Amid heightened political tension in the region, executives in the UAE and Saudi Arabia have reassessed investment and business decisions but with US President Donald Trump's clear commitment to supporting the two Gulf countries sentiment is expected to improve this year, a survey commissioned by The National reveals.

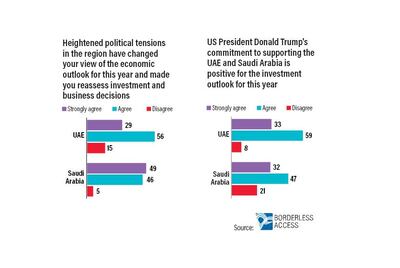

Eighty-five per cent of respondents to the survey carried out by Borderless Access in the UAE either strongly agreed or agreed that tensions had made them revise their economic outlook for this year and led them to reassess investment and business decisions.

In Saudi Arabia 95 per cent of those that were asked the question strongly agreed, according to the survey.

"The survey results are clearly highlighting the fact on how geopolitical tensions builds uncertainty within business sentiments and has a direct impact on economic outlook and investment decisions," said Dushyant Gupta, senior vice president of Borderless Access, which conducted the poll.

Mr Gupta attributed the greater concern in Saudi Arabia to the country's proximity to political tension. In the UAE, one in six respondents said they were not changing business decisions in spite of the political situation.

The poll comes into the fourth month of a dispute between Qatar and a number of Middle Eastern nations. The UAE, Saudi Arabia, Bahrain and Egypt on June 5 broke diplomatic ties with Qatar and cut off air, sea and land access to the country over Doha’s support for “terrorist groups aiming to destabilise the region”. The dispute is the most serious between GCC members since the organisation’s creation in 1981.

So far, economists say the bulk of the economic damage in the region is being done to Qatar as the number of visitors falls and a sell-off in the country's stock market and drop in demand for Qatari riyals rattles the country's financial industry.

At the same time, the survey found that businessmen in the UAE and Saudi Arabia are upbeat about the investment outlook this year after President Trump's visit to the region earlier this year.

Ninety-two percent of respondents to the poll in the UAE either strongly agreed or agreed that Mr Trump's commitment to supporting the UAE and Saudi Arabia is positive for the investment outlook this year while in Saudi Arabia of those polled 79 per cent either strongly agreed or agreed with the notion.

______________________

Read more:

[ Donald Trump meets King Salman in Saudi Arabia amid deals worth $380bn ]

[ Trump’s historic visit to Riyadh ]

_______________________

President Trump visited Saudi Arabia in May, signing deals valued at more than US$380 billion (Dh1.4 trillion) which included the supply of US defence equipment and services to Saudi Arabia.

His visit was aimed at putting in place a framework for enhanced partnership with traditional US Arab allies that involves them taking on a greater share of the responsibility for regional security.

Previous US presidents have made attempts to put such a plan in place, but diverging views and threat perceptions, as well as concerns about the US abandoning the region, have always undermined them.

The Trump administration has taken a much harder line on Iran than its predecessor. It has vowed to work with Arabian Gulf countries to bolster their ability to deter and contain Iran, which Riyadh considers its greatest security threat and regional rival.

Despite the tensions, economists remain upbeat about an economic recovery in the UAE following several years of tepid growth. The UAE's non-oil economy is set to get a boost in the second half of the year from a pick-up in government spending ahead of Expo 2020.

Economists also say that an improvement in the fortunes of the global economy will also aid tourism and real estate. Consumer spending activity, which has also been improving, is also set to get a lift in the final quarter of this year from the introduction of a value added tax as people buy durable goods before the 5 per cent levy is introduced on January 1.