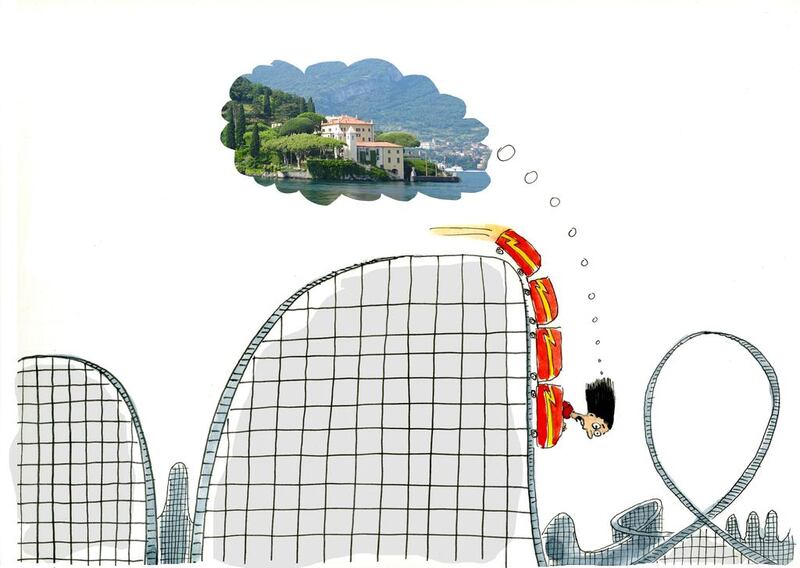

Whoa. I've been on a roller-coaster ride of insanity involving a 36-hour resolve to spend ?800,000 (Dh4 million) - that I don't have - on an imaginary life that I invented for myself that would kick in at some point in the future. But I am saved.

I managed to pulled myself back from the brink of crazy salivating want, and self-justification, and am now looking on the experience with amazement - at how easy it was for me to get drawn into the abyss of "no-sense".

Here's how it happened: I had come across the most beautiful monastery on Italy's Lake Como that had been converted into residential flats.

Just picture it: the most wonderful architecture, the high vaulted ceilings, the art, private lake access, its own park, and did I tell you about the views? Oh, the views across Lake Como . and the grounds. Did I tell you about the grounds? To die for . and did I tell you about the views?

Ahem. I'm getting carried away. So I contacted the developer. Found out that the place I really wanted - that ticked all my boxes: expanse of water, grounds, hiking, outdoorsy, close to ski resorts (OK, not as close as I'd like in my ideal utopia), had space for me, my child and a visiting friend - was a mere ?800,000, splutter.

And so I spent the next 36 hours doing mental maths to get it to work - ie for me to, somehow, be able to do this: buy the place, have it as my "retirement" home and go-to sanity box, write my books, live surrounded by all that is beautiful and inspiring, and have the best of both worlds: Dubai and Europe.

Ha.

I obviously don't have ?800,000 lying around, so I looked at the minimum deposit and started figuring out ways to earn more money. I just had to make this happen.

In other words, I was inventing a debt hell that would sap away any cash in my system, should I be able to find the money to put down in the first place.

Even if I had let it out as a holiday place, the mortgage wouldn't be covered.

I had done the classic "how can I afford it?" scenario - which is great if you want to push yourself and, say, buy a property to rent out - where it would generate an income, but this piece of real estate would have landed me in a lot of financial strife. I was buying a liability, not an asset: I would have to keep finding cash to hold on to this "investment". This was a pure aspirational/ luxury play. But instead of spending core cash on these things, we should be accumulating assets that pay out - that generate cash-flow.

As cash-flow grows, we can then use it to indulge in life's luxuries. Unfortunately, most people buy luxuries first, before they have bought cash-generating assets. Which means that they stay stuck in financial groundhog day. They are most likely getting deeper in debt with every purchase - or at best they're losing out on the chance to save up for assets that generate money that they can then spend on their jewels, cars and branded clothes - or a dream pad somewhere that doesn't rent out easily and in no way pays for its upkeep.

The bottom line is that any money I have in my life needs to be put to work. As much as I would love one of the flats on offer, I simply cannot justify it, even if I could afford it.

Plus now that I am cool of head and heart, I realise that getting to and from it would be a nightmare of connecting modes of transport and logistics. Thank goodness for that. It makes turning my back on it that bit easier (I lie).

My biggest lesson has been that, boy, are we vulnerable. It's as though we need to be on constant alert not to fall into the justification trap to spend on things we really do not need. Or that we cannot afford at this point in time. If we play our cards right and keep as much of our money as possible, and make it work for us today and tomorrow, then perhaps we will end up neighbours on Lake Como after all.

Here's to dreaming big but keeping our feet firmly on the firma.

Nima Abu Wardeh is the founder of the personal finance website www.cashy.me. You can contact her at nima@cashy.me

Follow us on Twitter @TheNationalPF

Forced to give up on dream home. For now

Nima Abu Wardeh reins in a dream to buy an ?800,000 pad overlooking Italy's Lake Como just in time.

More from the national