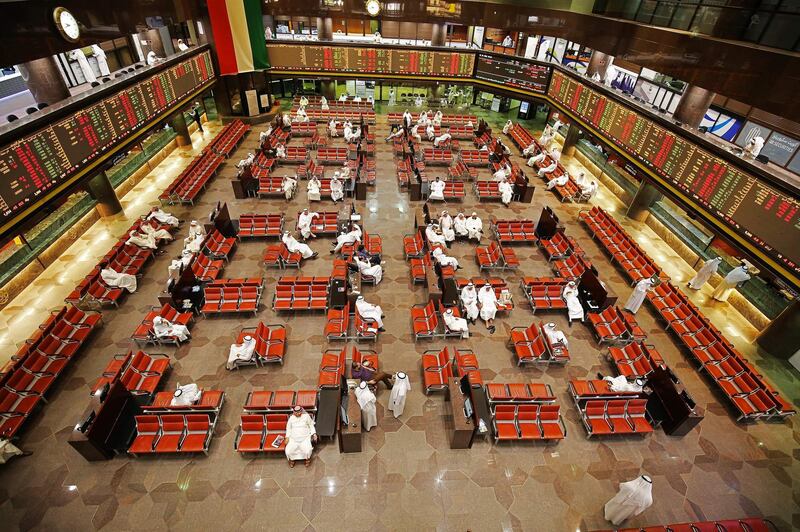

Boursa Kuwait shares retreated on the second day of trading after a stellar debut, however, the exchange's long term prospects remain intact as it heads for the MSCI Emerging Market Index inclusion at the end of this quarter.

Boursa Kuwait shares slid 2.37 per cent on Tuesday, to close at 1,030 fils. It was the most active stock in terms of the number of trades and ended the day as the second-worst performer behind Warba Bank, which closed 3.8 per cent lower. The country's benchmark Premier Market closed 0.09 per cent higher.

“We think after a good debut on market … it is bound to see some profit taking, which we have witnessed today,” Hettish Karmani, head of research at Muscat-based U-Capital, said.

“In the long run, we believe it is a good stock and it is trading at a discount to its peers with a further push to trading values to come post inclusion by MSCI.”

Boursa Kuwait surged more than 10-fold on its trading debut on Monday, as it became only the second GCC and the third Middle Eastern publicly traded exchange, after the Dubai Financial Market and Tel Aviv Stock Exchange, respectively.

It rose as high as 1,210 fils during trading but pared gains to close at 1,055 fils. The stock was offered at 100 fils in an initial public offering last year as part of the Capital Markets Authority law that mandated the privatisation of the Kuwait Stock Exchange.

Around 50 per cent of the KSE shares were sold to Kuwaiti citizens in the public offering that was more than eight times oversubscribed.

Exchanges in the region are increasingly looking to list their own shares as they look to attract foreign investors. Saudi Arabia’s Tadawul, the biggest bourse in the region, has also lined up its own IPO. Tadawul will assess the timing of the public listing in the first quarter of next year, its chief executive Khalid Al Hussan said earlier this month.

Boursa Kuwait listing has come ahead of country’s stock market inclusion in the MSCI emerging market gauge at the end of this quarter. The upgrade, delayed by six months due to the Covid-19 pandemic, will make the bourse more accessible to international investors and will widen its investor base.

“We believe the Kuwait upgrade should bring in anywhere between $2.5 billion (Dh9.18bn) to $3bn in passive inflows with a weight [on the MSCI EM Index] ranging between 55-60 basis points," Mr Karmani said.

"The active flows will be probably even higher as the upgrade to emerging market status opens the country to a bigger pool of actively managed funds.”