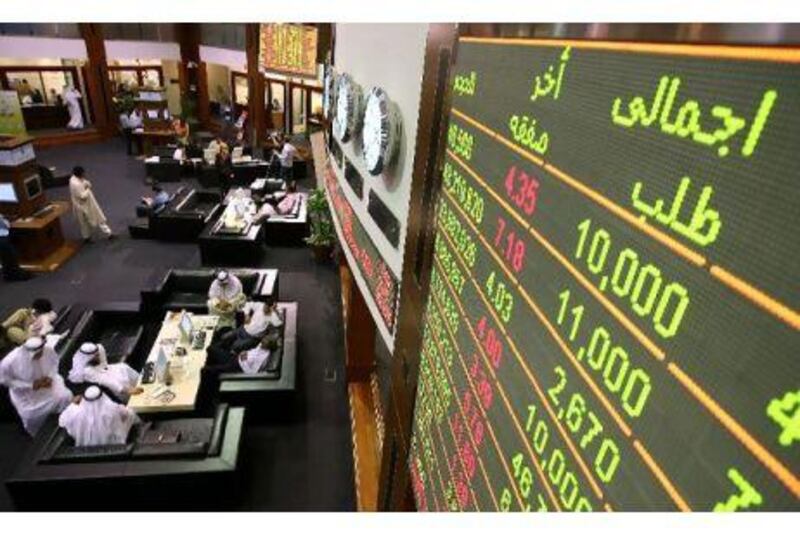

The Dubai Financial Market (DFM) made its biggest gain in almost two weeks as investors responded positively to the emirate's bid to raise up to US$5 billion from selling bonds.

Yesterday, the Dubai Government launched a bond programme to take advantage of improving international sentiment towards Gulf debt.

The DFM General Index ended the day 0.4 per cent higher at 1,557.60 points, reversing losses on Sunday, and the Abu Dhabi Securities Exchange General Index edged 0.3 higher to 2,709.56 points.

"It's a good time to raise money, and from a long-term perspective the restructuring that's happened in the last couple of years are all positive developments," said Shakeel Sarwar, the head of asset management at Securities & Investment in Bahrain.

"That's why you're seeing risk premium in Dubai going down," Mr Sarwar said. But he added that retail traders were still dictating the movement of markets.

Dubai's market had slipped to its lowest level of the month on Sunday. Volumes have also dwindled and yesterday stood at about 70 million, compared with averages of 100 million shares during the past few months.

Among the best performers on Dubai's market, the bourse operator DFM Company, which represents the only publicly listed stock market in the Arab world, advanced 0.8 per cent to Dh1.20.

On Sunday, HSBC analysts raised their rating on DFM to "neutral" from "underweight", despite its shares falling 17.8 per cent in the past six weeks.

Heavyweight property stocks also led the momentum as Emaar Properties added 0.7 per cent to Dh3.10 and Arabtec advanced 1.5 per cent to Dh1.32.