Working Lunch was stymied recently by the confusions of the Google calendar system. Offered a meeting with Inga Beale, the chief executive of Lloyd’s of London, the historic insurance market based in the heart of the Square Mile, I readily agreed and was pleased to get confirmation of what looked like a noon meeting via the Google system.

A little early perhaps – lunch for me is the meal that begins at 1pm – but within the parameters. We agreed to meet at Café Belge, the buzzy restaurant in the Ritz-Carlton in the Dubai International Financial Centre.

It was only on the morning of our rendezvous that I checked with Lloyd’s local office, and realised that noon was given in London time, GMT. So we settled for afternoon tea instead in the hotel’s Lobby Lounge.

As Lloyd’s is perhaps the quintessentially English financial institution, high tea seemed entirely appropriate. An eccentric collection of savoury sandwiches and sweet desserts, it is served in the UK on a tiered platter in the middle of the afternoon and washed down by the quintessential English beverage, tea.

When I was a boy, tea was any meal taken after lunchtime, which could include dinner too, but I think that was a proletarian thing. In posh places, tea was taken at 4pm, amid much ceremony.

__________

Working lunch

■ The inner sanctum of Gulf business legend Mishal Kanoo

■ Ziad Makhzoumi one of most compelling men on Gulf's financial scene

■ Badr Jafar of Crescent Group channelling talk into much-needed action

■ Hussein Hachem of Aramex is a man in a hurry

■ Mark Beer of DIFC Courts has many titles but one key role

__________

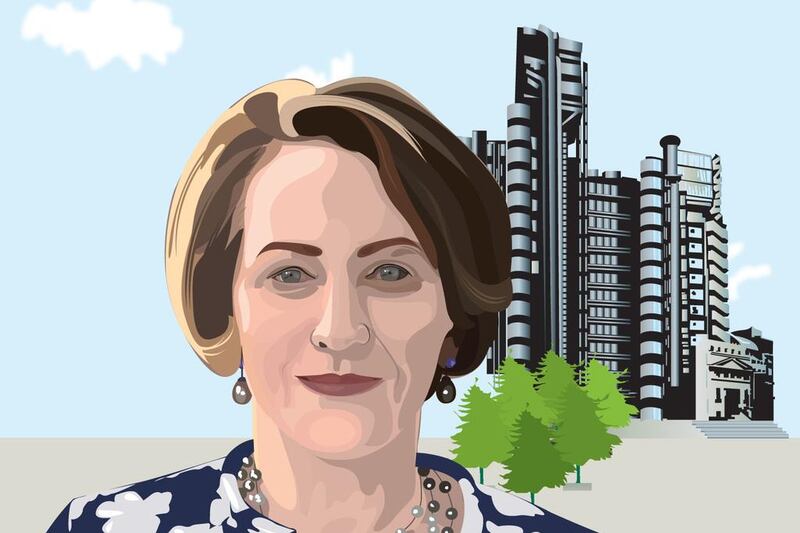

Inga Beale looks and sounds quintessentially Home Counties English, too, but there is also a streak of Norwegian there via her mother, and she has spent a lot of her life outside the UK – in the US, Australia, South East Asia and South Africa.

Maybe it is that heritage that has turned her into a gentle revolutionary for Lloyd’s. Since she became chief executive in 2013 – the first woman in that role in the market’s 329-year history – she had presided over a period of transformation designed to drag the market into the globalised 21st century: advancing female equality, controversially scrapping some of Lloyd’s cherished traditions, such as the long “liquid” lunch, and initiating a programme of international expansion that saw Lloyd’s sprout offices in many foreign financial centres, including, in 2015, the UAE.

“This is nice,” she said as the waiter brought our tea. Individual delicacies were laid out in what looked like a miniature bookcase. With no silver service in sight, it was not very English. But completely Dubai.

“We’re very happy with our first two years here. It’s rivalling Singapore as a business centre and we’ve been there for 16 years. The trend is for more expertise in insurance in the Middle East, especially Dubai, and we see it as a long-term strategic play,” she said, nibbling at a smoked salmon sandwich.

Lloyd’s opening two years ago was regarded as a major boost for the insurance business in the Arab world. The business had previously been slightly tainted in cultural terms and there was little legislation for compulsory insurance in the medical field, the workplace or property. It is difficult to understand why, really, given that insurance is all about the underwriting of risk, and the Middle East is no stranger to risk. Ms Beale ran through the kind of risk Lloyd’s helps protect against – “energy, marine, political violence and terrorism, instability of all kinds, and property risks, like fire” – she listed. The wider region has plenty of all those.

But, despite the obvious market and the introduction of compulsory workplace medical insurance in Dubai and Abu Dhabi, the Middle East and North Africa still lags behind the rest of the world. Insurance accounts for only 1.6 per cent of GDP on average in the whole region, compared with a global rate of 2.8 per cent and levels as high as 5 per cent in the Netherlands and Switzerland.

It is Ms Beale’s long-term ambition to increase this substantially and the presence of Lloyd’s in Dubai is a central part of that. There are now 11 underwriting syndicates in Dubai, out of a global total of 84, and she says there was a 30 per cent growth in the platform last year.

