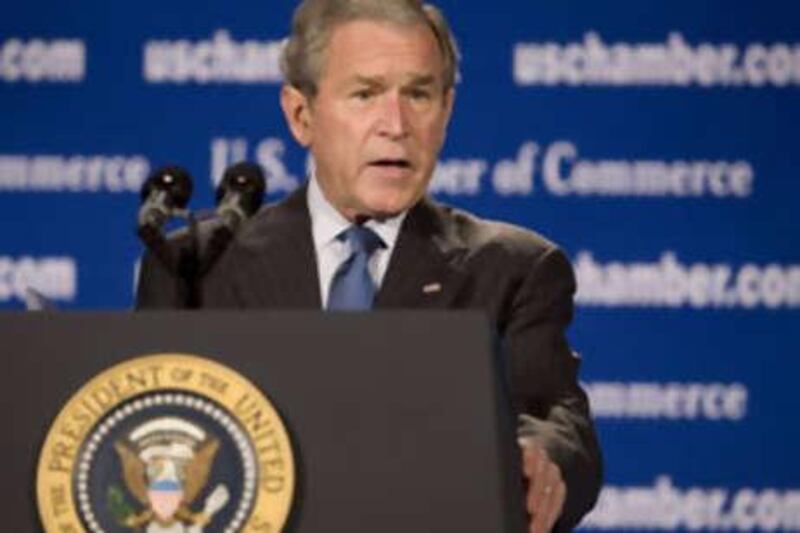

WASHINGTON // The government's drastic economic rescue efforts will eventually pay off, George W Bush insisted today, offering calming words to anxious Americans but no suggestions of a quick revival as Wall Street braced for another wild day. The economy didn't falter overnight, "and it's going to take a while for the credit system to thaw", Mr Bush said just before the markets opened, speaking across a park from the White House at the US Chamber of Commerce building, a symbolic headquarters of American business. Wall Street tumbled again early today after the government said new home construction dropped by more than expected last month to the lowest pace since early 1991. The Dow Jones industrials fell 200 points. Housing starts fell more than six per cent in September to an annual rate of 817,000 units, the Commerce Department reported. That figure is lower than the 880,000 units forecast by Wall Street economists surveyed by Thomson/IFR. Building permits also sank. The report was yet another piece of evidence that the nation is struggling with a weak economy that, if the financial crisis is not solved, could dive into a sustained downturn. It's been an erratic week on Wall Street, with the Dow soaring 936 points on Monday, slipping moderately on Tuesday, sinking 733 points on Wednesday, and then rallying 401 points on Thursday. Most worldwide commodity markets also bounced today, paring the previous session's hefty losses as financial markets turned higher again after gains overnight in US stocks. Oil rose above $70 a barrel, recovering from a 16-month low, copper gained more than six per cent, zinc leapt nine per cent and sugar and coffee also pushed higher. However, gold extended the previous session's losses as the dollar firmed. European shares jumped in early trade, tracking gains in the United States and Asia. The Dow Jones industrial average jumped 4.7 per cent while the broader Standard & Poor's 500 Index climbed 4.2 per cent. But commodity prices remain well below where they started the year with fears about demand and aversion to risk making investors rush from the sector. Analysts questioned whether the steep declines in prices of industrial raw materials - nickel down 80 per cent from record highs in 2007, oil off more than 50 per cent from lifetime highs in July - were fully justified by the prospect of a recession. "The interesting question is whether a recession really will result in sufficient demand destruction to warrant a 60 per cent retracement in [commodity] prices," said Jonathan Barratt, at Commodity Broking Services in Sydney. "In previous recessions, prices fell by a quarter. Look at zinc - it's gone from $4,500 to $1,250. Does a drop in growth of say, three per cent, really require that kind of pullback?" US crude for November delivery rose $1.13 to $70.98 a barrel by 0950 GMT. It touched a low of $68.57 on Thursday, its lowest since June last year. "The market is up in line with other asset classes," said Thomas Stenvoll at UBS. "Oil is dependent on strength in the economy but in order to have a sustainable rally we need to have proof that it has really improved or at least it is not collapsing," he said. "And right now we are not getting that proof." Analysts said oil traders were also betting the Organisation of the Petroleum Exporting Countries (Opec) would reduce supply to support prices when it meets next week. The 13-member cartel said yesterday it had brought forward to Friday next week an emergency meeting to discuss the impact of global recession on oil markets. *Agencies

Bush urges calm over finances

The US president says drastic economic rescue efforts will eventually pay off, as Wall Street opens down.

More from the national