Rahul, a salesman in Mumbai, says that more than half of his savings are parked in gold that he keeps at home, including coins, small bars and jewellery.

“Gold is there in every Indian’s house,” says Rahul, who declines to reveal his last name. “You can encash it anytime of the day,” he says.

He explains that he would not want to deposit his gold with a bank – a move that India is trying to encourage under a new plan – because he does not want to declare his assets to the authorities and he wants to have immediate access to his savings.

India’s finance ministry last month announced its draft guidelines for a new gold monetisation plan, under which gold could be deposited with banks to earn tax-free interest. That deposited gold could then be lent by the banks to jewellers.

The minimum amount proposed for deposit is 30 grams. This is seen as a significant step for India towards trying to integrate the vast amounts of gold in the country into its economy in a more financially productive way.

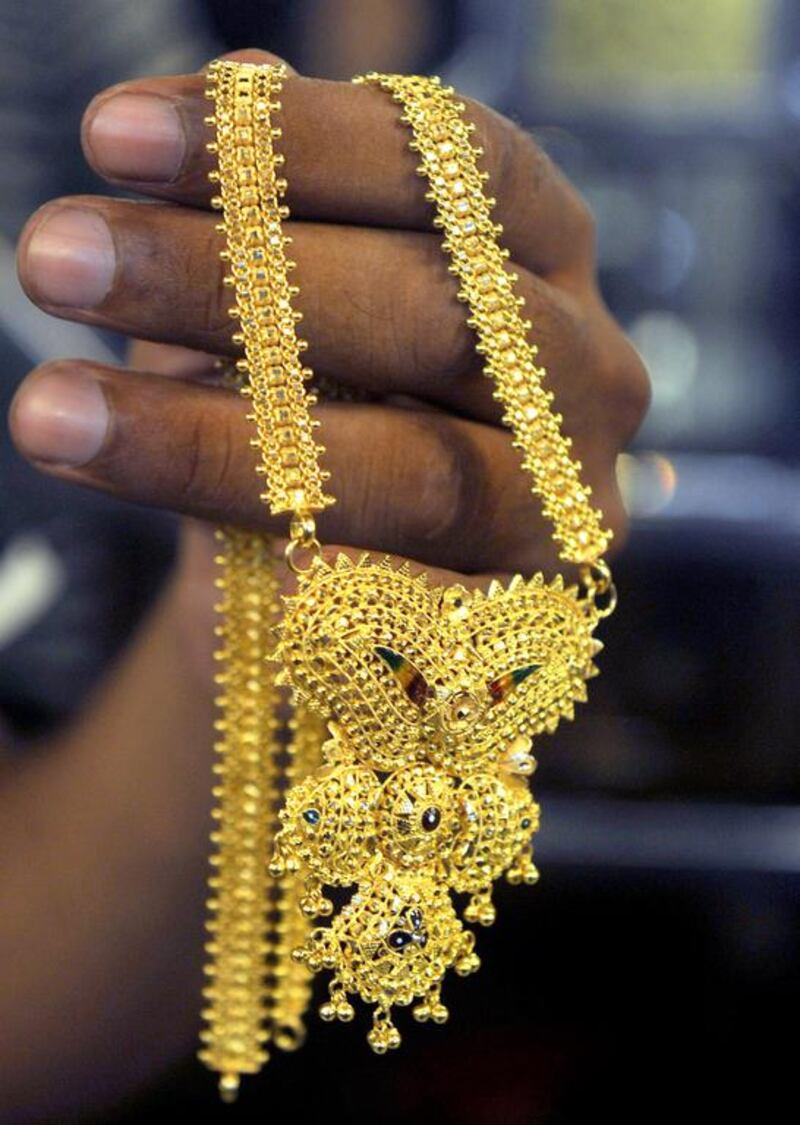

Gold plays a significant cultural and traditional role in India, including in weddings and religious festivals, and it is also used as an alternative to the formal banking system, with households storing gold at home. Rural Indians may not have access to a bank account at all, so gold is a convenient alternative for them.

India imports most of its gold, which is a huge burden on its current-account deficit, so trying to curb imports and make the precious metal more productive for the economy has long been an issue that authorities have been grappling with.

India was the world’s biggest consumer of gold last year, with demand for the precious metal totalling 842.7 tonnes, according to the World Gold Council. The organisation expects demand for gold in India to rise to 900 to 1,000 tonnes this year. India accounts for about a quarter of the entire demand for the precious metal globally, and at least 2.5 million are employed in the country’s gold industry.

