The business plan for Planetary Resources sounds like it is straight out of a Hollywood blockbuster.

And it even involves James Cameron, the director of the sci-fi film smash-hit Avatar, who is listed as an adviser on the company's website.

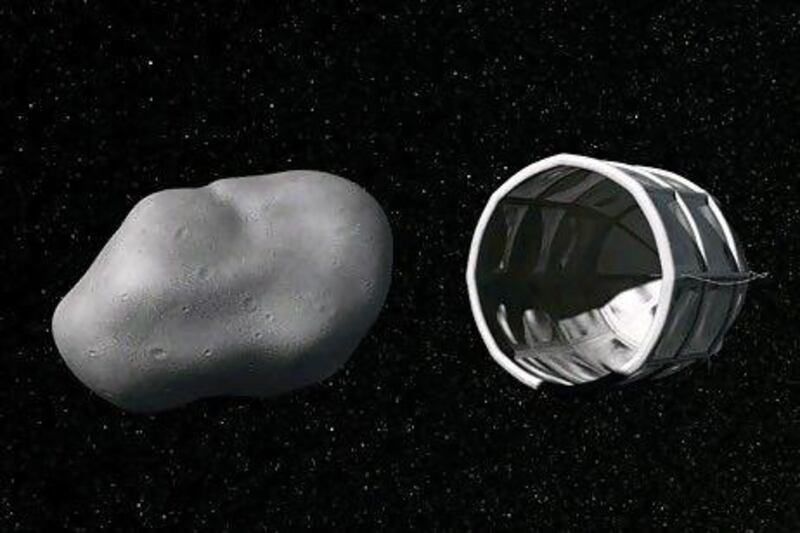

But its aim, to mine asteroids for resources ranging from water to precious metals such as platinum, is very real.

There are "near-limitless" numbers of asteroids in space and more are being discovered each year, according to the company's website.

And more than 1,500 are as easy to reach as the Moon and are in similar orbits to the Earth, it says.

"Harnessing valuable minerals from a practically infinite source will provide stability on Earth, increase humanity's prosperity and help establish and maintain human presence in space," says a statement on the website.

"Water from asteroids will fuel the in-space economy and rare metals will increase Earth's GDP," it adds.

The company was co-founded by Eric Anderson, an entrepreneur and aerospace engineer who is involved in a portfolio of "innovative technology and spaceflight companies, including Intentional Software Corporation". The other founder is Peter Diamandis, the head of the not-for-profit X Prize Foundation, best known for its US$10 million (Dh36.7m) Ansari X Prize for private spaceflight. The inaugural prize was won in 2004 by the aerospace designer Burt Rutan and the financier Paul Allen, who led the first private team to build and launch a spacecraft capable of carrying three people to an altitude of 100km. The president of Planetary Resources is Chris Lewicki, who was involved with Nasa's Mars Exploration Rovers and the Phoenix Mars Lander.

But if you are looking for an investment a little more down to Earth, one you can actually see blossom, you would do well to check out Plantation Capital, which offers people the chance to buy agarwood trees.

The trees, which are grown in the company's plantations in Asia, produce oud, a key ingredient in Middle East perfumes, as a natural reaction to a type of fungus.

However, unless you decide to sell on your trees, which you buy as saplings, you will have to wait a while to cash in your investment.

"There is a certain process of inoculation that has to occur to stimulate the production of the resin," says Shelley Low, the company's operations and marketing director.

"It's a natural product, so you can't really put a time frame to it. But six to seven years is the average."

Investing in agarwood is not cheap. Packages with Plantation Capital start at about £15,000 (Dh85,589). If seven years sounds too long to wait to see returns, the company also offers packages in other products, including bamboo, which start at about £3,000 and start paying back after year two.

Investments in forestry products are not necessarily more profitable than stocks and shares. But it is a sustainable business that also helps the environment.

"If you just type in Google you will see Bloomberg Wealth Manager and all the big banks have researched it and done studies on the forestry and timber market. There's a growing population. There's an ever bigger demand for wood products," says Ms Low.

Of course, like all other alternative investments, it is still considered to be highly risky.

"Everybody knows stocks and shares. But because it's a niche industry it's uncertain," she adds.