Geely Automobile surpassed its top three Japanese rivals to become the third-largest car maker in China, helped by models that appeal to the nation’s young consumers.

Reporting a 54 per cent jump in net income for the six months through June, the car maker said in a filing on Wednesday that sales this year will beat its target of 1.58 million units. Geely now trails only Volkswagen and General Motors in China, after overtaking Nissan, Honda and Toyota in the period.

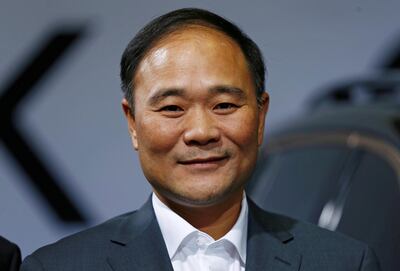

Controlled by billionaire Li Shufu, Geely is among Chinese car makers seeking to dominate the auto industry as newer technologies such as electrification and automation define the future of transport.

“In view of an even stronger new products pipeline ahead, the Group should be in a good position to secure higher market share in China’s passenger vehicle market in the near future,” Geely said in its filing.

The mainland market share of the Hong Kong-listed company increased to 6.4 per cent in the first half of this year, from 5 per cent in 2017. It sold 766,630 vehicles in the period, beating Nissan’s 720,447. Geely sold 1.25 million vehicles in 2017.

_______________

Read more:

Chinese electric car start-ups race for lead

The other Great Wall: Chinese cars in the UAE

_______________

Mr Li has also been active overseas, expanding his automotive empire. After his purchase of Volvo Cars in 2010 from Ford, he snapped up stakes in the iconic British sports-car maker Lotus and Malaysia’s Proton. In February this year, he disclosed a 9.7 per cent stake in Daimler, emerging as the largest shareholder in the maker of Mercedes-Benz.

With an eye on leadership in its key market, Geely has been expanding, offering vehicles such as those under the Lynk & Co brand jointly developed with Volvo.

Although cuts in subsidies for electric vehicles and the tariff war between the world’s biggest economies will weigh on industry sales in the second half, the company will build on the momentum from the first half, it said. Shares of Geely fell 1 per cent to HK$16.22 as of 1:58pm in Hong Kong.

Chinese car sales slumped for a second consecutive month in July as a slowing economy and a tit-for-tat trade war with the US kept consumers away from showrooms. Retail sales of cars, 4x4s and multipurpose vehicles fell 5.4 per cent to 1.6 million units in July, the China Passenger Car Association said. That compares with a 3.7 per cent drop in June, trimming the year-to-date growth in the world’s biggest automobile market to 2 per cent.

Geely has been far outpacing the broader market by posting 43 per cent increase in its sales in the first seven months this year.

Net income at Geely rose to 6.67 billion yuan (Dh3.58bn) from 4.34bn yuan a year ago, according to the filing. Revenue jumped 36 per cent to 53.7bn yuan.