As an overseas worker living in Singapore in 2016, Michele Ferrario was earning a decent salary and saving well. However, the Italian native had a problem: his savings were in cash.

With a background in finance, Mr Ferrario wanted to build a diversified investment portfolio that focused on low-fee exchange-traded funds and his first step was to approach a couple of Singapore’s premium banks.

However, there were few options for what he wanted to do; the banks were offering to sell him high-fee products such as mutual funds. Shortly after, Mr Ferrario learnt about the rise in popularity of robo-advisers in the US – and that is when he had his lightbulb moment.

Robo-advisers are digital investment platforms that calculate an investor’s risk tolerance based on a series of questions. Using automated algorithms, they then assign investors a tailored investment portfolio of ETFs or index funds. Typically, they charge lower fees compared with traditional financial advisers and wealth managers.

"I Googled robo-adviser Singapore and couldn't find anything. I learned a new term for the digital low-cost ETF … [and] this is exactly what I wanted to do," Mr Ferrario, the former chief executive of Singapore-based e-commerce platform Zelora, tells The National.

But rather than simply investing his savings in a robo-adviser, Mr Ferrario took his lightbulb moment a step further and established StashAway in 2016, growing it into one of South-East Asia's largest digital wealth managers with $1 billion in assets under management.

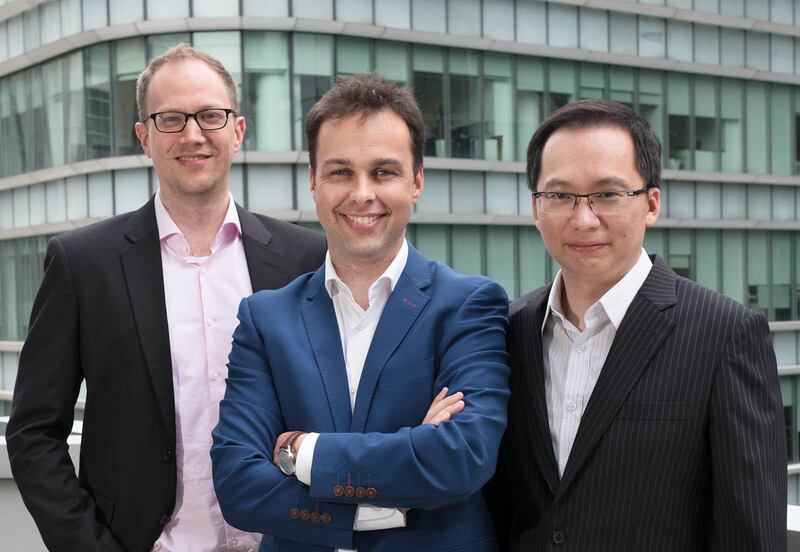

Along with co-founders Freddy Lim, StashAway's chief investment officer, and Nino Ulsamer, chief technology officer, the three partners unveiled the robo-advisory company in July 2017 after nine months of building the platform and receiving a licence to operate from the Monetary Authority of Singapore.

While the US is the leading market for robo-advisers, they are growing in popularity around the world, the World Bank said in its 2019 Robo-Advisers: Investing through Machines report.

“Emerging economies have also witnessed the emergence of their own robo-advisors. For example, the number of robo-advisers is growing fast in Asia, driven by an emerging middle class and high technological connectivity,” the Washington-based lender said in the report.

In the US alone, the World Bank projects the robo-advisory sector to grow at an average annual rate of 31 per cent to reach about $1.5 trillion by 2023 from more than $400bn in 2018.

StashAway has capitalised on the boom and has expanded to Malaysia, North Africa and Hong Kong since its launch.

Last November, the digital wealth manager secured an asset management licence from the Dubai Financial Services Authority to operate in the UAE as part of its plan tap into the region's growing segment of affluent investors looking for low-cost ways to build their wealth.

StashAway’s expansion into the UAE was well timed. Since the outbreak of the Covid-19 pandemic, bored novice investors worldwide have embraced digital trading platforms, including the likes of Robinhood, eToro, Interactive Brokers and the UAE’s robo-advisory Sarwa.

“I think in the Middle East, there is a clear gap in the market similar to what we experienced in Singapore when we launched five years ago … their experience with banks and financial advisers,” Mr Ferrario, StashAway's chief executive, says.

“The other thing is financial advisers are quite prevalent [in the UAE] and quite aggressive and that creates a … sense of mistrust. I think we brought to the table a fresh perspective and a platform that is easy to understand, very transparent, low fees – things people understand.

“We are seeing very strong traction, positive growth [in the UAE] and people are starting with significant amounts in terms of their first deposit,” Mr Ferrario adds without giving specific numbers.

Unlike other trading platforms, StashAway does not have a minimum investment requirement, Mr Ferrario says.

“The reason we have a $0 minimum amount is that we want people to be able to try whatever they feel comfortable with. So there's going to be people who feel that $100 is enough to kind of try and people who feel that $100,000 is a small amount. It's all relative,” he says.

“The beauty of the platform is that because we offer fractional shares, even if you try with $100, or $500, or $1,000, you actually will be able to get a diversified portfolio.

“So you know, if you invest anything more than $10, we'll be able to actually invest it in a diversified fashion.”

Last month, StashAway raised $25 million in a series D funding round led by venture capital company Sequola Capital India. The funding round brings the company’s total paid-up capital to $61.4m and will accelerate investment product and feature developments across its five markets, Mr Ferrario says.

“This vote of confidence by one of the most successful venture capital firms affirms that we’ve been taking the right approach by expanding early into high-opportunity markets, continuing to deepen our product offering, and building a lean and mission-driven team. These steps have translated into rapid AUM growth since our beginning,” Mr Ferrario said about the funding round in a statement on April 26.

StashAway plans to use the latest funding round to continue improving the client experience.

“This means continuing to listen to feedback and react to that by adding a few new features, potentially investment products,” he adds.

“Starting from Singapore, we’re adding a few wealth management tools that are not specifically investment products and then getting the products to more and more people … [as] we are now in five countries.”

In the long term, Mr Ferrario says the aim of StashAway is to help as many people as possible to build financial peace of mind.

“We want to empower people to build and protect wealth for the long term. It’s a long journey that you start by building trust, enabling people to build their portfolios over time,” he says.

“Hopefully, 10 years from now, we'll be able to say, ‘Wow, we really changed the lives of tens or hundreds of thousands of people … to be significantly more wealthy than they would have done ... because of lower fees, more diligence and being more systematic in their approach to investing on a monthly basis’.”

Q&A with Michele Ferrario, co-founder and chief executive of StashAway

What other successful start-up do you wish you had started?

Perhaps something to help people stay fit? I like the idea of helping people create positive habits and this is key in building wealth, but it's probably even more [important to be] healthy and fit.

Who is your role model?

I do not have a whole-around role model. As an entrepreneur and a manager, I definitely look up to Jeff Bezos as I think there's a lot to learn from the management systems he has created at Amazon.

What new skills have you learnt since launching your business?

I have definitely sharpened my public speaking skills, as I have done public seminars weekly for a few years!

Where do you want to be in five years?

In five years, I hope to be able to look back and see that StashAway has enabled hundreds of thousands of people to live a happier life thanks to financial peace of mind.

If you could do it all differently, what would you change?

Honestly, not much. StashAway has been an amazing ride and I am very proud of what we have done so far. I would not change anything of the last five years’ journey!