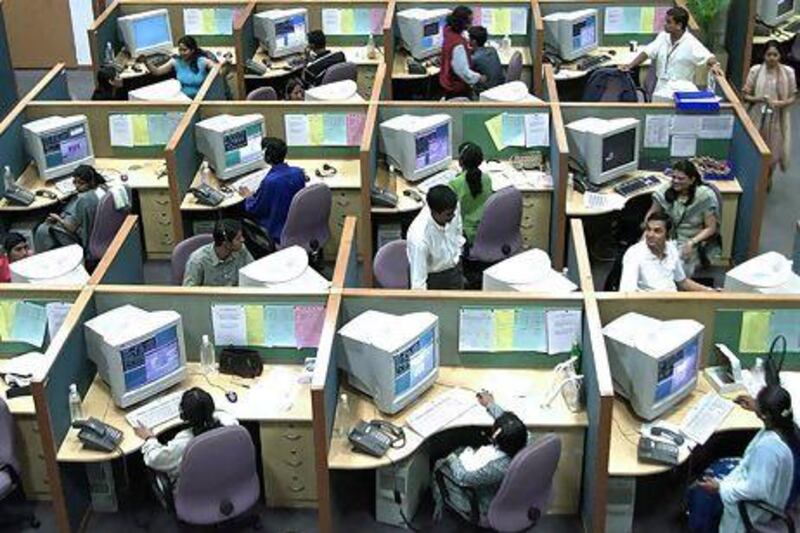

Exporters in India, particularly IT outsourcing companies, are benefiting from the weak rupee.

The currency's decline helps to boost profits because of the relative strength of earnings from abroad in dollars and other currencies.

The rupee has plunged more than 20 per cent in recent months to record lows against the dollar, hitting 65.5 last week compared to trading at levels of about 54 rupees to the dollar in May. The majority of revenues for the IT sector come from the United States.

"The biggest clear beneficiary is IT," said Sonam Udasi, the senior vice president and head of research at IDBI Capital. "Not only will you benefit from an exchange rate scenario [but also] when the dollar becomes stronger, it sends out a signal that the US economy is recovering. So your discretionary spend from clients in the US will start to move up as they get more confident."

The pharmaceutical sector too, which is also heavily dependent on foreign earnings, also benefits from the slide in the rupee, he added. "It is worth remembering that currency weakness has some positives too," according to analysts at Capital Economics.

"A weaker rupee should support India's export competitiveness and slow imports. In short, it is exactly what is needed over the long run to narrow the current account deficit and reduce India's dependence on volatile financing from abroad," they said.

"As long as the ongoing slide in the currency does not turn into a destabilising rout, there may be some long-term benefits from the current breakdown in market confidence."

Indian exporters of goods such as rice and tea also stand to benefit as they are able to offer more competitive prices to overseas buyers.

M Rafeeque Ahmed, the president of the Federation of Indian Export Organisations, said "that exporters should use rupee depreciation to augment exports by cutting down their prices to out-price their competitors", explaining that such steps were already helping to achieve growth.

The softness in the rupee helped the IT firm Infosys to achieve 3.7 per cent growth in its net profits which reached 23.7 billion rupees (Dh1.35bn) in the quarter from April to June compared with the same months last year.

"If you look at our business, yes, you get more rupees for the same dollar we were earning say three months back," said BVR Mohan Reddy, the chairman and managing director of Infotech Enterprises, an engineering outsourcing company headquartered in Hyderabad.

About 58 per cent of Infotech's business is in US dollars, while about 19 per cent is from the euro and 11 per cent from the British pound. The rupee has also weakened sharply against the euro and sterling. But, he explained that hedging mechanisms that were in place because of the volatility of the rupee limited the gains.

"Most of the IT companies do hedge their inflows," said Mr Reddy. "The hedging policies vary from company to company. For example, my company hedged 70 per cent of our net foreign exchange earnings over the next 12 months. The advantages of getting foreign exchange are not completely captured by the industry."

Faisal Husain, the chief executive of Synechron, an IT services company, said his firm did not hedge, but explained that the rupee's tumble could also have negative consequences.

"It might give a short-term boost to profits," Mr Husain said. "On the surface it might seem like a positive, but it's much more complicated. Right now we are benefiting, but it is short term."

Companies often had costs and loans in dollars, which were more expensive to service in rupees, he said.

"Long term [the weakness of the rupee] is actually very bad because it increases inflation, it increases wage," he said. "A lot of the Indian talent that has returned home because the economy was doing well might want to go back overseas."

Mr Reddy agreed that rising costs in India would hurt business and pointed out that the rupee remained unpredictable.

"Ultimately, it's not good for the industry," he said. "The customers might start thinking: 'These guys may be making more money'. The last thing that you like to do is reopen the customer contract and have negotiations with them based on the currency, which actually are very difficult because they're very volatile.

"Who knows, if the government of India does something different, it [the dollar] might even go back to 45."