Bahrain, the smallest oil producer in the Arabian Gulf, will look at all possible options to finance the recovery of its offshore shale reserves, its biggest discovery in over 80 years, according to an advisor to the country’s oil minister.

"We’re looking at all options, frankly, we might invite [international oil companies] or we might invest some. It’s premature, however. We need time,” Dawood Nassif told reporters in Abu Dhabi.

"In six months time we’d be in a better position."

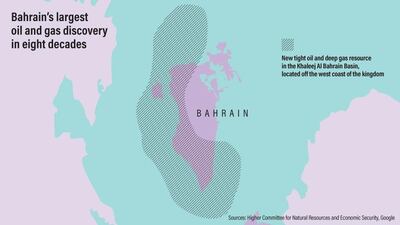

Bahrain, the smallest economy in the GCC, announced the discovery of 80 billion barrels of unconventional oil and up to 20 trillion cubic feet of tight gas off its west coast earlier this month. The discovery dwarfs Bahrain’s current proven reserves, which according to the CIA Facebook stand at 124.6 million barrels of oil and around three trillion cubic feet of gas.

Bahrain’s discovery of unconventional oil is significant and bigger than recent finds in the US shale basins, such as Wolfcamp Shale in the Permian, which is estimated to hold around 20 billion barrels of oil.

Mr Nassif, who also sits on the board of the country’s state-owned Bahrain Petroleum Company, said the field’s recovery rate would not be known “for a few months to come”.

Analysts suggest that despite the significant number of barrels, an offshore shale oil field could only yield between five and 10 per cent of the total estimated oil in place. Among recent discoveries, for instance, only 16 billion barrels of the 270 billon barrels of the Argentinian Vaca Muerta shale basin is estimated to be recoverable.

__________________

Read more:

[ Bahrain says it has discovered 80 billion barrels of shale oil ]

[ Good fiscal terms needed to make Bahrain oil discovery viable, say analysts ]

[ Bahrain's largest oil discovery since 1932 'can be game changer' ]

__________________

Bahrain, which has reached an agreement to drill two appraisal wells with US contractor Halliburton this year, hopes to exploit its new discovery in five years.

Before the discovery, Bahrain had focused on developing its downstream industry to eke out more value form every barrel of oil produced. Bahrain’s current production averages just under 50,000 barrels per day onshore, as well half the yield from the offshore Abu Safah field shared with Saudi Arabia, which averages 300,000 bpd.

The news of the discovery comes amid an ongoing effort to expand the country’s sole refinery at Sitra. Financial closure to boost the refinery’s production capacity from 267,000 barrels per day to 360,000 bpd will be reached “this year”, said Mr Nassif.

Bapco also has plans to diversify into chemicals to increase its profit margins.

Engineering, procurement and construction work tenders for a planned aromatics facility in a joint venture with Kuwait’s state-owned Petrochemical Industries Company was “in progress” with technology selected and front end engineering and design work completed, he said.

“Once we finish the financing for this one, we’ll start work on the aromatics facility,” added Mr Nassif.

The prospect of more barrels come at a time of steep decline in production and heavy borrowings for the island kingdom, which was the first among its GCC peers to strike oil in 1932.

The discovery would alleviate some of Bahrain’s public debt levels, which Moody’s Investors Service has cautioned could reach 100 per cent of GDP by next year.