I was recently reading about diets that appear to enhance longevity. The typical Mediterranean-cum-Japanese mantra of fresh vegetables and fish seems to be the standard fare of people who live longer than most. But I wonder: what are their mental faculties like? I would love to live to a ripe old age and discover what the world will be like in a few decades, as well as meet future members of my family. But I'd want to be healthy and "all there". And most of all, I'd want to be able to afford it.

These thoughts came back to me as I watched a super film, Quartet, on a flight recently. I was on my way back from visiting an uncle in his mid-70s who has always been a "doer" - whether it's the physical labour of beautifying his garden and upgrading his home, or the hard graft of building up his business. Not one to sit idly, he has enjoyed an active life of biking, hiking and skiing. But that's changing, and his body is no longer able to do what his mind wishes him to. I believe his obvious and growing frustrations are, in large part, due to this.

For those who don't know about the movie, it centres around the lives of the residents of a home for retired musicians. They appear to be a fortunate lot: mainly sound of mind and with faculties intact - if this reflects real life then it's a great advert for us all to take up music pronto.

Unfortunately, we cannot bank on being so lucky. Some of us will age gracefully and healthily, able to live independently and safely into our 80s perhaps. But others will be in need of great care and assistance in our 60s.

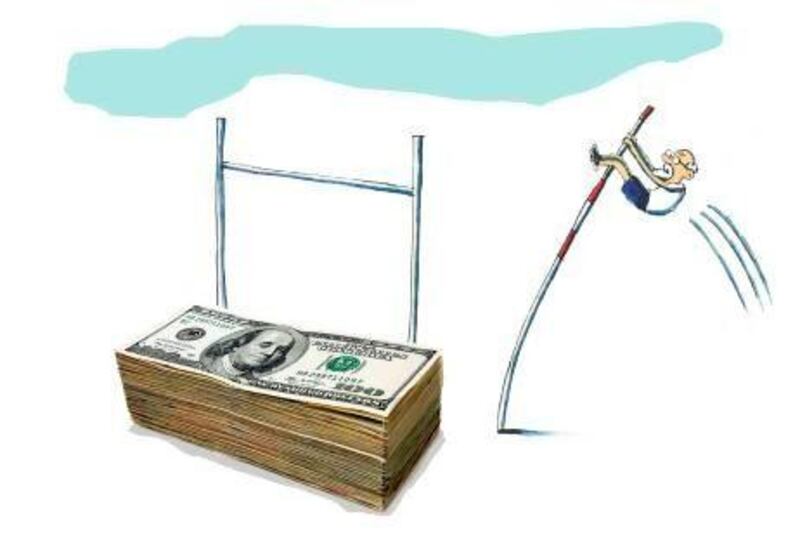

There's no way of knowing how we'll end up - until it happens. Statistics show that we are living longer, but that our savings haven't kept up with the added years. What does this mean? Well, it means that our pensions must provide, and it appears that conventional calculations don't take into account our increasing life expectancy.

Another thing is figuring out how we'll need money to work for us later on in life; when do we make the transition from wanting capital to generate income streams, to a much shorter time horizon where we might need to literally liquidate our assets and most likely spend a lot on health care and care generally.

Watching the film, and staying with my uncle, has set me thinking about these issues. Obviously, exactly what money is needed will depend on our health; the biggest and fastest-growing retirement expense is health care, as well as the cost of survival - how much we will need depends on how long we live.

And it appears we are not very good at guessing our potential lifespan. The Society of Actuaries, a US and Canadian trade group that measures risk in finance, insurance and pensions, finds that roughly 54 per cent of retirees underestimate the life expectancy of the average person their own age. This is interesting because it indicates that people might be overestimating how much they can spend during retirement - which in turn means they won't have enough to sustain them for their lifetime.

Simple online retirement calculators are a good thing to look at to get a feel for what all this means and how it translates into dollars and cents.

They ask things like: "income replacement at retirement" and have it preset around the 75 per cent mark. Many advisers would counsel aiming for an 85 per cent income replacement. But the scary thing is that even that appears to fall short. More evidence is pointing towards us needing an income replacement rate of 100 per cent ... getting the figures from the online calculators is simply terrifying. I suggest you have a look. I used the first one that came up on the web after putting in a search for "How much should I save for my retirement?"

So if you're planning to live to a ripe old age, here's hoping they will be healthy years, and remember to get your head around the real cost of it and start putting away a big chunk of annual income - right now. It would be sad to think that your sought-after longevity would turn out to be a threat to your well-being rather than the jackpot of joy of being around to share life with your nearest and dearest. The onus is on us individuals to save enough.

Are you? I just found out that I'm not ... and I'm scared. But will I be scared enough tomorrow and do something about it? That is the question.

Nima Abu Wardeh is the founder of the personal finance website www.cashy.me. You can contact her at nima@cashy.me

Live long and prosper … but do build savings too

On the money: I was recently reading about diets that appear to enhance longevity. The typical Mediterranean-cum-Japanese mantra of fresh vegetables and fish seems to be the standard fare of people who live longer than most. But I wonder: what are their mental faculties like?

Editor's picks

More from the national