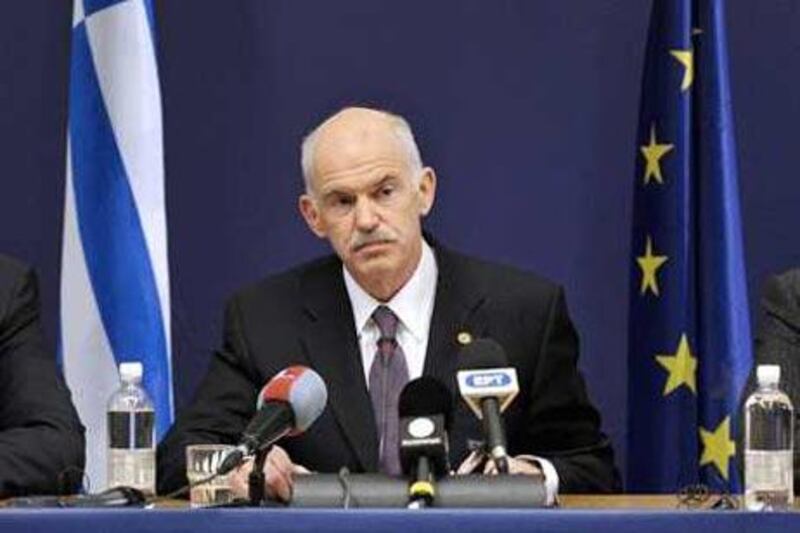

A vague EU pledge of support for the financially beleaguered Greece has failed to stem a growing retreat by global investors away from what they consider to be relatively risky markets, including Dubai debt. On Friday, George Papandreou, the Greek prime minister, thanked his country's neighbours for promising to come to Greece's aid, but said dithering over how to respond to the country's fiscal woes was only intensifying its debt crisis.

While European leaders pledged last Thursday to prevent Greece from defaulting, they offered no details after Germany reportedly blocked talks over how to provide the financing. Mr Papandreou said the EU was turning Greece into "a laboratory animal in the battle between Europe and the markets". The euro fell to an eight-month low against the US dollar in the disappointment over the EU rescue and amid new signs that the European economic recovery was stalling.

A rising dollar benefits the UAE by lowering inflation and boosting its buying power in European markets. But less appetite for risk would be bad for local financial markets, as investors eschew markets perceived as relatively riskier in favour of the safety of the US dollar and government bonds. European finance ministers are scheduled to meet tomorrow and Tuesday in what could produce more concrete measures, but concern over Greece's creditworthiness has already spread to other heavily indebted economies in Europe - Portugal and Spain in particular - and beyond.

Currencies from countries as distant from Greece as Mexico fell on Friday amid concern about rising government indebtedness after the global financial crisis. The sudden anxiety over sovereign risk was sparked by Dubai, which shocked global financial markets on November 25 when it announced it was taking over day-to-day management at Dubai World and requested a six-month "standstill" agreement from the company's creditors.

Now Europe's debt worries are rippling back into the Gulf. The cost of insuring Dubai Government bonds jumped on Friday in London to its highest price since the Dubai World announcement. Investors now consider Dubai more likely to default on its debts than not only Greece, but also Iceland and Iraq. Adding to the dismay in Europe are moves by China to pull back its economy, cool inflation and slow what many economists warn is a dangerous bubble in asset prices. China on Friday raised the amount banks must keep in reserve at the central bank, the second time it has done so in a month.

The reversal in global risk appetite is causing concern across Asia and other emerging economies. On Saturday, Lee Hsien Loong, the prime minister of Singapore, warned that the trade-dependent state needed to brace itself for possible effects from the financial difficulties facing Dubai and Greece. "Although economies have largely stabilised, there may still be surprises and close calls," Mr Lee said in his Lunar New Year address.

"Property values in Dubai have fallen sharply. Greece is in severe financial distress, and Spain and Portugal are under pressure too. This is troubling the whole of the euro zone and unsettling global financial markets." Greece has an estimated ?272bn (Dh1.36 trillion) of government debt, equal to about 113 per cent of its economy, Fitch Ratings says. The Greeks have about ?20bn in debt maturing in April and May, part of ?53.2bn they will need to borrow this year, Reuters estimates.

The erosion of confidence in the euro and the weaker members of the EU comes amid signs that group's nascent recovery may have stalled. Data released on Friday by the EU statistics agency showed the economy of the 16 nations that share the euro grew by just 0.1 per cent in the fourth quarter of last year compared with the previous quarter. With a direct bailout by the EU prohibited under the union's rules, any aid for Greece will have to come from individual members, particularly France and Germany, analysts say.

"A core feature of the European monetary union is that the government cannot absorb the debts of another," said Brian Coulton, a sovereign debt analyst at Fitch Ratings in London. "No bailout clause exists, so that countries with poor fiscal discipline don't pollute others across the region." But Angela Merkel, the German chancellor, faces public opposition to lending aid to Greece. Members of one of the parties in Mrs Merkel's ruling coalition, the Free Democratic Party, have threatened to block her from offering any direct aid.

@Email:warnold@thenational.ae