The head of the IMF has called on Europe to turn from austerity back to economic stimulus to combat a "threatening downward spiral".

The call highlights growing confusion among policymakers over how to spur growth and solve the continent's sovereign debt crisis.

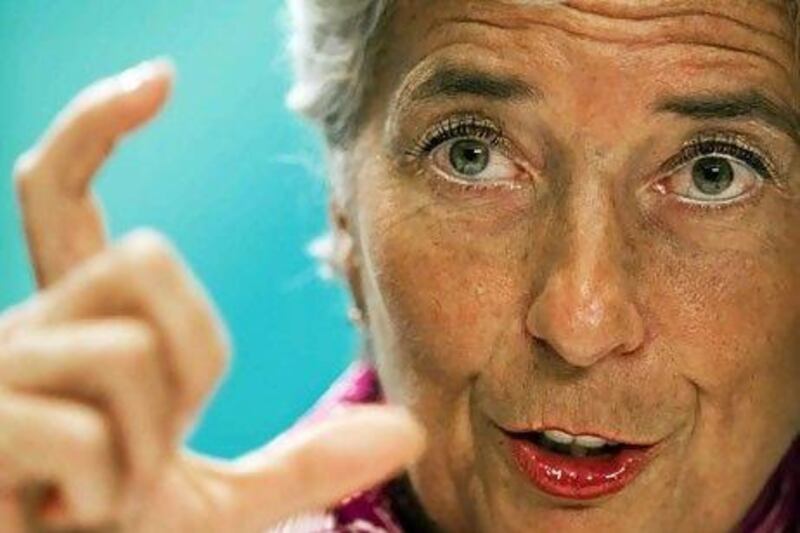

Christine Lagarde, whose organisation has put billions of dollars into bailouts of debt-ridden European countries, told the German magazine Der Spiegelthe IMF was recommending countries "adjust their austerity programmes to a changed situation and consider measures to drive growth".

That was an about-face from the IMF's stance last year when European countries enacted austerity measures to pay down debts and stave off worries about government finances.

The IMF called the UK's £83 billion (Dh494bn) of public-sector cuts last year "appropriately ambitious", saying the plan "supports a balanced recovery". The IMF's participation in Greece's second bailout in June was contingent on the government enacting austerity measures.

The apparent change in tack comes as Europe and the US battle a new phase of economic danger, coupled with declines in global stock markets, disappointing economic data and Europe's spreading sovereign debt crisis.

Markets in the US and Europe fell by more than 2 per cent on Friday, and uninspiring US jobs figures at the weekend set the stage for Barack Obama's key presidential speech this week on employment.

In Europe, the finances of Greece and Italy are under the microscope once more as economic growth deteriorates.

"For all the US's problems it is apparent that these are now being eclipsed by those of the euro zone, where Greece is still facing the prospect of a disorderly default, Italy is fast opening up as the new flank of the sovereign debt crisis, and where growth has also taken a decisive shift lower," said Timothy Fox, the chief economist at Emirates NBD in Dubai.

The latest bout of panic over a possible double-dip recession has raised confusion to new heights in Europe. EU countries responded to the global economic downturn in 2008 with economic stimulus measures and aid for banks.

When the global economy started to recover in 2009, that help was gradually withdrawn, and the European Central Bank began to raise benchmark interest rates.

The austerity packages came when Europe's sovereign debt crisis erupted.

But with renewed worry that the US and parts of Europe could sink back into recession, Ms Lagarde said European countries may have room to abandon short-term austerity plans in favour of stimulus, depending on what the US does.

Ms Lagarde also urged European leaders to require banks to further bolster their capital cushions even after many received government injections.

The health of the continent's banks has become a contentious issue since eight lenders failed European Banking Authority stress tests in July and many more barely passed.

Jean-Claude Trichet, the president of the European Central Bank (ECB), has said repeatedly in recent weeks that the banking system is healthy.

A key test of Europe's attitude towards stimulus will come later this week, when the ECB holds meetings to set benchmark interest rates. The central bank has raised them twice this year to 1.5 per cent, but could reverse course and lower them in a bid to stimulate the economy.

"The greater scope for policy surprises is now in the hands of the ECB facing increasing pressure to make a volte face by reversing this year's two interest-rate rises," Mr Fox said. "For this reason Mr Trichet's press conference on Thursday [on bank policies] will probably be the most avidly watched event of the week."

Central banks in the UK, Japan, Australia and Canada are also holding interest-rate policy meetings this week.

In their first trading session since the US jobs figures came out, stock markets in the UAE traded slightly down. The Dubai Financial Market fell 0.6 per cent, while the Abu Dhabi Securities Exchange dropped 0.1 per cent.