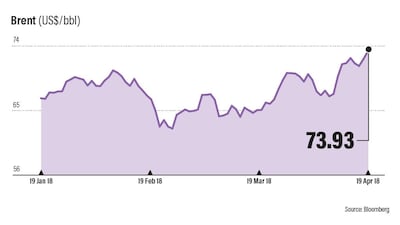

Opec is expected to continue taking barrels off the market despite three-year-and-a-half high oil prices of above $74 per barrel as the group’s monitoring committee, which includes Russia convenes in Jeddah on Friday to discuss the newer market dynamics and plans to forge a stronger alliance.

Opec, which has been curbing output by 1.8 million barrels a day since January 2017, will need to "over-tighten the market rather than under-tighten the market", to keep US shale from flooding the sector, said Michael Tran, managing director, global energy strategy at RBC Capital Markets in an interview with The National in Abu Dhabi.

“If [Opec] prematurely takes the cuts off and US production at some point over the next number of months floods the market again, this ultimately makes all of Opec’s efforts over the past 15 to 16 months quite superfluous and Opec is at a point where they’ve seen historically high levels of compliance, so we certainly think that they will continue to keep the wheels on the bus,” he added.

_______________

Read more:

Brent’s $70 plus rise on the back of Syria tensions is unsustainable, say analysts

Oil rebounds on Opec optimism and US stockpile fall

_______________

The price of Brent, the international benchmark for light sweet crude, topped $74 per barrel, the highest since late 2014 on Thursday, as a mix of geopolitical tensions in the Middle East, and supply disruptions in Venezuela spurred its rally. Analysts including investment bank JP Morgan had predicted that oil prices could rise as high as $80 per barrel this year.

While $70 per barrel was the budgetary breakeven earlier targeted by producers such as Iran, Opec countries may aim for a higher level this year, to meet fiscal requirements, and in the Saudi Arabia help a successful floatation of Saudi Aramco, the world's biggest oil producer.

Mr Tran pointed to the “wealth disparity” among Opec members such as Venezuela and Nigeria which required a much higher breakeven price for oil on a fiscal basis, necessitating cuts to remain in place for much of the year.

While analysts forecast Brent to rally up to $80 per barrel in the run up to the US strikes against Syrian targets, such a high is likely to remain for a “short period but not be sustained”, cautioned Spencer Welch, oil markets director at IHS Markit.

“US production is too responsive to high price and there is still plenty of crude oil in tanks,” he said.

The London-based research firm has taken the view of Brent averaging between $70 per barrel and higher levels of $60 per barrel for 2018.

“Some of this restricted (Opec) oil production might start to return to the market,” he added.

IHS expects the oil price to be lower in 2019 on the expectation of rising US production that could cause the market to over-supply again.

"US production has increased by 1 million barrels per day over the last 12 months, we expect similar rate of increase over the next 12 months," said Mr Welch.

RBC on the other hand took a bearish approach to the prospects for shale flooding the market, pointing to inadequate takeaway capacity in the US that would curtail a supply surplus.

The US has become a victim of its own success to the point where US shale production, particularly from the Permian, the largest and most prolific North American basin, had grown at such a prolific rate that it has outstripped pipeline takeaway capacity, said Mr Tran.

"You’ve grown so much, you have a lot of barrels, but you can’t move these barrels out. This is a temporary phenomenon, so we will get additional pipeline capacity coming on by mid-next year and over the course of the next 12 to 15 months,” he said.

“The idea of bearish US production just getting dumped onto the open market and taking down oil prices is getting some reprieve for now."