General Electric plans to add 3 gigawatts of power capacity to the grid in Iraq by this summer as it pushes ahead with a plan to overhaul the country's damaged power infrastructure.

"We have many power plants that are under service work and we have several power plants that are under installation to support them for the summer," Joseph Anis, president, and chief executive of GE gas power services in the Middle East and Africa told reporters in Dubai on Tuesday.

"It's in the range of about 3GW of power ... some new installations that will come online and some of the service work and maintenance that we're doing to ensure it's ready for the summer," he added.

Iraq has been courting large multinational energy services companies such as Siemens and GE to rebuild its damaged utilities and reduce gas flaring, which has led to billions of dollars in lost revenue over the past decade. GE is undertaking projects as part of a 14GW blueprint to overhaul the country's power infrastructure, which has been wrecked by years of war and conflict.

The US firm won a contract in September to develop the third phase of Iraq's largest power plant - the Besmaya project in central Iraq, which will add 1.5GW of capacity to the grid by 2021, raising total capacity to 4.5GW.

Work on the scheme is ongoing with a portion of the gas turbines being installed to be available for the summer, with the combined cycle operation set to start operation in 12 to 14 months, said Mr Anis.

Iraq has been mired in political uncertainty following months of local protests. The country's prime minister-designate Mohammed Tawfiq Allawi earlier this week withdrew his name from the running after he failed to form a government.

Mr Anis remained optimistic about the implementation of GE's power projects despite the stalemate in the Iraqi government.

"Obviously we do need a government that we can engage and continue to have our discussions on additional plans. All those plans are there and can easily be implemented and discussed as soon as the government is in place," he said.

GE, which has operations in 130 countries, has also made no revisions to its growth forecast or sales projections for this year following the disruption to global supply chains due to the rapid spread of the novel coronavirus. The deadly epidemic has so far claimed more than 3,000 lives, with the number of infected cases exceeding 90,000 worldwide.

GE has been working to ensure the safety of employees and maintain business continuity amid the health scare, Mr Anis said.

"The beauty of a global supply chain is that we do have suppliers all over the world across the globe, so we aren't really tied into one area per se or one supplier," he said.

"There are always multiple vendors qualified so a lot of work has been done to ensure that we don't have any delays and we've been looking at that early on to ensure that we can support all of our projects from a supply chain standpoint," Mr Anis added.

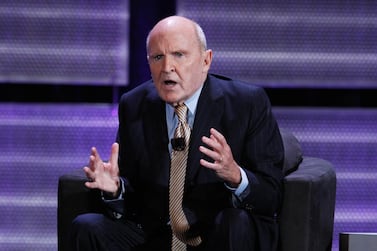

GE, which at the turn of the century was the biggest US company by market value, is mourning the loss of its former chief executive Jack Welch who was known to have transformed the multinational between 1981 and 2001.

Mr Welch, known as 'Neutron' Jack for implementing efficiencies and scaling up the company in the 1990s, passed away on Monday at the age of 84.

Under his leadership, the company's market value grew from $12 billion (Dh44bn) to $410bn. However, the multinational's fortunes have fallen after the 9/11 attacks in 2001 as well as the 2008 financial crisis, with its current market cap valued at just below $100bn.

"Certainly the times are different and the size of the company, the industries that we were in were very different," Mr Anis said.

The company will remain committed towards enhancing "good returns" for the shareholders, following Mr Welch's legacy, he added.

GE's portfolio of industrial businesses, aviation, healthcare, power, and gas power are sectors where the company is "well-positioned" to grow.

"We believe there is long-term demand and we will continue to grow over time," Mr Anis said.