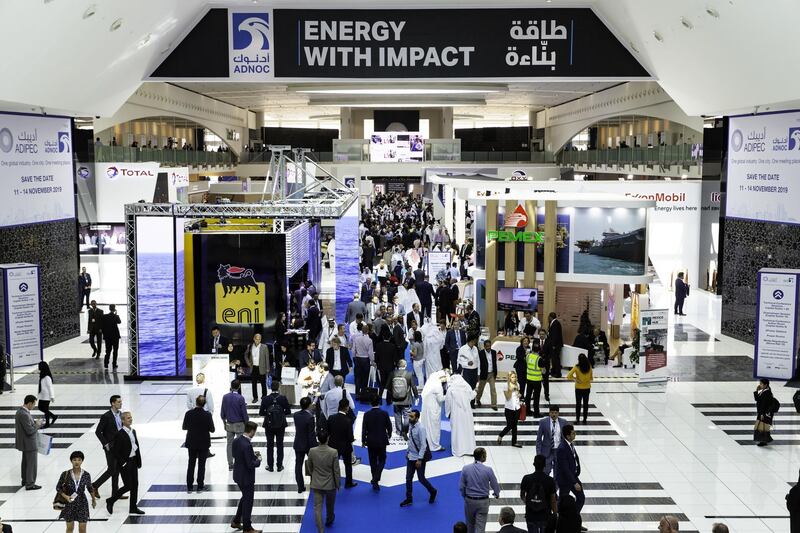

Chief executives from BP, Total and Eni are among top-brass of the global energy landscape convening for the industry's must-attend Abu Dhabi

International Petroleum Exhibition and Conference in the capital, which begins on Monday.

“Oil and Gas 4.0”, the theme for this year’s Adipec, will explore how upstream companies can navigate the new and challenging times facing the industry. A bearish oil market, slowing global economic growth and demand concerns, as well as a hostile narrative on hydrocarbons, have all overshadowed the industry for much of this year.

Headlining this year's event is Condoleezza Rice, former US Secretary of State in George W Bush's administration, who will address navigating the political risk – an increasingly complex challenge for the oil and gas industry and for regional national oil companies in particular. Geopolitical risks for the hydrocarbon-rich Arabian Gulf region that accounts for about a third of the proven oil reserves, have increased this year, as multiple attacks on oil tankers transiting the congested Strait of Hormuz, stoked tensions further.

The capture of a tanker by the Iranian Revolutionary Guard Corps as well as the impounding of an Iranian vessel by the British Royal Marines, off the coast of Gibraltar, all compounded to a high geopolitical risk premium in shipping costs.

However, oil prices remain fairly subdued, weighed down by the tariff war between the US and China, that is threatening global growth and demand for oil in some of the emerging markets.

The industry also grappled with the biggest outage of oil supply in decades when multiple drone attacks on Saudi Aramco's oil facilities in the kingdom's Eastern Province, including the world's largest oil processing centre and a producing field, took nearly 5 per cent of global output offline. The attacks, which affected more than half of the world's largest oil exporter's production, were a stark reminder of how geopolitical risks still loom large.

The annual four-day event will see government representation from the US, now the world’s biggest oil producer, with day one featuring Frank Fannon, assistant secretary at the Bureau of Energy Resources with the US Department of Energy. The US is expected to hit a production level of 13 million barrels per day of crude by year-end, according to the Energy Information Administration.

Mohammed Barkindo, secretary general of Opec and Dharmendra Pradhan, India's Minister of Petroleum are also attending the event.

However, unlike previous years, Saudi Arabia will not have a ministerial representation at Adipec, as the country is busy preparing for the domestic listing of state oil giant Saudi Aramco.

Its chief executive, Amin Nasser, a regular attendee will also be missing. Aramco is expected to issue its prospectus on Saturday, after having confirmed last week plans for the IPO.

Also taking centre stage are energy ministers from oil-exporting countries such as Iraq, the UAE, and Oman. Oil importers such as India, Jordan and Morocco will address issues of affordability, access as well as sustainable use of resources. Ministers from smaller African producers such as Uganda, Kenya and Sudan will address issues of enabling access to energy.

Around 41 per cent of this year’s attendees are expected to be from the Middle East and North Africa region, with 22 per cent from Asia. Around 32.4 per cent conference delegates are from regional upstream entities, with 11.6 per cent from international oil companies.