From starting out as a small online bookseller to an e-commerce giant, Amazon became the second US company to hit $1 trillion in stock market value on Tuesday in the latest demonstration of the rising clout of American technology heavyweights.

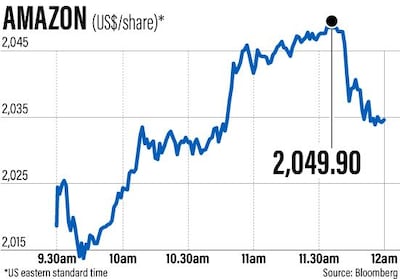

The online retailer broke the barrier at about 7.40pm (3.40pm GMT) when it's share price hit $2,050.50.

The Amazon landmark comes about a month after Apple smashed the $1 trillion barrier.

After crossing the $1tn mark, Amazon’s valuation slipped to $988.8 billion at 8.27pm.

Founded in 1994 by Jeff Bezos, who is now the world's richest man, Amazon has grown exponentially from its roots as an online bookseller into a sector-crossing behemoth.

It competes directly with retail giant Walmart and is at the forefront of the latest trends in artificial intelligence with its Alexa personal assistant programme.

__________

Read more:

Will the 'Amazon effect' take hold in the Middle East?

Amazon sales lift Jeff Bezos's fortune by $12bn in a day

___________

Other ventures include its purchase in 2017 of Whole Foods Market and an increasingly vital presence in the production of movie and television shows that are made available to subscribers of its Amazon Prime streaming service.

The e-commerce giant also bought souq.com, the Middle East's biggest online retailer, for $580 million last year.

The company's employee count has soared to 575,000 as it has spread out into ever-more sectors of the economy.

Company profits, which long played second fiddle to revenue growth, have shown impressive gains.

Amazon's long road to $1,000,000,000,000

Amazon's journey from an online bookseller started in a garage to a global e-commerce powerhouse has centred on obsession with the long road.

The company initially incorporated as "Cadabra" by Jeff Bezos in 1994 and backed with money borrowed from his parents.

"It's funny comparing Apple and Amazon because they are very different companies," said independent technology analyst Rob Enderle.

"Apple is basically a one product company nowadays; Amazon is anything but."

While Apple makes most of its money from iPhones, the Amazon empire includes global e-commerce operations, cloud computing, artificial intelligence, streaming television, groceries and more.

Created in a garage in a suburb of Seattle, Washington, the company renamed "Amazon" sold its first book - Fluid Concepts and Creative Analogies: Computer Models of the Fundamental Mechanisms of Thought by Douglas Hofstadter - to a computer engineer in mid 1995.

By the end of that year, Amazon was selling books online throughout the US. Amazon went public in early 1997.

The company for more than a decade put growth over profit, investing heavily in warehouses, distribution networks, and data centres.

"Every cent they made they put back in the company," Mr Enderle said of Amazon.

"They kept their eye on the prize, which was initially to take over most of commerce."

Innovation sans scandal

Neil Saunders of the research firm GlobalData said Amazon's success comes from the fact that it innovates unlike any other.

"This heady pace of creativity is the key reason why it stays several steps ahead of the market and is able to generate so much growth," Mr Saunders said.

Mr Bezos has kept firm control of Amazon, steering clear of hedge fund investors inclined to short-term tactics aimed at getting share prices to jump. He also avoided scandals or other distractions, keeping revenue and costs close enough to manage and easing into "adjacent markets" that play into Amazon strengths or interests, according to Mr Enderle.

For example, Amazon Web Services cloud computing business is a lucrative business built on technology infrastructure that the company needed to run its own operations.

Investing in warehouses, haulage, drones, shipping and other distribution systems not only enables Amazon to drive down costs, they position the company to compete with other delivery services like FedEx and UPS.

Buying Whole Foods grocery chain last year got Amazon established real world outlets while putting its delivery and retail smarts and systems to work in the brick-and-mortar world.

Drugs and digital ads

Prescription medicine would be a natural market for Amazon to expand into, according to Mr Enderle. Meanwhile, Amazon is reportedly beefing up its digital advertising business to better compete in an online ad market dominated by Google and Facebook.

In the past quarter, Amazon posted its best-ever profit as Bezos highlighted the importance of the digital assistant Alexa that powers Amazon electronics along with cars, appliances and other connected devices.

According to the research firm eMarketer, Amazon's e-commerce revenue will grow more than 28 per cent this year to reach $394bn, and will account for 49 per cent of US online retail sales and nearly five per cent of all retail spending.

One of Amazon's revenue drivers is its Prime subscription service which offers streaming video and music, free delivery and other perks and which has more than 100 million members worldwide.

Arrogance trap

Some fear Amazon is becoming too dominant a force, especially in retail, sparking antitrust discussion even as the company keeps expanding globally and searches for a second headquarters in North America.

"It wasn't that long ago that people were freaking out about Walmart, and Amazon basically stepped on Walmart," Mr Enderle said.

"What Amazon means is disruption and people don't like to be disrupted."

Critics of the company include US President Donald Trump, who has expressed ire at the Bezos-owned Washington Post newspaper that has published stories the president didn't like.

Mr Bezos bought the Washington Post five years ago for $250 million from his personal funds.

While it made sense that his skills could be advantageous in the content-oriented news business, it came with the risk of displeased politicians using their power against the company.

"The Post was a mistake because it results in him going to war with people he wouldn't otherwise go to war with," Mr Enderle said.

"You really don't want to go to war with the government."

Amazon's huge cloud computing segment powers systems for government clients, and contracts could be influenced by politics.

Amazon must also guard against the kind of arrogance that can undo companies that come to dominate markets, according to the analyst.

"When companies get big, it starts being about what you have the power to do and now what is right to do," Mr Enderle said.

"If Amazon does have a downfall, it will be arrogance in dealing with the customer."