It has to be said that 2012 was a good year for me on the money front.

Not because I made pots of cash but because I grew up financially and finally became a better saver than spender.

While my 20s were a period of excess - too much partying, too much spending and just generally too much of everything - my 30s have seen my attitude towards life and my finances mature.

But it has been a slow process.

My growing maturity has a lot to do with having a young family and the huge sense of responsibility that comes with that role.

No longer can I blow the savings and head off on my travels for a three-week adventure. There are now little mouths to feed and young brains to educate.

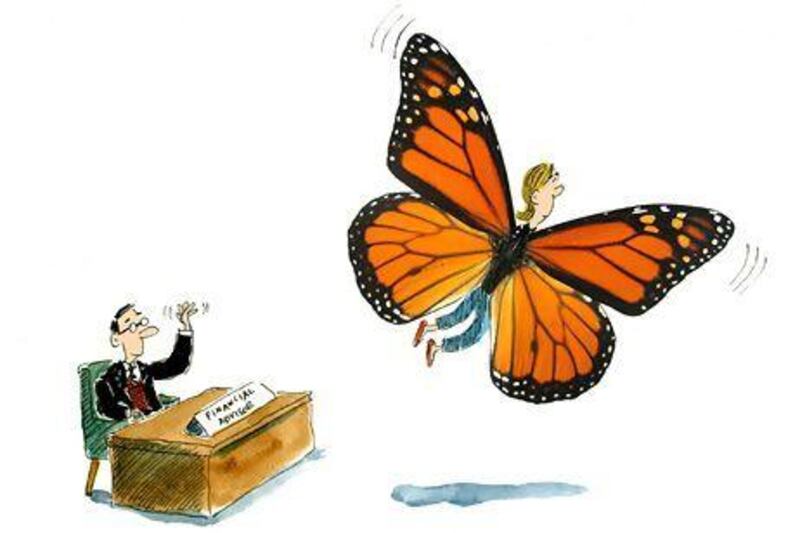

In fact I can remember the first time a financial adviser came round to my house to meet my husband and I. I was 31 and my daughter, now six, was a few months old.

As he tried to explain the importance of life insurance, pensions and education plans, my colicky daughter screamed her little head off in protest, making it difficult to focus on the big picture.

Consequently, the decisions we made that day have not fared well, probably because they were made with an accompanying cacophony of deafening cries. It's a bit like trying to write an important work document with a fire alarm blasting off at the same time.

Since then I've tried very hard to be a better saver and financial planner but it has not been easy because of the constant internal battle between my desire to spend and my desire to save.

While it's nice to know the money is stacking up, it's also nice to go on that family holiday to Sri Lanka or go out for a nice dinner to a swanky restaurant. You can see my dilemma and it's the same one we all face - save for the future or live in the moment.

Two things happened in 2012 that finally set me on the right track towards financial maturity.

The first was signing up with a fantastic financial adviser who helped me plan a strategy for my entire life.

He asked me where I wanted to retire and when and then calculated exactly how much I needed to save to get there. Rather than having wistful dreams of my future, I can actually see myself living in that picturesque cottage in the English countryside now because I know I will have done enough to afford it.

I also know exactly how much I need to stash for the children's future education requirements and have a clearer understanding of what a diversified portfolio really means.

He also worked out what is left in the pot to indulge the spender in me. There's something quite comforting about knowing I can still be a little spontaneous when I need to. The difference now, however, is that there is a much clearer balance between my spendthrift tendencies and the sensible forward planner.

The second thing to happen in 2012 was a period of bad health that made me realise the absolute importance of having plenty of savings stacked up. For a few worrying weeks, I had no idea when I was going to get better and there was suddenly a real urgency to save harder.

Sadly, we never know what is going to happen in life and while it is nice to hope everything will be rosy, it is also nice to know you will be OK if things take a turn for the worse.

So as we ease into 2013, I feel confident about my financial affairs, possibly for the first time in my life. I feel I can look ahead for the next 12 months and as long as everyone is healthy and employed, all will be good.

And if they're not, well, with some careful money management, we should be able to cope. It seems at the ripe old age of 38, I have finally grown up. I'm an adult now.

My financial adviser brought me a box of chocolates to thank me for my support last year. Frankly, I think I should have bought him one.

Felicity Glover is on leave and will return next Saturday