But it is also widely considered to be an idle asset, with about 22,000 tonnes of gold worth more than US$1 trillion kept in homes, according to a recent report by the World Gold Council and the Federation of Indian Chambers of Commerce and Industry (Ficci). This report concluded that Indians’ demand for gold “cannot so easily be curtailed”.

“The solution to India’s enduring appetite for gold would therefore seem to lie not in restricting the import of gold, but in making better use of the gold that is already in the country,” according to the report.

Despite steps taken by the previous government in an effort to reduce gold imports, including higher import duties, jewellery demand hit a record high of 662.1 tonnes last year, according to the World Gold Council.

Such measures to try to reduce gold consumption have actually led to a rise in smuggling of the precious metal, which is costly to the economy.

The World Gold Council estimates that amount of gold smuggled into the country reached about 175 tonnes last year, as import duties of 10 per cent on the metal make this a lucrative activity.

There are already ways in which gold is contributing to India’s economy, however.

“The gems and jewellery sector is the leading foreign exchange earner in India and one of the fastest growing industries in the country,” analysts wrote. “India’s gold market is driven primarily by the consumption and fabrication of gold. Both have a significant impact in terms of economic value add, employment, contribution to foreign exchange earnings and the trade balance.”

Gold boosts economic output in India by about $30 billion a year, according to the consultancy PwC.

The Ficci report outlines that “gold makes a stronger economic contribution and imports could be reduced if gold was more effectively monetised”. Measures it suggests include encouraging the development of more gold-backed investment and saving products, allowing Indian banks to use gold as part of their liquidity reserves and setting up a gold exchange to ensure pricing standardisation and improve transparency.

Dheeraj Jain, a jeweller who runs a shop called Surana Gold in Colaba in south Mumbai, says that formal gold products with financial institutions were unlikely to appeal to the masses.

“Indians who buy gold want to keep it close to them,” Mr Jain says. “If they buy gold jewellery, they can also wear it on occasions such as weddings. They want to use the gold and they want to see it. Maybe such financial products can appeal to the upper classes. I think most Indians will be a little uncomfortable to disclose what they have.”

There will be challenges for banks that want to offer the programme too.

K A Babu, the head of retail business at Federal Bank, which is headquartered in Kerala and has more than 1,000 branches across the country, explains that customers would expect rates of about 3 per cent on their gold to make depositing an attractive option.

“At the same time, banks have to pay a fee for services rendered by refiners and testing centres,” he says. “Hence the interest rate charged by banks will be a function of all these factors, and it will be challenging for banks to offer an attractive rate of interest and maintain their desired profit margin.”

There would also be various logistical and infrastructure hurdles, including securely moving the gold from between locations, which adds to the costs in terms of delivery and insurance charges.

“As in the case of any new project, the gold monetisation plan will also have to pass through initial pains,” Mr Babu says, adding that he still believes that the programme “is promising” and could bring down gold imports and allow households to generate some income on idle gold.

In some cases, gold is used as a method of storing black money – funds that should have been taxed or that have been obtained through illegal activities.

Legitimate gold owners might struggle to prove the source of their gold if it is inherited, for example, so this could deter them from wanting to deposit the metal for fear that they might be questioned or come under the scrutiny of tax authorities.

Many Indians would be reluctant to melt down their gold, which would be required for the gold monetisation plan, Mr Jain adds. There would also be the hassle of having to test the purity of the gold, he points out.

There are others more optimistic about the plan.

Somasundaram PR, the managing director for India at the World Gold Council, says that the plan demonstrates “a practical approach” by India.

“Once the incentive framework falls into place to the satisfaction of the banks, customers and others, we will own a uniquely Indian plan that allows gold to become a dynamic, fungible asset in the hands of gold savers with significant benefits to the economy,” he says.

He adds that there has long been a “need to go beyond duty cuts and artificial regulatory limitations on demand and instead focus on holistic solutions” in India.

“Demand for gold cannot be wished away by supply curbs. It is imperative to nurture the savings mindset embedded in households through gold accumulation, and then use it to enhance savings, putting it to work for the economy.”

Rahul, meanwhile, plans to keep investing in gold and keep it at home, which he considers one of the safest ways of storing his finances.

“I’ll keep buying gold,” he says. “The sky’s the limit.”

business@thenational.ae

Follow The National's Business section on Twitter