Investors here and abroad are set to take their cues this week from Greece, where politicians will be campaigning for upcoming parliamentary elections as the country sinks further into a debt crisis.

Stock markets from New York to Hong Kong suffered heavy volatility last week as investors lost appetite for riskier assets.

"The risk-reward ratio is too high right now," said Marwan Shurrab, the vice president and chief trader at Gulfmena Investments in Dubai. "All eyes are on the political developments taking place in Greece; that's when the picture will become more clear."

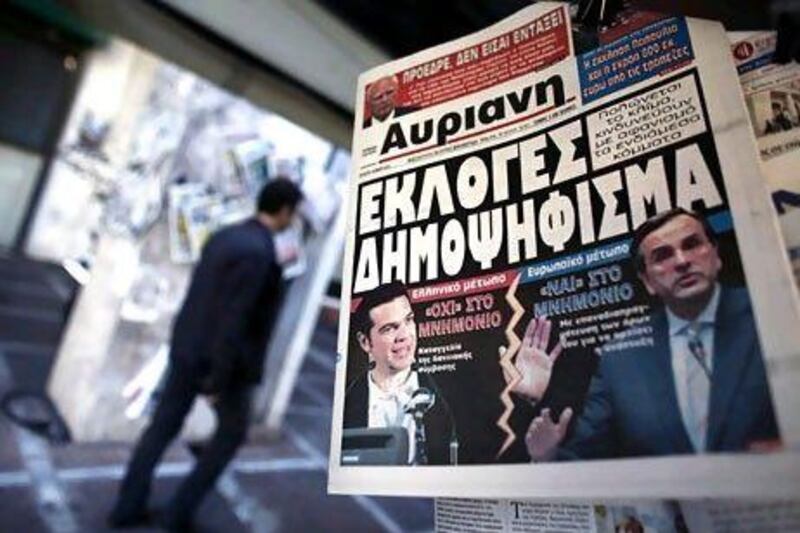

Greek voters will be going to the polls on June 17 after last-ditch talks to form a coalition government failed last Tuesday.

The May 6 parliamentary elections left New Democracy and Pasok, the parties that supported the international rescue in an interim government this year, two deputies short of the 151 seats needed for a majority in parliament. Syriza, the party that advocates cancelling the bailout and nationalising banks, came in second, and resisted pressure to join a coalition government.

"Investors are looking for any kind of hint towards whether Greece will go ahead with its austerity plans, or leave the euro zone, depending on which party wins the most votes" in the new elections, Mr Shurrab said.

Regional stock markets declined last week, with the Abu Dhabi Securities Exchange General Index down 0.2 per cent over the course of the week to 2,467.85.

The Dubai Financial Market slipped 2.6 per cent to 1,475.58. Dubai's index, which rose as much as 30 per cent this year, has lost most of its gains and is now up 8 per cent for the year. "Local markets have become highly correlated with international markets, taking lead from Europe before deciding on trades," Mr Shurrab said.

On Thursday, UAE stock markets opened strongly, taking cues from Asian markets. But they lost steam just before European markets opened, as futures indicated a downward trend for European stocks. About Dh50 million worth of shares traded in Abu Dhabi and Dubai, compared with a daily average of Dh200 million so far this month.

"With such volumes, how is that interesting for any investors to take any risk?" Mr Shurrab said.

Egypt's stock market is expected to remain subdued, with low turnover, as the presidential election edges closer. Egyptians will vote on Wednesday and Thursday for a president for the first time since Hosni Mubarak stepped down in February last year.

"We won't see a clear direction on some of the macro variables for some time," Simon Kitchen, a strategist at EFG-Hermes in Cairo, told Reuters. "The market will be looking around for a direction and won't be finding it."

The election comes as the nation is in negotiations with the IMFto obtain a US$3.2 billion (Dh11.7bn) loan. Many hope the IMF loan will be disbursed by the time the president is sworn in on June 30. "The macro picture will not be clear until you have a president and constitution in place, the IMF loans are secured and FC [foreign currency] risk goes away," Amer Khan, a fund manager at Shuaa Asset Management, told Reuters.

Egypt's foreign-currency reserves have dwindled to about $15bn, down from $20bn at the start of the uprising last year.

The Egyptian Exchange, which crashed and was closed for weeks after the revolution, has risen more than 35 per cent so far this year as losses were seen as overdone. The market, however, shaved some of its gains last week amid a lack of appetite for riskier assets - the result of events in Cairo and Athens.

Kuwait's measure slipped 0.2 per cent over the course of last week to 6,429.09, Bahrain's lost 0.7 per cent to end the week at 1,151.52, Oman's MSM 30 Index fell 1.3 per cent to 5,656.77, and Qatar's QE Index was down 0.9 per cent to 8,455.33.

The Saudi Tadawul All-Share Index fell 1.8 per cent to 6,966.37 yesterday.

* with Bloomberg News