As the world attempts to hit its emissions targets by 2050 and reduce energy poverty, a unique intersection of blockchain and economic development is looking to solve many developmental challenges.

About 940 million people, or 13 per cent of the world’s population, have no access to electricity while about 3 billion people, or 40 per cent of the population, do not have access to clean cooking fuel.

A holistic overhaul of the world’s energy system is expected to disproportionately affect the world’s poor.

Companies such as the Libra Project, which is based at the Abu Dhabi Global Markets, are looking to divert capital away from developed economies and democratise ownership of sustainable assets for those in the developing world.

They are using tokenisation, where a company issues a blockchain token, that provides tradeable partial ownership of a real tangible asset. These tokens also promise sufficient liquidity and can be traded on the secondary market.

“We wanted to make a system where people got paid, not on the amount of profit but on the amount of impact that has been delivered,” says James Spence, co-founder and director of the Libra Project.

“So, back in 2017, that is when everyone was doing their ICO [initial coin offering], blockchain was just coming in, and we did not want to go down that road because we looked at ICOs and thought they were illegal.”

The company, which started in 2016, intends to tokenise small projects in the developing world, with total valuations of $10 million to $15 million.

The token gives owners shareholder rights and leads to transparent and highly democratised decision making, says Mr Spence.

The nascent global tokenisation market is expected to grow at a compound annual growth rate of 19.5 per cent from the current $1.9 billion to $4.8bn by 2025, according to research company Markets and Markets.

North America is poised to have the highest proportion of issued tokens.

Tokenisation can help investors to pitch in and fund stranded assets such as an isolated patch of the North American shale basin, which is economically unviable to develop.

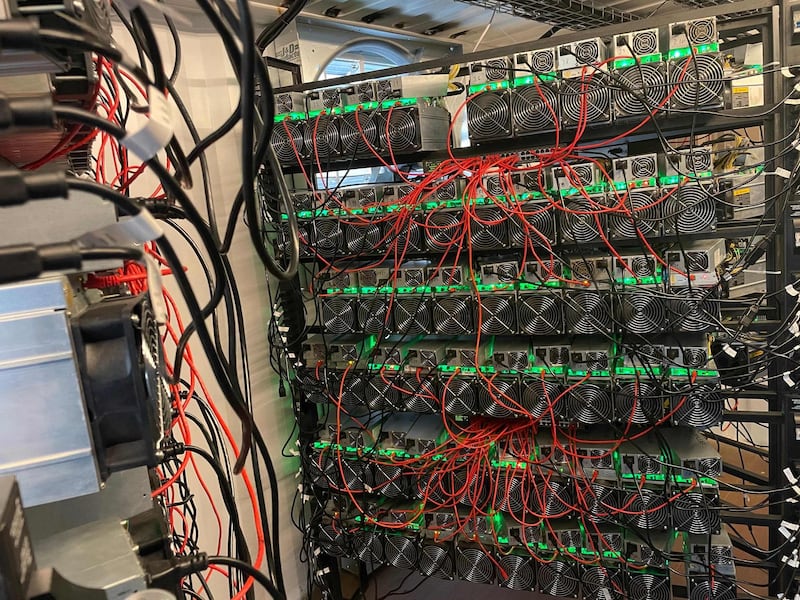

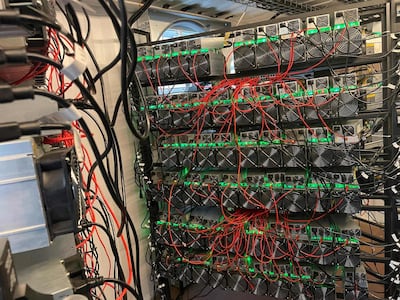

Gas from these assets can then be used to power Bitcoin data centres, which are high energy consumers. These data centres offset flared natural gas by channelling it into mining for digital currencies instead.

Tokenisation can play a big role in improving the energy efficiency of big oil producers such as the US, which loses more than half of the energy it produces to inefficiencies.

Iraq, Opec’s second-largest producer, could also reap the benefits of using technology to develop assets. The country faces a massive gas-flaring problem that costs the economy billions of dollars in lost revenue.

Tokenisation could also mobilise investment in energy efficiency, especially as funding for the sector is projected to have fallen by 9 per cent last year.