Emerging markets are where the growth will come in the insurance business over the coming years, Ms Beale said, citing a study by the consulting firm McKinsey & Co that foresaw about 60 per cent of global growth in commercial insurance coming from outside the developed markets.

“There is a diaspora under way with hubs setting up round the world, and we have to be part of that,” she said.

Even the insurance world’s most enthusiastic participants will admit that it is not always the most exciting business but it has been her working life in some form or other since her first job as an underwriter at the Prudential in London. There followed jobs at the insurance business of General Electric in the US, then a stint in Switzerland at the reinsurer Converium before elevation to the management board of Zurich Insurance. She prepared for her Lloyd’s role with a term as chief executive of a private insurer, Canopius.

She was in Dubai to speak at the inaugural Dubai World Insurance Congress, itself a symbol of the emirate’s ambitions in the industry. About 500 or so top executives of the industry gathered in the DIFC last month to discuss the global and technological forces shaping the business. Ms Beale struck a controversial note by suggesting that firms were “sleepwalking into the new world”.

She has never been afraid to take a high-profile stance on the big issues of the day. Her particular cause since very early on – when she asked some male Prudential executives to remove pictures of women that she found offensive – has been gender rights. This is what still motivates her.

She hosted a “women in business” dinner for some female executives working across the spectrum in Dubai, including some high-level Emirati women at well-known government-related companies.

“I think it’s important to show that there is a network of support for women in the modern business world. I’ve been part of the network in London and would like to see it thrive in Dubai too. It’s a bit like an old boys’ club, except of course none of us went to school together. A lot of it is about building confidence. I know how daunting it is to walk into a room of 20 people to find you’re the only woman,” she says, by now picking at one of the very English scones and jam that came with the tea.

The London network was launched about nine years ago, “just women talking to each other”, she said. Men were welcomed and many were shocked at their female colleagues’ experiences of discrimination and bias. “It was a cultural thing and we had to take it slowly at first,” she said.

We chatted about the cultural forces in the Arabian Gulf region that still hold women back in business.

“If it is a result of family pressure, it is much more serious. If it’s institutionalised in the workplace, you can find a way through, often by cultivating successful women as role models. But young women can be much more isolated in the family environment,” she said.

What advice would she give a young woman who was facing patriarchal resistance to pursuing her chosen career in a Gulf family? “I would tell her to try to find an enlightened female family member to act as her protector and promoter,” she advised.

Back in London, she has been carrying on the battle for diversity and inclusion at Lloyd’s, which could also be a daunting place. Despite the iconic architecture of the building in the City (designed by the star architect Richard Rogers in the 1970s) attitudes and work practices remained almost Victorian among the predominantly male workforce.

That changed abruptly this year in a move that Ms Beale said “generated more global headlines ever” for Lloyds. A new drugs and alcohol policy was introduced that changed traditional work practices there.

There was some criticism from the die-hards but she was unrepentant. “It’s all about ensuring professional standards from people who are giving key advice. You wouldn’t want to visit your doctor or dentist when he or she wasn’t in full control, so why your underwriter?” she asked rhetorically.

High up on her list of culture changes is to do something about the very formal Lloyd’s dress code, which says men must wear shirt and tie at all times, and cannot remove their jackets in the course of the working day.

She has two other urgent priorities. One of the themes of the Dubai conference was “insurtech”, the process by which digital technology is changing what has been a paper-dominated industry, and she is pushing through a “major modernisation programme” at Lloyds under which paper records will be displaced by digital.

Anybody who has ever seen daily life at Lloyd’s, with brokers and underwriters lugging around heavy files of paper documents, will understand what a wrench that will be.

“We want to retain the trading culture and the human interaction but it will be entirely paperless,” she said.

The second priority is, of course, Brexit, and the effect it will have on the City of London. Lloyd’s admits it will lose access to some key European markets, so it is looking to set up a “subsidiary legal entity” in European Union territory to carry on its business. She is still examining options in this regard but it is unlikely to be France, which she says is “not a global insurance market”.

There are risks, however. “It should not involve a loss of business if we do it right. But passporting issues still have to be resolved. It is a distraction we could do without but we will do it,” she said.

We’d just about finished and the waiter was fussily clearing things away. I managed to grab one of the scones and it really was delicious. You might almost imagine yourself in the Savoy Hotel on London’s Strand.

We small-talked for a while. How did she relax? “Well I try to go to the gym,” she said, reminding me that she used to play quite serious rugby. “But mainly it’s about family, trying to see them as much as possible.” Her husband is a Swiss jewellery designer and they have two older children by his former marriage.

She told me the story of Lloyd’s role in the 1906 San Francisco earthquake, when it earned itself an enduring role in the US insurance business with the historic telegram “Lloyd’s will pay all claims”.

Maybe so, but it will not pay for afternoon tea, I thought to myself as I tapped in the PIN number of my credit card. By the rules, I broker that liability, underwritten by The National of course.

business@thenational.ae

Follow The National's Business section on Twitter