Greta Thunberg's impassioned speech dominated the recent UN climate summit. "Change is coming, whether you like it or not," she said. We must act on Greta's hectoring. She represents a generation whose voice is not being heeded by a generation of policymakers placing a high discount rate on an increasingly existential threat to our planet. They will be long gone, but their legacy will be planetary ecocide.

Last year, global energy-related carbon dioxide emissions rose by 1.7 per cent to the highest level since 2013, according to the International Energy Administration, with this year estimated to be steeper. While the sharp decline in cost of renewables (90 per cent for solar) has led to the rapid growth of its dissemination, it has not been enough to offset the increased use of fossil fuels. The growing existential threat of climate change necessitates quicker and sustained policy action.

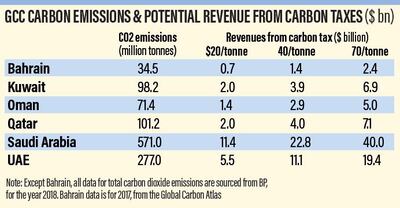

The Middle East is particularly vulnerable. The region's share of global emissions reached a record 6.3 per cent in 2018, nearly double its 3.3 per cent share of world GDP. Some Arab countries fall among the top nations when it comes to emissions per capita.

Reducing greenhouse gas emissions requires deploying low-carbon energy in addition to improving the efficiency of energy consumption (see my previous column). The announced renewable energy policies of GCC nations are a step in the right direction. They aim to shift preferences, consumer and producer choices towards renewables and away from fossil fuel activities and production. But there is room for more to be done.

Government policies can be augmented by a determined carbon pricing that increases the relative cost of fossil fuel generated energy compared to that produced by renewables. Carbon pricing is the most effective and cost-efficient means to reduce emissions. It forces producers and users of carbon fuels to internalise external costs of their emissions and ties them to sources through a price on carbon (the polluter pays principle).

There are two efficient options: emissions trading systems, or cap-and-trade as implemented in the EU and carbon taxes. Carbon taxes are more comprehensive since they apply to all CO2 emissions from the combustion or consumption of fuels (coal, oil, gas) to limit emissions. The tax is applied at the point of production, including a border adjustment on imports of energy-intensive products to shield domestic manufacturers from international competitors that do not face a similar tax. A carbon tax sends a clear price signal to polluters to discontinue their polluting activity, or bear the cost for emissions. The carbon price also encourages clean technology and market innovation, fuelling new, low-carbon drivers of economic growth and decarbonisation.

Introducing a tax in the GCC would result in structural change for local economies. The challenge for policymakers is that the high energy-intensive sectors such as petrochemicals, aluminium, aviation and shipping have been the basis of economic diversification strategies. They would be the most directly impacted by carbon taxes. Fossil fuel assets can be sold (as in the Saudi Aramco planned IPO), while capital stock would need to be written down, phased out or destroyed to be replaced by "green assets & capital". The policy choice is between starting on the energy transition path now, or later facing the dismal alternative of massive adjustment and stranded assets.

Iata has adopted the Carbon Offsetting and Reduction Scheme for International Aviation and the International Maritime Organisation is considering measures to decarbonise maritime transport by 2035. Similarly, a record 515 institutional investors managing $35 trillion (Dh128tn) in assets (nearly half the world's invested capital) last week urged governments worldwide to step up action to tackle climate change and achieve the Paris Agreement's goals. Central bankers are also going green: extreme-climate scenarios will be introduced into financial stress tests, given the sector's exposure to climate-related risks and the writedown in the value of fossil fuel assets.

Given the GCC's high carbon footprint, the introduction of a carbon tax would generate substantial revenues for the governments. Revenues could range between $5.5bn to $19.4bn for a carbon tax ranging from $20 to $70 per tonne of CO2 in the UAE to $11.4bn to $40bn in Saudi Arabia.

It's worth noting that a carbon tax is cheaper to collect and brings substantially more revenue than the amounts being raised by the VAT (in 2018, UAE and Saudi Arabia collected $7.35bn and $12.5bn, respectively).

More in state revenues mean it can be used to finance decarbonisation and make the energy transition smooth: by investing in climate-resilient infrastructure; retrofitting buildings and structures; subsidising renewable investments by the private sector and in vulnerable industries such as transport. Part of the revenue can be apportioned to national funds backing research and development and develop the domestic clean technology and renewables sectors, including desalination. Carbon tax revenues would finance clean economic diversification and investment-led green economy growth for the GCC. It is a win-win.

Dr Nasser Saidi is the chair of the Mena Clean Energy Business Council and founder and president of the economic advisory and business consultancy Nasser Saidi & Associates