Abu Dhabi Global Market (ADGM), the capital’s new financial free zone, and the Abu Dhabi Securities Exchange (ADX), its stock market, are to explore the possibility of setting up a new financial exchange on ADGM’s Al Maryah Island site.

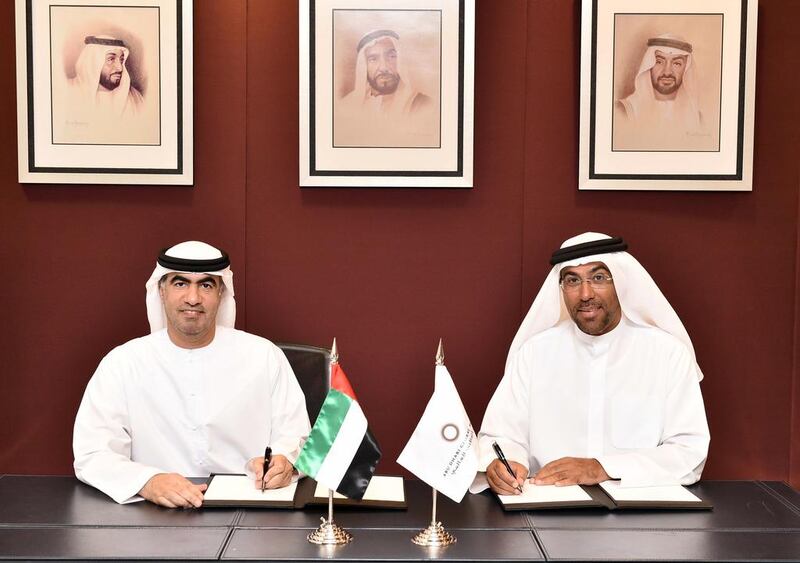

The groundwork for a new exchange has been laid with a memorandum of understanding between the two bodies, signed yesterday. The agreement is intended to “foster bilateral cooperation” and “supports ADX’s commitment to the growth of the financial services sector in the emirate of Abu Dhabi,” a joint statement said.

Ahmed Al Sayegh, the chairman of ADGM, said: “The MoU is a strategic and symbolic extension of our close relationship with ADX, which has been an important contributing partner since the inception of ADGM, and continues to be a significant stakeholder in the development of Abu Dhabi as an international economic hub. This collaboration allows both teams to work closely in establishing the objective of an exchange in ADGM.”

He added: “In addition, we will explore and develop a wider range of financial products and service offerings that can be available to, and traded by, both local and global market participants and investors in ADGM.”

Hamad Abdullah Al Shamsi, the chairman of ADX, said: “We look forward through this MoU to create new opportunities to promote further cooperation and synergy between the two markets and in various fields. We hope this agreement will contribute to strengthening the level of coordination between us, which will benefit our joint activities and contribute to economic growth in the emirate of Abu Dhabi.”

He added: “ADX is committed to achieving the vision of the Abu Dhabi government by strengthening the capital market, developing a system for asset and wealth management, channelling financial surpluses in the financial sector towards investing in the core sectors and activating non-traditional financing methods. Economic diversification, alongside focusing on non-oil sectors, is one of the main long-term goals of Abu Dhabi’s Economic Vision 2030.”

Both bodies declined to elaborate on the plans for an exchange on Al Maryah, but setting up a full securities and trading operation there would be a big boost to ADGM’s ambitions as a financial hub. “All opportunities are to be explored,” said a senior source who declined to be identified.

ADGM’s initial strategy has been to focus on wealth and asset management as well as private banking, but it has reserved the right to get involved in businesses across the financial spectrum, including securities trading.

The rulebook of the ADGM financial services regulatory authority has provisions for all types of capital raising in equities and bond markets, including primary listings and initial public offerings.

It is not known whether ADX would be prepared to physically move to Al Maryah. One of the towers there is named after ADX, and the main ADGM building has a state-of-the-art “bear pit” trading floor designed in its premises. But ADX is believed to be committed to its existing “onshore” headquarters on Hamdan Street, regulated by the Emirates Securities and Commodities Authority.

The UAE has two other financial markets: the Dubai Financial Market and the “offshore” Nasdaq Dubai market located in the Dubai International Financial Centre free zone, although they share a common trading platform and back-office facilities.

fkane@thenational.ae

Follow The National's Business section on Twitter