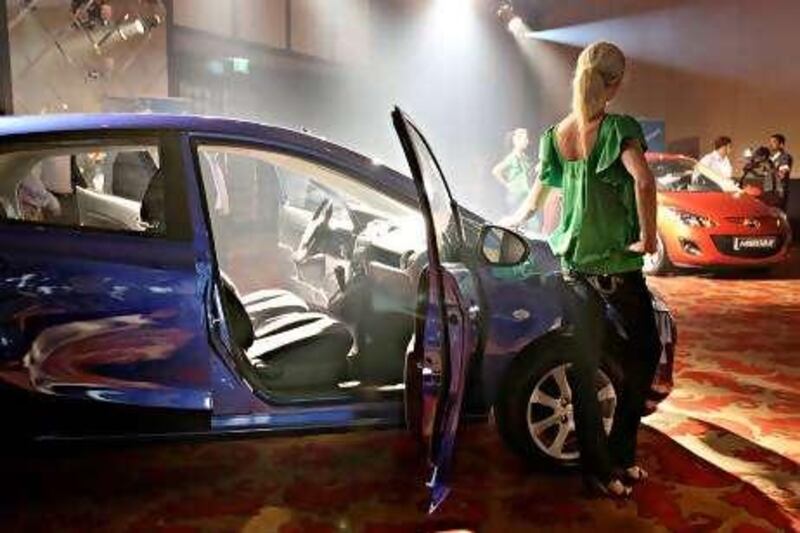

Mazda is hoping for a little miracle. The car maker hopes a new austerity will mean the Mazda2, its smallest car yet, will be able to leave its mark on roads ruled by the monster sport-utility vehicle. "The market has seen recession and there was a downturn in the economy," said Ghaya Uzzaman, the group marketing manager for Mazda's local distributor, Galadari Brothers, at the car's Dubai launch yesterday. "It's a more relevant car."

Mr Uzzaman said rising petrol prices would probably send newly price-conscious UAE consumers to the sub-compact car market. Sub-compact vehicles such as the Toyota Yaris are the smallest cars offered. Earlier models of the Mazda2 have been sold around the world for about three years but 4x4s and luxury sedans were more to the Emirates's taste. Anna-Marie Baisden, the head of car research for Business Monitor International, which is based in London, said she did not believe that preference would change.

Petrol prices, which rose this year by as much as 27 per cent depending on the grade, would not affect high-income customers, Ms Baisden said. But the rising cost of fuel and continuing credit restrictions may push those who previously bought mid-size cars to go for something smaller, she said. "We do not see any reason for the popularity of SUVs to dwindle as they are a big part of the premium segment that is still so strong in the UAE and suit the local driving conditions," Ms Baisden said.

"At the same time, we are also seeing the growth of volume brands and smaller cars." Volkswagen recently announced it planned to boost its sales in the Middle East by launching smaller models, she added. Last year was extremely difficult for car dealers in the UAE. While there are no official figures, distributors estimate UAE car market sales last year fell by as much as 40 per cent. In Dubai last year, new vehicle registrations for passenger cars dropped by almost a third, to 149,730 from 218,429 in 2008, according to Dubai Roads and Transport Authority figures compiled by the Dubai Chamber.

This was partly due to consumers avoiding long-term, big-ticket financial commitments. Banks also tightened criteria for car loans. These factors have spurred the country's car dealers to change strategies, with methods that include providing better after-sales service to customers who keep their cars longer, and offering more affordable and fuel-efficient cars. Mr Uzzaman said Galadari's sales dipped last year but he was looking for "single-digit growth" this year. He expected the 2011 Mazda2, which will cost between Dh46,000 (US$12,520) and Dh52,000, to help push this growth.

VG Ramakrishnan, the director of the automotive and transport practice for south Asia and Middle East at the research consultancy Frost & Sullivan, did not anticipate a long-term shift in the Emirates towards sub-compacts. But introducing a more affordable vehicle would help to attract new customers until the UAE market fully recovered in 2012 or 2013, Mr Ramakrishnan said. "Used cars or a sub-compact at this point in time might be able to bring in customers, by making it lighter on their pockets," he said.

aligaya@thenational.ae