Asian, European and Gulf shares continued to drop today as financial fallout continued to shake global markets.

Financial Fallout: Read The National's coverage of the global economic chaos

Oil tumbles as gold tops $1,700 World stocks tumbled yesterday as investors fretted about the rate of global growth after Standard & Poor's cut its rating for the US on Friday. Read article

Investment advice never more timely Worried about the dwindling value of your stock portfolio after the market mayhem? Advisers say stay calm. Read article

Gulf businesses will find it harder to get funding Big businesses in the Gulf face rising borrowing costs as a result of the US and euro zone troubles. read article

Mixed effect of dollar decline for small businesses in UAE Small businesses that import goods priced in foreign currencies fear they will suffer if the dollar declines sharply. read article

Double whammy hits recovery Debt troubles in the US and the euro zone risks harming the Gulf's economic growth outlook. Read article

In Asia, Korea's KOSPI Index was down 3.6 per cent to 1801.35 points. Hong Kong's Hang Seng Index was down 2.6 per cent to 19943.60 points. Japan's Nikkei 225 Index was down 1.6 per cent to 8944.48 points.

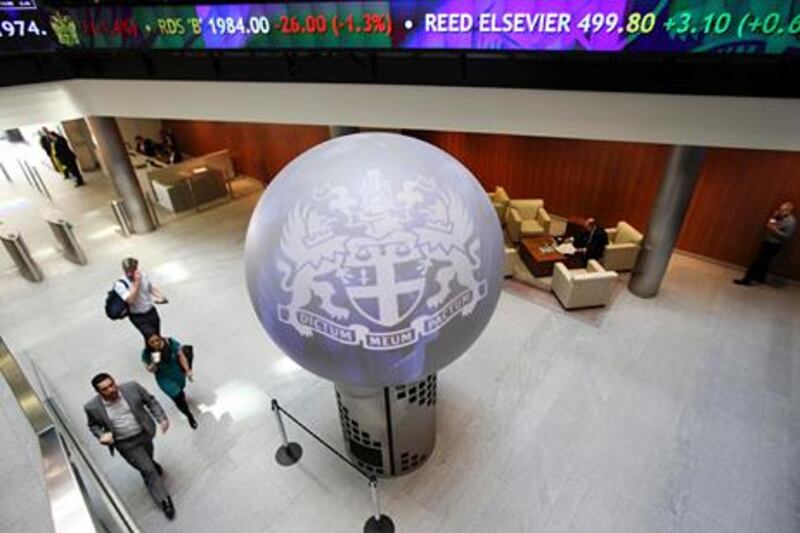

In Europe, the FTSE 100 Index was down 4.3 per cent to 4938.14 points, the lowest since July last year and 20 per cent down since this year's high on Feburary 8, as it emerged UK manufacturing unexpectedly fell in June and the trade gap widened, adding to evidence that its economic recovery is faltering. Factory output declined 0.4 per cent from the previous month, when it rose 1.8 per cent, the Office for National Statistics said today. Barclays Plc dropped 7.3 per cent to 162.55 pence, while Royal Bank of Scotland Group Plc tumbled 7.2 per cent to 25.29 pence at 9:26 am in London trading.

The US Federal Reserve will meet later today with investors anxiously wondering if the central bank will end a two month hiatus and announce new measures to support the US largest economy.

In the UAE, the Dubai Financial Market General Index was down 1.3 per cent to 1453.84 points, while the FTSE Nasdaq Dubai UAE 20 Index was down 2.6 per cent to 1519.42 points.The Abu Dhabi Securities Exchange General Index was down 1.1 per cent to 2584.18 points.

Gold, considered a safe-haven in turbulent times, exceeded $1,770 an ounce for the first time at 11:45 am local time. Gold futures for December rose 3.6 per cent to $1,753.70. Gold for immediate delivery rose 3.1 per cent to an all-time high of $1,772.38 points.

The Swiss Franc jumped to an all-time high against the euro. The franc advanced to a record 1.0605 per euro from 1.0705 before trading at 1.0748.

Elsewhere in the region, Kuwait's measure was down 0.4 per cent to 5927.40 points. Bahrain's measure lost 0.4 per cent to 1268.81. Oman's index was down 0.4 per cent to 5577.62 points. Qatar's index was down 0.8 per cent to 8142.81 points. The Saudi Tadawul All-Share Index was down 0.3 per cent to 6057.79 points.

With Bloomberg

halsayegh@thenational.ae