The internet is heading for the biggest traffic jam in its history within the next few years.

Web traffic is set to quadruple by 2016, the global networking giant Cisco has reported. This will result in bandwidth shortages for customers and small businesses everywhere, together with increased costs and data limitations.

According to Cisco's Global IP Traffic Forecast 2011-2016 report, released in May, there will be about 3.4 billion internet users by 2016, with Wi-Fi wireless network connections accounting for almost half of the traffic. This is predicted to have massive repercussions for the IT industry.

Computer gaming companies such as Sony and Microsoft will be forced to accommodate mushrooming global demand for high-quality, high-data video streaming. Organisations will have to pay a premium for guaranteed reliability on their corporate communications networks, and small businesses unable to afford specialists such as Cisco will struggle with unreliable consumer contracts.

"This should adversely impact streaming companies, including cloud gaming, because their services will either be excessively expensive or heavily throttled," says Rob Enderle, an analyst at the Enderle Group in California's Silicon Valley.

"[But] this should do wonders for networking companies and firms who can figure out how to compress and decompress images aggressively with little data loss," Mr Enderle says.

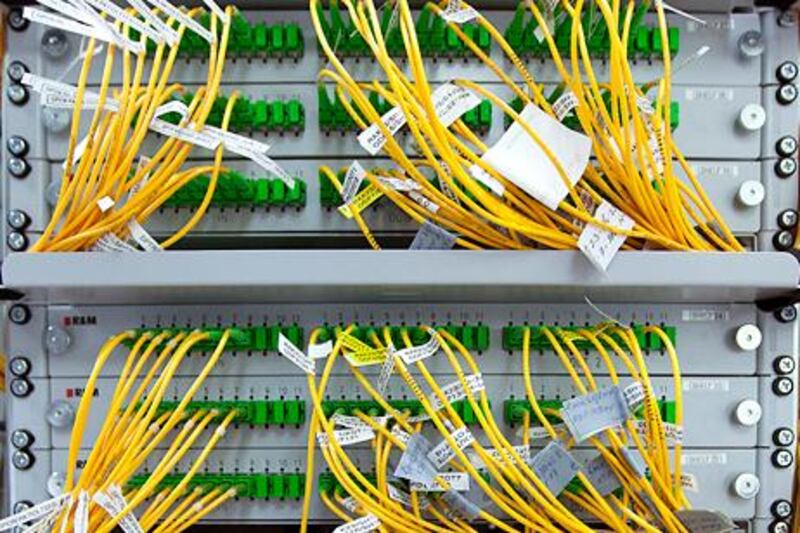

It is, however, the network carriers such as Vodafone that will be faced with the huge costs of upgrading their infrastructure, and this will be passed on to the industry and to customers.

"It is an interesting situation as competition has created a great deal for consumers. This is especially the case for fixed-line broadband connections, which remain a lot cheaper than mobile broadband," says Charlie Davies, an analyst at the international research firm Ovum.

"The big question is who pays for all the extra bandwidth, and it is the network carriers such as the major telecoms operators who are investing most heavily. The other question is whether they will get sufficient return on their investment," Ms Davies says.

She believes customers distributing content over the internet could pay part of the carriers' costs. The telecoms operators are also increasingly asking content providers such as the online music distributor Spotify to share revenue in some way. But most of increased costs will eventually be passed on to the consumer in one form or another.

"Consumers will therefore see increasing investments delivering them faster connectivity, but will also be faced with more complex tariff/package options," says Tim Shepherd, an analyst at the international research firm Canalys. "Heavy users may well be able to get a package that delivers them great speeds and all the data they need, but it will likely cost a significant premium looking ahead."

Analysts agree that consumers may have to get used to the fact that days of all-you-can-eat internet tariffs are nearing their end. "The fallout will have multiple repercussions. Internet service providers and mobile operators will need to innovate around the charges and maximum data allowances they offer," says Mr Shepherd.

But much of the mushrooming demand from internet users across the developing world will initially hit mobile communications networks. For most new internet users, smartphones are more convenient and less expensive than personal computers or laptops.

"There are new users, many of them in new growth markets, that are being slowly inducted into the connected world, often through their internet-connected mobile phones," says Mr Shepherd. "So more users, with more data-intensive demands, will inevitably lead to a significant increase in traffic in the coming years."

The result of this will be a traffic jam of such proportions that mobile communications across the world would crash unless carriers limited usage. The most obvious way to do this is by tiered pricing.

"We will likely see more tiered data tariffs, particularly in the mobile space, limiting the amount of data that can be consumed. Unlimited-use offers will become increasingly uncommon," says Mr Shepherd.

Business may also be forced to stump up increased internet usage fees to ensure reliability of service. But those firms not big enough to afford long-term business contracts with network service providers may find themselves having to make do with an inferior service.

"In the enterprise space, corporates, for which connectivity is of paramount importance, will subscribe to specialist services to accommodate their specific requirements," says Mr Shepherd. "But small and micro businesses that often depend on domestic-level internet packages and services will most likely encounter challenges and need to upgrade their service levels."

After 2016, the global demand for increased bandwidth is set to grow again as more people in the developing world start to use the internet and existing users become more demanding.

The question is whether the network carriers will be able to keep pace with demand.