I have been told a tale that merits a storyline in any number of soap operas . stay with it until the end and you'll see the twists and turns unravel.

It all started because a stash of cash was sitting idly in an account, not earning much.

Enter main character: a beautiful wife and mother who always has the best interests of her family at heart. This is Mrs X.

She sees the stash and thinks of her loving husband toiling away relentlessly at his job, and decides that the money must be put to good use. If it brings in extra cash, then surely this would take some of the pressure off her husband.

So off she goes in search of options and opportunities.

Camera cuts to dashing, Porsche-driving wealth manager.

They meet, they seem to be made for each other: she sees in him a man who will fix her problems - he'll help her get to see more of her husband. He sees in her a chance to help her make the best use of her assets and make money too. Or so we think.

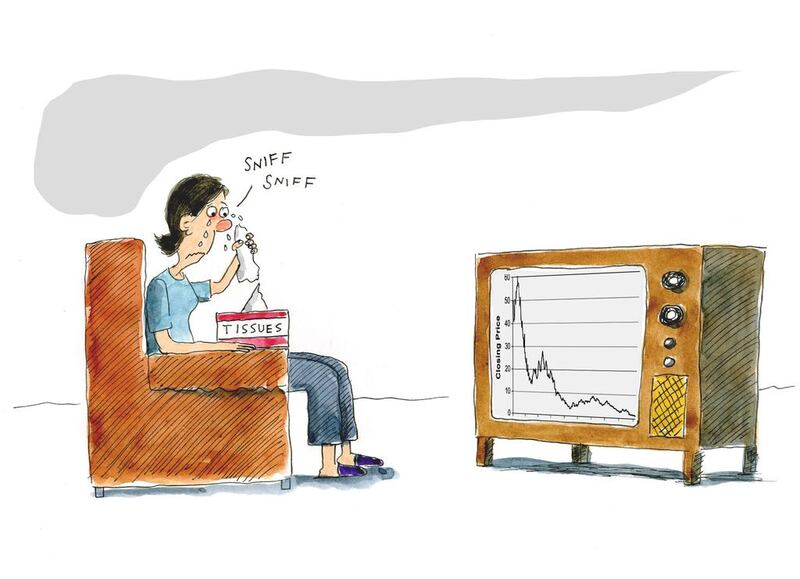

This suave operator works for an international bank that is a big name. She feels "secure". She trusts him. Mrs X has a long meeting with him, she is shown many graphs and results over the past two years. She is encouraged to ask as many questions as she wants. She hangs on his every word, and decides to defer to his expert opinion and buy into what he recommends.

She signs on the dotted line, and we see her happily head home.

Change of scene.

Devious Dan - the wealth manager - is in his cubby hole - he flashes his perfect teeth as he smiles to himself thinking back to his meeting with Mrs X and notches another sell on his desk. Turns out the only wealth he's interested in managing is his own .

He has sold the woman his riskiest investment. All the while assuring her that it isn't so. Glossing over the downside and playing up its impressive track record.

Feet up, cigar clamped in his mouth, he takes out Mrs X's paperwork and starts leisurely adding ticks to boxes and writing.

Camera zooms in. This is what he's writing: client's net worth is US$13 million. She has three-plus years experience of this sort of investment, and her investor profile is that of highest risk taker.

Ahh, it's like taking sweets from babies he thinks to himself.

He hands the doctored paperwork over to his assistant and thinks nothing of it.

But this time it's different.

Mrs X's husband knows a thing or two about investment and money matters. He realises that something is very wrong .

"He said what?"

"It's focusing on American markets?"

"But darling, the nice man from the bank said that it's been paying out a monthly 8 per cent dividend for ever."

"Let me have a look."

And that's where it starts to unravel.

Handsome husband realises that the investment is very risky indeed. It's convertible bonds, high-yield bonds, equities and leverage. A far cry from low-risk fixed income options that Mrs X had asked for.

From what he sees, they stand to lose a lot more than the lump sum they had saved. They need to get rid of this liability asap. His wife has been stitched up, and by default, so has he. The fees alone are $20,000, and how much of the initial investment they get back depends on what the markets are doing.

Mrs X is now a bona fide damsel in distress. She calls Devious Dan straight away - "Oh, ah, you want out of the investment right now," he says. This was on a Thursday - at midday. Unfortunately, the request only came into effect on the following Tuesday - had it been before that, she would've made $10,000 - but it was down on the Tuesday and she took a hit - of $7,000.

As a result of this, this family is down $27,000.

And the worst is yet to come.

Mrs X didn't realise what she was getting herself into, and had been mis-sold a product. But tough luck, she had signed on the dotted line, so legally speaking, there is no redress.

A few days after disinvesting, Mrs X realised she didn't have the paperwork - the papers she filled in when she bought into it. She wanted to check a few details and asked the bank for it. Many days later, it materialised. Upset turned to shock when she and her husband saw the extra, fictitious information added to the paperwork. It's not her handwriting, nor is it in any way true. They are taking the matter up with the bank and have posted a complaint with the Central Bank. And yes, it is a real story.

The point isn't just the misplaced trust in the wealth manager, it's also about trust in the system, process and ethics of the organisation the wealth manager works for.

I am amazed Mrs X ever got to see the original, falsified paperwork - how lucky she is that she did - and how lucky we are that she shared what happened, so that we now always take copies of what we fill in, and put a big fat line through any unfilled spaces. Not because we don't want to trust, but because we can't afford to.

Nima Abu Wardeh is the founder of the personal finance website cashy.me. You can reach her at nima@cashy.me.

Follow us on Twitter @TheNationalPF

Led up the garden path in a saga of high drama

Nima Abu Wardeh writes a warning story of how some wealth managers put their own interests ahead of their clients.

Editor's picks

More from the national