Gopal Darak is an engineer in Dubai and is looking to buy property in western India near his home town Pune as an investment.

"I visited six to seven developers," says Mr Darak who visited the India Property Show in Dubai last week. "There are few names [that I have heard of]."

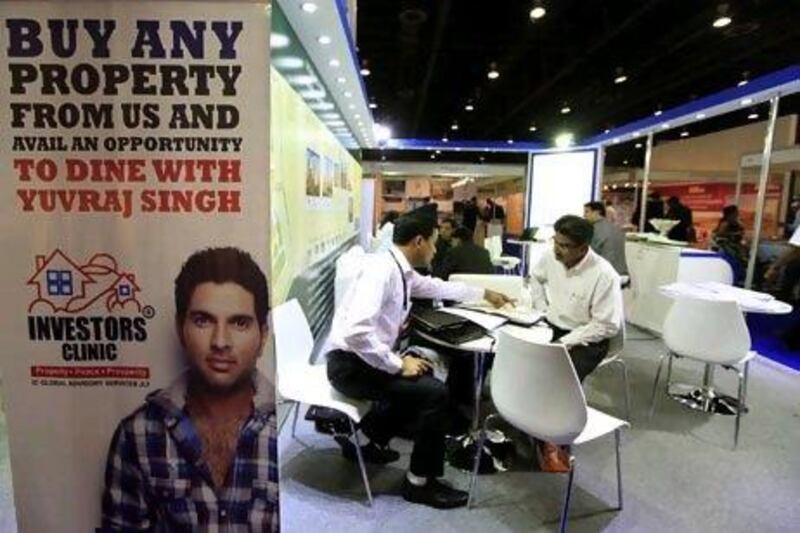

The exhibition is among an increasing number of Indian property shows in Dubai that caters to expats. Last year, there were at least five shows on the Indian property market. So far this year, there have been three with India's largest private sector lender, ICICI Bank, and the Times of India Group organising similar exhibitions.

For the developers, it is a cost-effective way of promoting their projects, which are usually in the higher price range of 3.5 million (Dh225,000) to 10m rupees.

"The average price point is 4.5m rupees this year," says Sunil Jaiswal, the chief executive and president of Sumansa Exhibitions, which organised the India Property Show last week.

During the past few weeks, the rupee has touched new lows against the dollar, making the property market an attractive investment option for Indian expats. But experts say investors as well as homebuyers should have an appetite for risk and do due diligence in researching the developer and visiting the site before buying property.

"Investing in property is no different than investing in the stock market," Mr Jaiswal says. "You have to be pretty sure that you can [afford to] sell for a loss."

Home sales in major cities such as Mumbai, Delhi and Bangalore have dipped by 18 to 58 per cent in the January to March quarter due to a backlog of unsold units, high interest rates and a slowing economy, according to the Indian research firm PropEquity Analytics. If the trend continues, it might lead to a slump in prices. Still, the Indian property market is expected to remain strong for the next few years.

"[It] may not be severely impacted by the revival of the real estate market in the [Arabian] Gulf," says Anshuman Magazine, the chairman and managing director of the property consultant CBRE South Asia, based in India.

The fluctuating rupee does not change the attractiveness of the property market, either.

"We do not know which way the rupee will go or the prices," said Mr Jaiswal. "Today, what is costing less [to an Indian expat], the next day it might change as the rupee might be up."

Homebuyers must factor in an increase in monthly instalments if the rupee strengthens.

"Over last five years sales figures from these shows have seen an increase, especially in the last one year or so where [Indian expats] have benefited from the devaluation of the rupee," Mr Magazine said.

The property market in India has remained stable over the past four years. In addition to domestic demand, rampant speculation is less than in other markets where foreign investors have led to an increase in the prices of property.

"A good thing in India is the high amount of controls Reserve Bank of India has put in, such as foreigners cannot buy property [in India], and banks look at personal income [regarding loans]," said Mr Jaiswal.

But there are still dangers. Indian expats looking to invest in property back home need to do their homework. According to Mr Jaiswal, it is difficult for exhibition organisers to check each developer, so his advice is try and find out about the company yourself.

Investors should also conduct their own due diligence and look at past projects from developers they are interested in.

"[An investor] should also do a survey of other developments within the vicinity of his proposed investment to ensure that the area has a real estate potential," Mr Magazine said. "Evaluate whether the project has been pre-approved by a reputed lending institution."

Mr Darak for his part is in no hurry. "I got some ideas from the exhibition," he says.

"Buying a property is a long-term thing, I will do my research now."