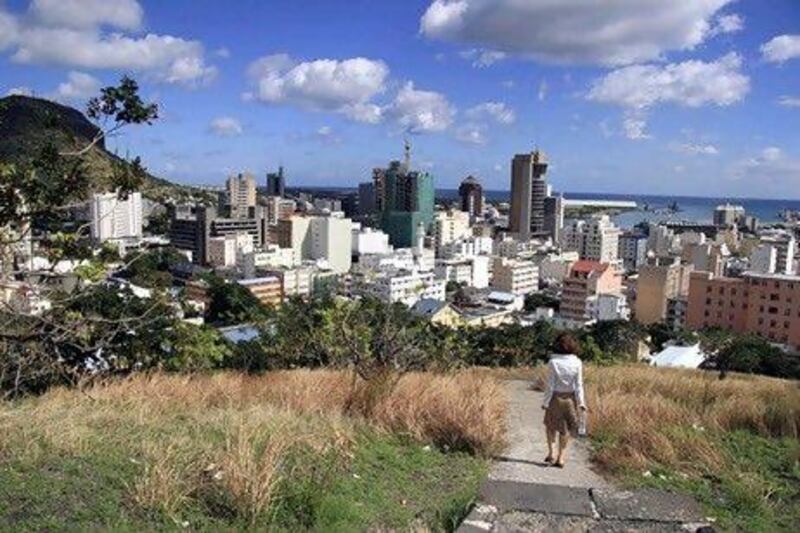

Investment into India is continuing to pour in through tax havens such as Mauritius and Singapore, despite concerns that some local and foreign investors are using these channels as a means of tax avoidance.

About 31 per cent of foreign direct investment (FDI) into India between April and August came from Mauritius, with US$2.5 billion (Dh9.18bn) coming from the island, according to data recently released by India's commerce and industry ministry.

That was followed by Singapore, at $961 million, which accounted for almost 12 per cent of the FDI into India during that period.

Investment through such low-tax regimes has come under increased scrutiny in India recently amid heightened concerns about "black money" and "round tripping", whereby Indian investors and companies channel their money through countries such as Mauritius to reduce tax liabilities. At the same time, the Indian government also wants to reduce its loss of revenues from foreign investors who are simply using offshore centres as a means of avoiding tax.

"The use of Mauritius by Indian companies for routing investments back into India is clearly abusive and the government is taking several steps to ensure that such abuse is curbed," said Dinesh Kanabar,the deputy chief executive and chairman for tax at KPMG in India.

In September the government said it was reviewing the Double Taxation Avoidance Convention between Mauritius and India to try to prevent "treaty abuse" and create greater transparency on the exchange of information on tax matters between the two countries. So far, eight rounds of discussions with Mauritius have taken place, said , P Chidambaram, India's finance minister.

In June, the Indian government issued its draft guidelines for its general anti-avoidance rules, which are targeted at investors and companies that are channelling funds into India through tax havens, including those that go through Mauritius to avoid paying capital gains taxes on short-term investments.

Investing through offshore centres is a legitimate process for many companies and investors.

"The use of holding companies in various jurisdictions is quite common in the global investing community," said Mr Kanabar. "Specifically, in an Indian context, it has been held by the courts that the mere use of holding companies for investing in India cannot be considered as being abusive from a tax point of view.

"While several global investors use holding companies in Mauritius and Singapore for investing in India, it cannot be said that this is motivated by 'tax avoidance'. While the availability of tax benefits is relevant, other factors such as the institutional maturity, availability of skilled manpower, existence of a well-developed legal regime, political stability, and their ability to act as a regional platform for investments also contribute to a large extent in making Mauritius and Singapore attractive platforms for investing in India."

Government data shows that between April 2000 and August this year, a total of $66.7bn in FDI, or 37 per cent of the total investment, came from Mauritius, while 10 per cent came through Singapore.

However, there has been a drop in volumes, the data shows. Total FDI flows into India between April and August this year slumped by 52 per cent compared to the same period last year, amid slowing growth in India's economy and hesitance in the introduction of important economic reforms.