Gulf General Investment Company (GGICO) is to delay its US$300 million (Dh1.1 billion) bond sale by up to three months because the cost of issuing debt is too high, says an executive at the company.

"We've spoken to our bankers and they have said it is not the right timing," said Ashish Oommen, a finance manager at GGICO. "International investors are still not on board and it's too expensive to tap into the market now."

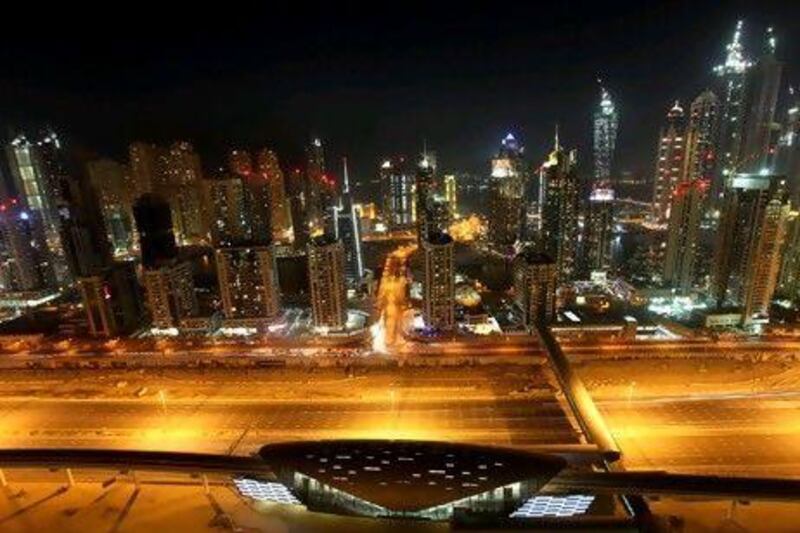

The Dubai conglomerate, which has interests in property, transport, tourism and financial services, planned to issue the bond by the end of last year, but has now set a timetable for the end of the first quarter.

The company mandated Deutsche Bank, HSBC Holdings and Standard Chartered Bank to act as joint lead managers and bookrunners on its bond sale, which was to be used for general corporate purposes and trim short-term debt.

In November, the ratings agency Moody's Investors Services assigned a "B1" rating to the proposed debt issue, with a "negative outlook".

Several companies in the region are also thinking of postponing debt offerings because of high prices.

Companies that borrow money from international investors through bond sales want to keep the interest rates they pay as low as possible, but they also want to ensure that appetite for the debt is strong. Higher rates generally stoke investor interest in debt - but also imply that it comes with a higher risk of default.

"Some of the corporate firms we have rated have decided to suspend or postpone their issue because they could not see the market as attractive at the current pricing," said Faisal Hijazi, a business development manager at Moody's in Dubai.

Most Gulf companies are forced to look outside the region because there are few local investors interested in sub-investment grade debt even if its pays high yields.

Many Gulf investors are only comfortable with investment-grade offerings.

"As firms lose their credit standings, they have no choice but to tap international markets like Europe, Asia and US," Mr Hijazi said.

"The region's asset fund management business is still not developed where managers would be interested in speculative ratings."

Outside the Gulf, global investors have been snapping up such speculative-grade bonds. Last year was the best on record for sub-investment grade debt, with $287bn issued in the US, surpassing the previous high of $162.7bn in 2009, according to Bloomberg.

Debt issues, including sukuk, have played an expanding role for local companies coming out of the financial crisis, in part because banks are more reluctant to pursue large loan syndications.

Analysts say better conditions in local debt markets are vital for corporate financing.

"It's been argued at the time where liquidity was taken out of the UAE, companies had problems financing themselves," said Jan Plantagie, an analyst at Standard and Poor's in Dubai. "Had there been a domestic bond market, the problems may have been less. Apart from bank funding, you don't have another form of domestic capital source."