US shale oil is making a comeback and, coincidentally, so is the American economy.

Record-high production is providing a stimulus by creating jobs, boosting industrial growth and reducing the gigantic trade deficit. Middle East producers are right to show concern, but a strong economy could also be a blessing if it translates into resilient global demand.

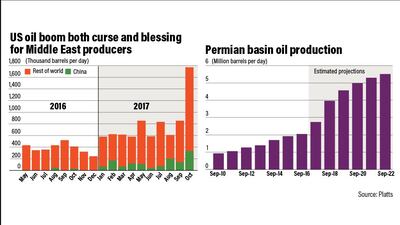

However, shale’s revival looks more like a curse at the moment. US petroleum output touched 9.6 million barrels per day (bpd) last week, which is an all-time high since its collapse at the end of last year when production slumped to around 8.4 million bpd. Even worse for the region, this could be the beginning of America dominating oil markets. The International Energy Agency (IEA) forecasts that unconventional US tight-oil production will increase by almost 50 per cent to around 7.5 million bpd by 2021.

US drillers have benefited the most from higher prices above US$60 per barrel. The revival has partly been made possible by greater efficiencies and the industry’s ability to adapt quickly to the price war launched two years. But the biggest catalyst has come from the sweeping supply cuts agreed by Opec and its allies including Moscow to drain global stockpiles.

With Opec and Russia expected to extend their pact for another year when the group meets in Vienna on November 30, activity is picking up in America’s oil patch. Stats compiled by S&P Global Platts RigData service shows that the total number of US land drilling rigs had climbed by 63 per cent at the end of the third quarter to 931 derricks. At the bottom of the market in 2016 the slump in prices was thought to have destroyed around 100,000 jobs in the US industry but hiring managers are beginning to see the green shoots of recovery taking hold with more operators taking on staff, especially in the productive Permian basin.

And more of the oil they will produce could make its way into export markets. US crude shipments overseas hit an all-time high of 2.1 million bpd this month. The extra flow of crude is helping to boost economic growth in the world’s largest economy and its biggest consumer of crude. According to S&P Global Analytics, America’s monthly trade deficit in petroleum has shrunk by two thirds since 2011 to around $10 billion at current levels. Annualised that equates to a near 80 per cent reduction from the $326bn in hard cash that was exiting the country six years ago to import foreign crude, according to S&P Global Analytics data.

_____________

Read more:

Opec will need a steady hand to exit oil output policy

Opec paints a rosy picture, but challenges lie ahead

New man at the helm for UK energy major seeking to fuel fracking boom

_____________

Instead of draining the economy, oil is now a key driver for US growth in addition to its role in boosting trade. Despite predictions of the US president Donald Trump’s administration presiding over a slowdown, the economy grew by 3 per cent in the third quarter, marking an extended period of expansion. The S&P 500 index has gained almost 20 per cent in the last year to hover close to 2,600 points in a further sign of confidence in the economy. Under normal circumstances all these signals should be good for crude demand.

But changing consumption patterns in the US and the growth of electric vehicles have made forecasting its thirst for crude tricky. Short-term, the IEA expects demand for oil to hold up for a few years but by the middle of the next decade the picture changes dramatically. According to its latest forecasts consumption in the US will collapse by at least 4.3 million bpd to 13.8 million bpd by 2040. Such a scenario is bad for Opec and Middle East producers still supplying the US market. If domestic demand weakens quicker than expected then it could push more US-produced crude on to international markets, posing an even bigger threat to Opec and its partners.

But forecasters are frequently wrong and demand for oil in America could easily beat their downbeat estimates through to the end of the decade. A stronger US economy may also prove helpful if it supports oil demand in faster-growing Asian markets such as China, where American crude exports still only account for a fraction of total consumption. Beijing is America’s biggest trading partner accounting for $580bn of total commerce last year. Strong growth in the US will see energy-thirsty factories in China busy for the foreseeable future, which is positive for Opec.

Despite the IEA’s pessimism, lower prices have also stimulated global demand growth of over 1.5 million bpd over the past three years and S&P Global Analytics forecasts this could climb by a further 300,000 bpd next year. Based on these figures total global demand could hit 100 million bpd for the first time in 2018. Supply may also be tighter than anticipated. Some estimates suggest that capital spending on new upstream projects may fall by $740bn between 2015 and the end of the decade, setting up a supply crunch.

Rather than destroying each other in a renewed price war both US producers and Opec could benefit from more co-operation to keep markets adequately supplied.

Today marks start of publishing this exclusive column from S&P Global Platts. Andy Critchlow is head of energy news, EMEA at S&P Global Platts