GYEONGJU, SOUTH KOREA // Greece is courting Abu Dhabi as the European country struggles to reduce its debt burden and avoid defaulting on loans.

Road to ruin or recovery?

Euro Zone The National charts Europe's struggles as it attempts to through of financial crisis. Learn more

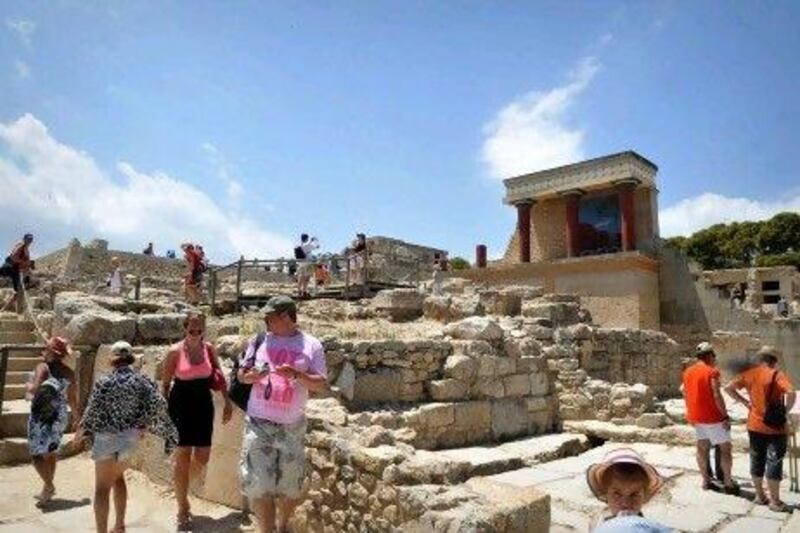

Athens wants the emirate to invest in its tourism industry.

The disclosure from the Greek tourism minister came as Angela Merkel, the German chancellor, and Nicolas Sarkozy, the French president, met in Berlin to tackle the Greek debt crisis and turmoil in the euro-zone banking sector.

"There has been interest from Abu Dhabi," said Pavlos Yeroulanos, Greece's minister of culture and tourism, who was in South Korea yesterday. "Mostly they are looking for areas that can be developed as resorts. But I would say that most people right now are mostly window shopping. They are preparing for the event that the situation stabilises."

Some international investors eyeing potential acquisitions in Greece are staying on the sidelines until more clarity emerges on whether the country will stay in the euro zone. If it is evicted, there is likely to be a dramatic impact on asset values.

Mr Yeroulanos declined to comment on the identity of the Abu Dhabi parties showing an interest in investing.

Euro-zone leaders are desperately trying to find solutions to the debt crisis in the single-currency bloc. Austerity measures in response to Greece's problems have caused soaring unemployment in the country.

"We have created a portfolio of assets, most of them related to the tourism industry, that can be privatised and invested in by foreign investors," Mr Yeroulanos said.

Greece was likely to try to raise investment in infrastructure development, including ports and marinas, the minister said.

Greece now expects its deficit to be 8.5 per cent of its GDP this year, down from 10.5 per cent last year but missing the 7.6 per cent target set by the IMF and the EU. This has raised fears of a severe worsening of the euro-zone situation, as it remains unclear whether Greece will receive a vital €8 billion (Dh39.3bn) loan. Without this, the country could run out of money within weeks.

"Greece is a country that has a very inefficient public sector," said Jarmo Kotilaine, the chief economist at National Commercial Bank in Saudi Arabia. "In some senses, Greece is one of these deficit economies in the world in terms of their external trade, and Gulf countries are among the surplus economies, so this is the fundamental imbalance we've had in the global economy now for an extended period," said Mr Kotilaine. "As part of rectifying this imbalance, what you really ought to see is that the surplus countries start acquiring assets in the deficit countries."

Greece has been seeking to raise fresh capital as it tries to plug its debts, with George Papandreou, the prime minister, agreeing to raise €50bn from privatisation by 2015. But there has been limited interest from investors. "Foreign direct investment in Greece has been hampered in the past due to bureaucracy, and we're doing everything we can to alleviate that so there is new interest from countries abroad to invest in Greece," said Mr Yeroulanos.

"The timing for this investment hopefully will be very soon," he said. "One of the most important questions in the world right now and for Greece right now is whether Europe will commit to stabilising the situation in order to get foreign direct investment flowing back in the country.

"As long as the situation in Europe is changing frequently, people are going to be cautious.

One of the things that will change tourism in Greece significantly is how we are preparing the country to become more efficient in attracting foreign direct investment."

Greece was not putting any of its islands up for sale, he said.

"We are talking about how they can invest, but not the sale of the island itself. I would say that none of the people that I've talked with are interested in buying something forever. They are just long-term leases that would allow them to utilise an island or a particular piece of land."

Mr Yeroulanos said tourism to Greece had recorded double-digit growth this year compared with last year, although tourism in Athens had been hurt.