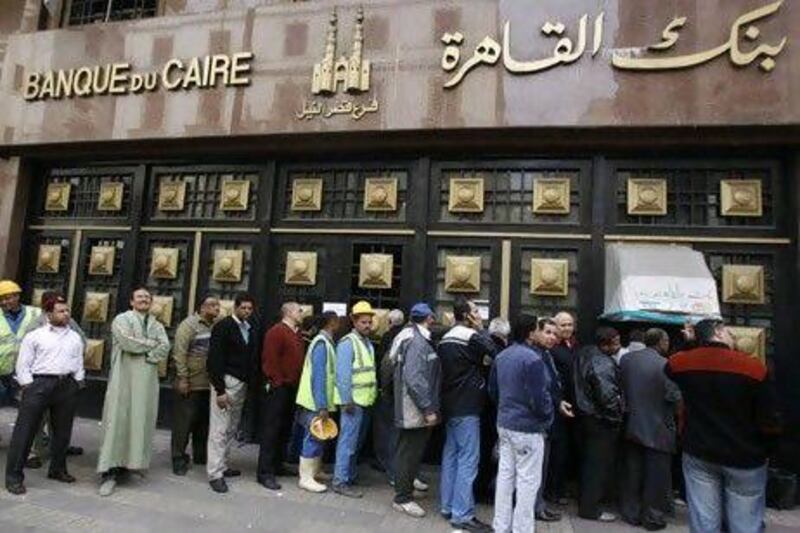

As Egyptians yesterday lined up in their thousands outside banks across the country to withdraw cash, it was a stark reminder of how Egypt had transformed from the darling economy of north Africa to a major question mark in the portfolios of investors.

While capital outflows on the first day of business since protesters took to the streets to call for Hosni Mubarak to step down after 30 years as president were less than expected, according to some bankers, the central bank said that as much as US$8 billion (Dh29.38bn) could leave the country in the coming weeks.

"What we're expecting to see going forward is a shift from investments in Egypt into the rest of the region," said Marwan Shurrab, the vice president and chief trader at Gulfmena Alternative Investments in Dubai. "This has not been seen yet, mainly because money is still stuck in Egypt. We will see it flow into regional markets in the coming weeks."

An investment banker in Dubai said the expectation was that there would be wide selling on the stock markets whenever they reopened, scheduled to be later this week, but that shrewd investors would discern between those companies connected with Mr Mubarak's regime - such as Orascom, Palm Hills Developments and Ezz Steel - and those positioned to hold on to their strategic position in the country - such as Telecom Egypt and Commercial International Bank (Egypt). "Before you were investing in Egypt because it was a macroeconomic story," the banker said. "Now you have to look at these companies much more closely and determine how they are going to come out of all this political change."

Standard & Poor's, Moody's Investors Service and Fitch Ratings have all downgraded Egyptian companies in the aftermath of the protests.

Richard Fox, the head of Middle East and Africa sovereign ratings at Fitch, said "the downgrade reflects the significant intensification of unrest, at the start of what is likely to be a volatile transition to a new government, and the increasingly negative consequences for the economy, public and external finances of the continuing disruption.

"Any political changes or upheaval of Egypt's leadership will have major impacts on everyday citizens - many of whom are unemployed and clamouring for a bigger role in the economy - but also on international businesses involved in the country's development," he said.

A new political power could have major impacts on policies involving economics, foreign direct investment, taxation and labour laws.

Badr Jafar, an executive director at Crescent Petroleum, said a major concern was for the Egyptian government to maintain the progressive policies implemented with regard to natural gas over the past several years. Crescent Petroleum is the largest shareholder of Dana Gas, which has concessions in Egypt.

"There has been a lot of progress with policies about the pricing of gas and reducing the subsidies," Mr Jafar said. "We just hope that those progressive policies continue however the leadership ends up being structured."

Dana Gas was conducting daily risk assessments on its assets in Egypt, but had not yet seen any incidents or disruptions to operations, he said. A pipeline unrelated to Dana Gas supplying Israel and Jordan with gas was sabotaged over the weekend, officials said.

"We all pray that we don't see any violence," Mr Jafar said. "Our region has seen enough of that in recent times. There is a transition of power and the most important thing is for that to be a peaceful one."

* With additional reporting by Hadeel al Sayegh