Mohammad Janili is rubbing his hands together with glee. "Business in the new year has got off to a good start and mobile handsets are flying off the shelves," he says.

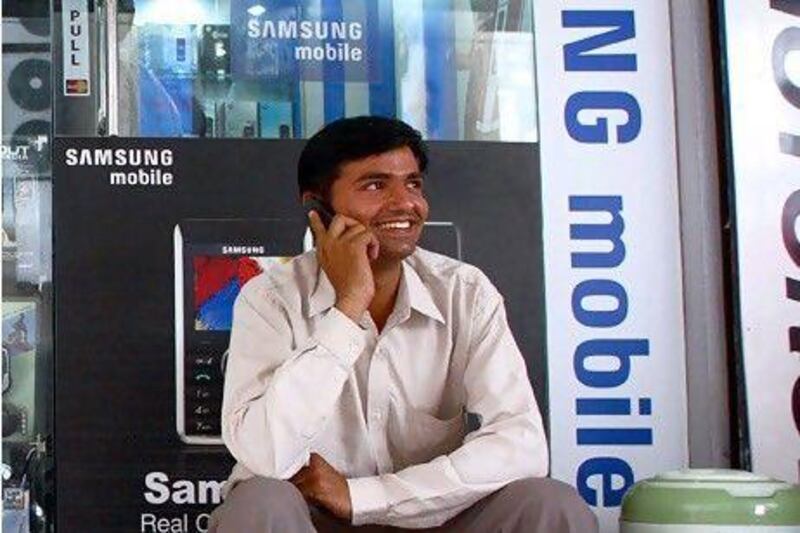

The mobile-phone salesman based in Mumbai says his best-selling phones are Samsung brands costing about 2,000 rupees (Dh142.56).

"Most popular are Samsung's C3011, which is a multimedia phone. Second-best seller is C2232, a dual SIM handset. But Nokia is not too far behind. The low-cost phones are selling well," he says.

Mr Janili's story has a familiar ring all over the country.

International handset makers such as the Finnish Nokia and South Korean Samsung are engaged in vigorous competition over market share in India. It seems Nokia is in danger of losing the contest.

In the past couple of years, the Finns have ruled the roost by overall sales. Nokia had a tight grip on the market with its share hitting 40 per cent in the country.

But this year looks likely to be a different story. A report leaked to the Indian media by GfK Nielsen shows Samsung has aggressively expanded its market share in smartphones and now holds the number one spot. GfK would not confirm the figures.

IDC, another global research house, says the data for the third quarter of this fiscal year shows Android, an operating system used by Samsung and SonyEricsson, has beaten Nokia's Symbian in the Indian market.

And there is more. According to data released last month by the research company CyberMedia, smartphone shipments in India touched 7.9 million units in the first nine months of last year.

Samsung emerged on top in the September quarter with a 39.7 per cent market share, with Nokia trailing at 34.7 per cent and the BlackBerry maker Research In Motion at 12.7 per cent in terms of shipments.

"Nokia's market share has shrunk in India because the competition has become tougher and there are more and more new entrants coming to the market," says Naveen Mishra, a lead analyst at CyberMedia.

"It's hard to predict if Nokia will be able to regain its top spot again. It depends on their strategy."

Nokia, which is promoting its latest smartphone range, called Lumia, dismisses the leaked report, asserting that the brand still holds the top spot in India.

"You need to have competencies in both hardware and software, backed up by strong, global assets and a very strong ecosystem," said a Nokia spokesman. "Nokia is one of very few companies with leading competencies in all areas."

Revenue in the Indian handset market grew by 15 per cent to 331.7 billion rupees last year from 288.9bn rupees the previous year, according to an annual survey by the Indian telecommunications industry journal Voice&Data.

The country's market is very different from others because "bundled" phone services are virtually nonexistent. But price and functionality are still priorities for the Indian consumer.

"Despite the difference, the Indian market is just as price-sensitive and feature-conscious as other markets," says Anant Jain, an account director at Telecom & IT GfK Nielsen India.

"In 2011, we saw the market increasing at the two extreme ends of the price points.

"The higher price point of phones costing more than 10,000 rupees grew due to smartphones' growth, while the lower end, those costing less than 2,000 rupees, has been growing because of multiple-SIM slot phones."

It is a market governed by customers wanting value, which may be the reason Nokia's Symbian platform phones have become less popular: users have to pay for its applications.

"Indian users are extremely cost-conscious and will opt for a phone that offers free applications, such as those phones running the Android operating system, instead of paid ones," says Rahul Gupta, the senior manager of Strategy Analytics in New Delhi.

Many local players, such as Micromax, Lava, Spice, Zen and Karbonn are also breathing down Nokia's neck in the low-cost-phone segment.

Industry observers say the brand at least retains credibility. "The word on the street is that Nokia continues to be a strong brand.

People associate it with quality and long battery life, and the company has managed to maintain this reputation in the lower segment," says Nilabh Jha, a journalist specialising in the mobile phone industry.

Apart from multimedia and smartphones, multiple-SIM handsets are popular in India because people want to be able to switch operators to get the best price for their calls without opening their phones to change SIM cards.

"[The] multiple-SIM slot segment has become the largest segment since the time the first dual-SIM device was launched in 2009. More than 50 per cent feature phones are now with multiple-SIM slots, and these handsets have overtaken single-SIM handset sales for the first time in Q3 2011," says Mr Jain. "This feature catapulted Indian brands to the mainstream of mobile phone industry."

Analysts say Nokia missed the boat with its two-SIM phones. "Nokia was late to market with its dual-SIM handsets, and in the meantime many local and foreign handset makers had managed to establish themselves and steal market share," says Mr Gupta.

Stephen Elop, the Nokia chief executive, insisted in a newspaper interview recently the company's dual-SIM phones were a hit.

"All our dual-SIM launches are doing well and we are witnessing rocketing sales. These launches have also had a halo effect on our single-SIM phones. India has shown that brand plus team plus great execution can deliver strong results," he said.

And it does seem that Nokia is fighting back. The company unveiled a partnership with the global mobile operator Vodafone in India to push its Lumia phone and has engaged in a huge advertising campaign with India's Jet Airways.

The jury is still out on whether the phone manufacturer can regain its lost market share in India. But one thing is sure - Indians' love affair with their gadgets will continue.

"This is the first time I am seeing more customers upgrading their phones than buying a phone for the first time," says the phone vendor Mr Janili.

"People are increasingly focused on phones that have multiple functions and are still affordable."