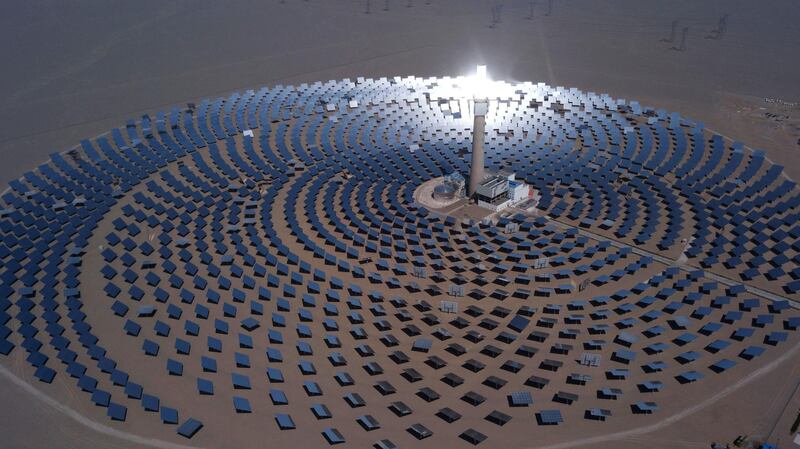

While tokenisation is being embraced widely by the art world, allowing for the efficient transfer and ownership of assets, it is also being increasingly used in developing energy projects, notably renewables and sustainable infrastructure.

The Libra Project scours the developing world for projects where they can make the biggest social impact. The company uses the UN's Sustainable Development Goals as the yardstick to base their investment decisions.

The UN's SDGs aim to rid the world of poverty, hunger, gender inequality, lack of access to water and sanitation and polluting fuels, among others, by 2030.

“Now energy is just the first scope. Because it is all based on blockchain, we can then consider [several] votes, as we start to build out,” says Mr Spence.

“We look at building renewable energy projects. And then off the back of that and once that is built, 10 per cent of the profits flow into the next vertical, so that is water.”

The company then mobilises the tokenised funds to build water projects focused on sanitation, which also seek to reduce the use of bottled water and the incidence of waterborne diseases. It also funds food, health care and education projects.

The yields for investors holding these tokens can be as high as 14.75 per cent, says Mr Spence.

The Libra Project is currently in the process of trying to lower the threshold for investment to $100, allowing all kinds of investors, particularly those living in the communities, to invest.

Mr Spence says the typical timetable of a power plant project is 12 years.

“What we are doing now is adding liquidity into this,” he says.

Currently, the company is looking to raise funds from accredited and institutional investors who have a minimum buy-in of $100,000.

“We call this the private equity stage of tokenisation,” says Mr Spence.

“Now, as we take this from where we are now to what we want to the call public space, it is going to take about 12 months to get to that regulatory process and we want to be dropping this down to an entry level of $100.”

Tokenisation is also becoming popular in the conventional energy space, which is under mounting pressure to adopt a more sustainable path.

PermianChain, a natural resources tokenisation platform, allows investors to invest in stranded assets and use them as an energy source to mine cryptocurrency.

The company specialises in communities that are switching away from fossil fuels but may have an asset or two that remain stranded, making them unviable for commercial extraction.

It is also looking to limit the flaring of gas across North American shale basins and channel that into crypto-mining.

“Maybe, [there is] a lack of infrastructure to take that gas to the sales market, or a lack of capital or market incentive to even [use] the gas,” says Mohammed El Masri, founder and chief executive at PermianChain.

“So, in that case tokenising stranded gas is a perfect opportunity because you know it is gas that is not being used at the moment, and it can be put to better use in some other forms or ways on-site without even transporting it anywhere.”

The company channels the gas to power the cryptocurrency mining sector, which is cheaper and more sustainable energy to generate Bitcoin.

The digital currency has stirred a lot of controversy over its energy consumption, with Iran banning crypto-mining last week and blaming it for causing four months of continuous power cuts in the country.

PermianChain operates by bringing data centres for mining Bitcoin, which are in the form of shipping containers, on to the sites. The centres then use the gas to produce power through generators that provide electricity for mining. The operation requires no pipeline or infrastructure as it is adjacent to the well-site.

Tokenisation of energy assets is also gaining ground in the solar photovoltaic sector in the Middle East, where companies are encouraging consumers to buy into panels and take ownership of assets.

However, tech-savvy investors are also taking advantage of blockchain's potential to create value and opportunities in trendier assets such as Tesla superchargers.

Fasset, which calls itself a platform for ethical financing of sustainable infrastructure, piloted the tokenisation of a Tesla supercharger in Bahrain earlier this month. The company has offices in London, Bahrain, the UAE, Malaysia and Singapore.

The company partnered with NEC Payments to issue 10 tokens, which allow the users to own part of the supercharger, while also allowing them to use the tokens to charge their Teslas.

“Once you buy into this network, you get discounted rates for using it, so that is why all of our initial users are Tesla drivers,” says Mohammed Raafi Hossain, chief executive at Fasset.

“The token itself is, you can say, a key card or an access point to leveraging the supercharger itself,” he says.

“A typical share on Nasdaq does not give you all of these rights but a tokenised effort combines all of these things. It becomes an asset, becomes a utility, it becomes a key card, all in one.”